By company, iShares was the biggest winner in YTD flows, with 11 of the top 20. As for type of fund, it ran the gamut: S&P 500, small cap, emerging markets and fixed income.

Consider the overall total for another moment. If $94 billion were a company’s annual revenue, it would rank #23 on the newly released Fortune 500 – more than Citigroup, Wells Fargo or Bank of America.

Scroll through to see the latest 20 inflows year to date. All data from Morningstar.

20. iShares Core S&P Total US Stock Mkt (ITOT)

3-Yr. Return: 10.33%

Expense Ratio: 0.03%

Total Assets (millions): $8,929

19. DFA Emerging Markets Core Equity I (DFCEX)

3-Yr. Return: 2.48%

Expense Ratio: 0.53%

Total Assets (millions): $23,498

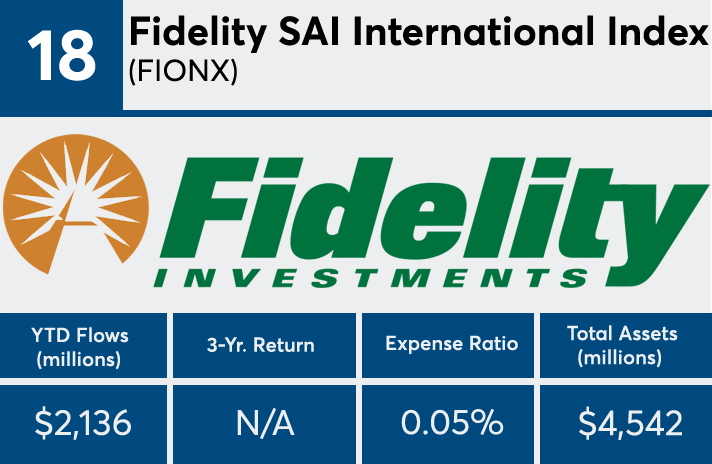

18. Fidelity SAI International Index (FIONX)

3-Yr. Return: N/A

Expense Ratio: 0.05%

Total Assets (millions): $4,542

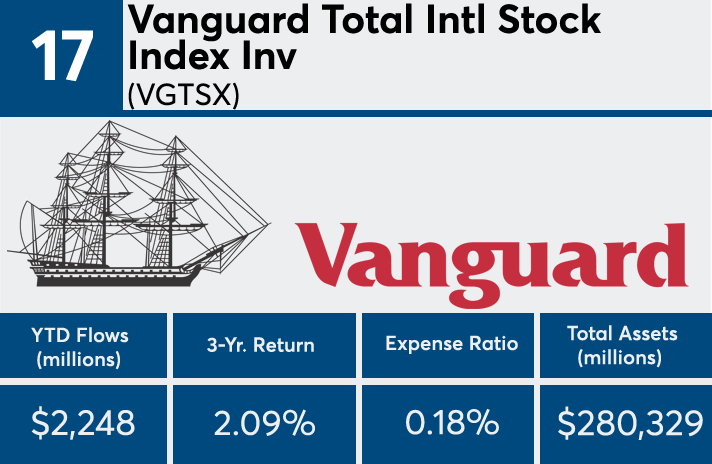

17. Vanguard Total Intl Stock Index Inv (VGTSX)

3-Yr. Return: 2.09%

Expense Ratio: 0.18%

Total Assets (millions): $280,329

16. Bridge Builder Core Bond (BBTBX)

3-Yr. Return: 3.15%

Expense Ratio: 0.17%

Total Assets (millions): $13,509

15. Strategic Advisers Core Income (FPCIX)

3-Yr. Return: 3.06%

Expense Ratio: 0.45%

Total Assets (millions): $32,455

14. BlackRock S&P 500 Index K (WFSPX)

3-Yr. Return: 10.48%

Expense Ratio: 0.04%

Total Assets (millions): $11,325

13. iShares Core US Aggregate Bond (AGG)

3-Yr. Return: 2.68%

Expense Ratio: 0.05%

Total Assets (millions): $45,475

12. PowerShares QQQ ETF (QQQ)

3-Yr. Return: 17.54%

Expense Ratio: 0.20%

Total Assets (millions): $52,743

11. iShares JPMorgan USD Emerg Markets Bond (EMB)

3-Yr. Return: 4.99%

Expense Ratio: 0.40%

Total Assets (millions): $11,847

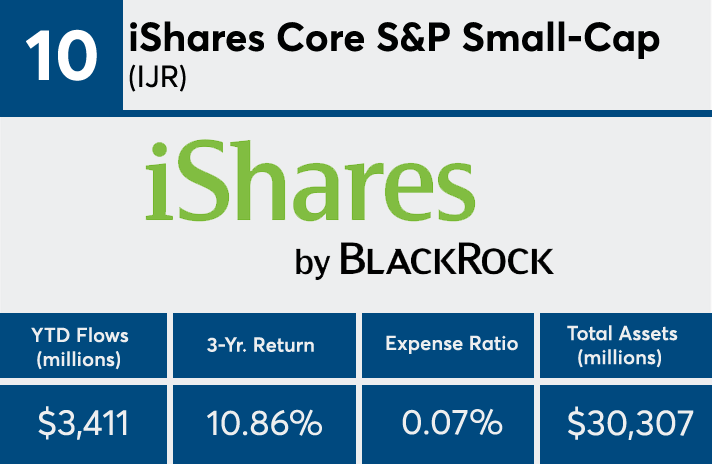

10. iShares Core S&P Small-Cap (IJR)

3-Yr. Return: 10.86%

Expense Ratio: 0.07%

Total Assets (millions): $30,307

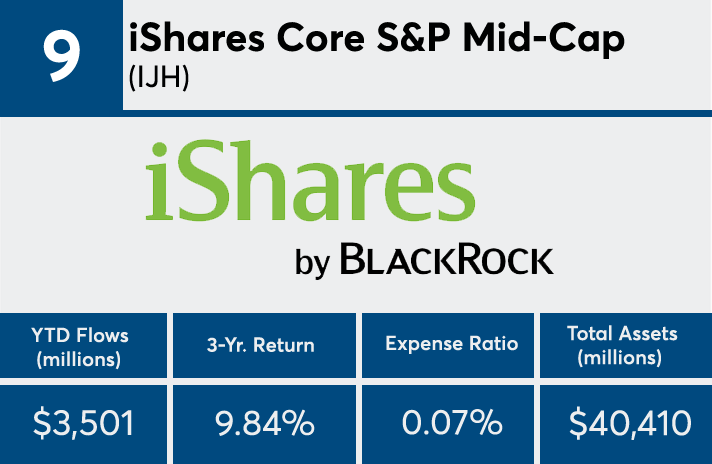

9. iShares Core S&P Mid-Cap (IJH)

3-Yr. Return: 9.84%

Expense Ratio: 0.07%

Total Assets (millions): $40,410

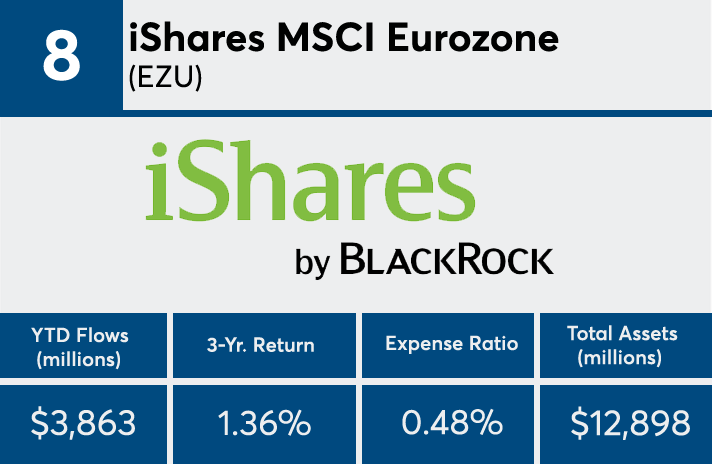

8. iShares MSCI Eurozone (EZU)

3-Yr. Return: 1.36%

Expense Ratio: 0.48%

Total Assets (millions): $12,898

7. Vanguard Total Stock Mkt Idx Inv (VTSMX)

3-Yr. Return: 9.97%

Expense Ratio: 0.15%

Total Assets (millions): $574,642

6. iShares iBoxx $ Invst Grade Crp Bond (LQD)

3-Yr. Return: 3.92%

Expense Ratio: 0.15%

Total Assets (millions): $34,517

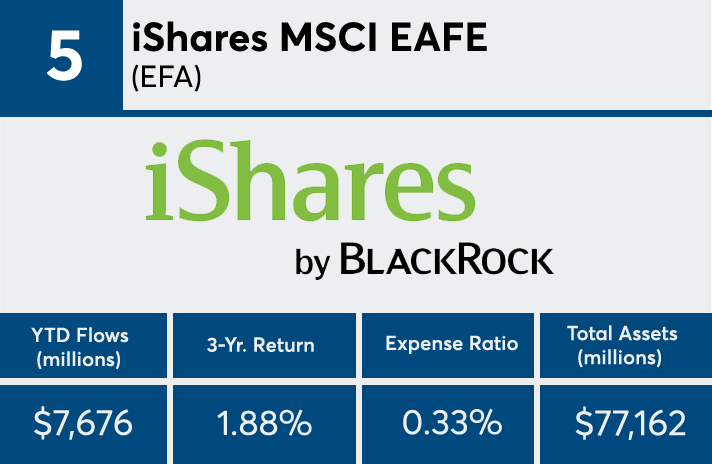

5. iShares MSCI EAFE (EFA)

3-Yr. Return: 1.88%

Expense Ratio: 0.33%

Total Assets (millions): $77,162

4. Vanguard Total Bond Market II Idx Inv (VTBIX)

3-Yr. Return: 2.56%

Expense Ratio: 0.09%

Total Assets (millions): $129,823

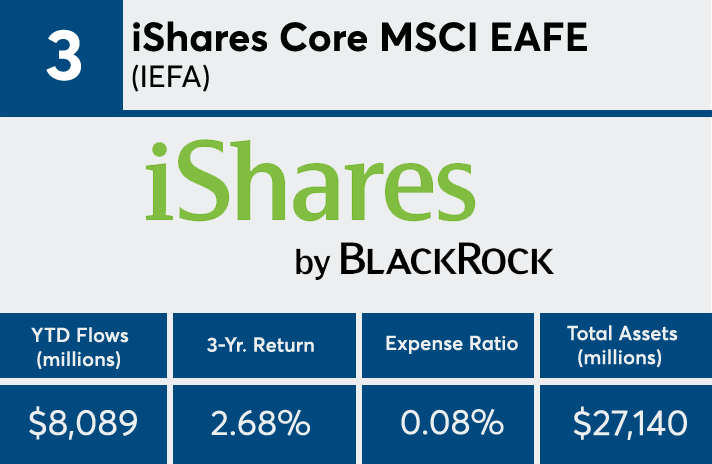

3. iShares Core MSCI EAFE (IEFA)

3-Yr. Return: 2.68%

Expense Ratio: 0.08%

Total Assets (millions): $27,140

2. iShares Core MSCI Emerging Markets (IEMG)

3-Yr. Return: 1.89%

Expense Ratio: 0.14%

Total Assets (millions): $31,555

1. iShares Core S&P 500 (IVV)

3-Yr. Return: 10.47%

Expense Ratio: 0.04%

Total Assets (millions): $113,870