Longer-term, the election of Donald Trump is also seen giving a boost to investments tied to fossil fuels, following a prolonged decline in prices.

Amid the volatility, consider the results of major energy funds both year-to-date and over the past five years.

For advisers or clients hoping to play the energy sector, MLPs dominated the best performers, which can offer tax advantages as well as higher income potential than many other investments.

All data is from Morningstar. Many funds have additional share classes that may come with a slightly higher expense ratio, but also a vastly lower minimum investment.

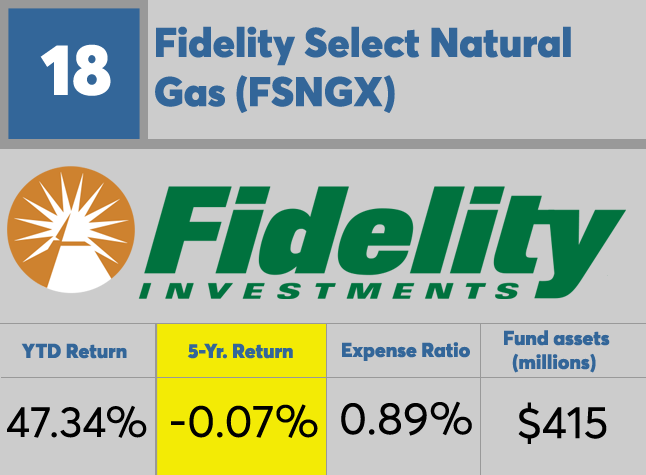

Fidelity Select Natural Gas (FSNGX)

5-Yr. Return: -0.07%

Expense Ratio: 0.89%

Fund assets (millions): $415

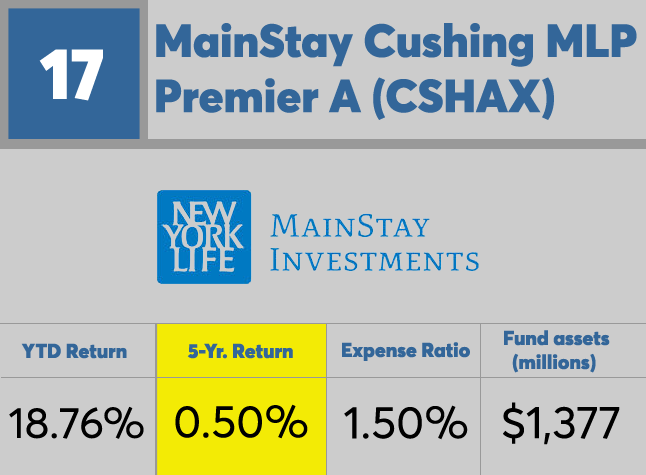

MainStay Cushing MLP Premier A (CSHAX)

5-Yr. Return: 0.50%

Expense Ratio: 1.50%

Fund assets (millions): $1,377

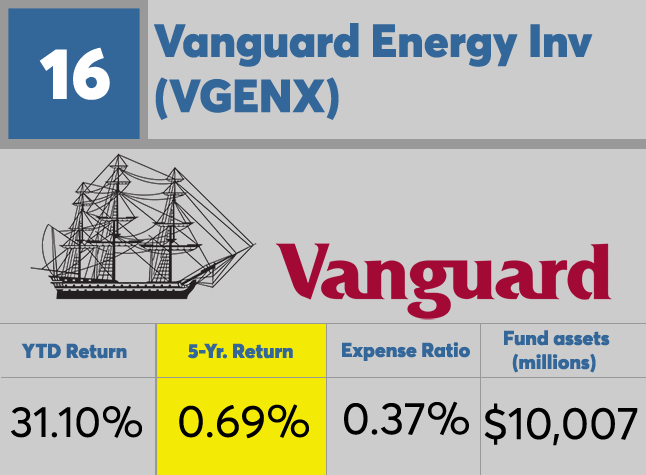

Vanguard Energy Inv (VGENX)

5-Yr. Return: 0.69%

Expense Ratio: 0.37%

Fund assets (millions): $10,007

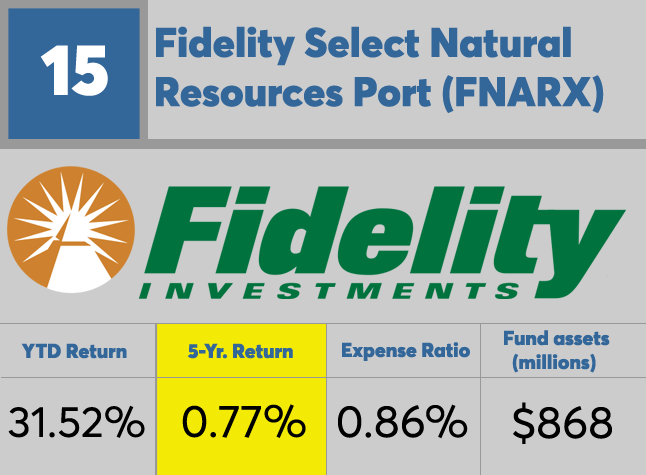

Fidelity Select Natural Resources Port (FNARX)

5-Yr. Return: 0.77%

Expense Ratio: 0.86%

Fund assets (millions): $868

JNL/Mellon Capital Oil & Gas Sector A (0P00003DB9)

5-Yr. Return: 2.10%

Expense Ratio: 0.64%

Fund assets (millions): $1,788

Oppenheimer SteelPath MLP Income A (MLPDX)

5-Yr. Return: 2.12%

Expense Ratio: 1.38%

Fund assets (millions): $3,756

Fidelity Advisor Energy T (FAGNX)

5-Yr. Return: 2.76%

Expense Ratio: 1.38%

Fund assets (millions): $981

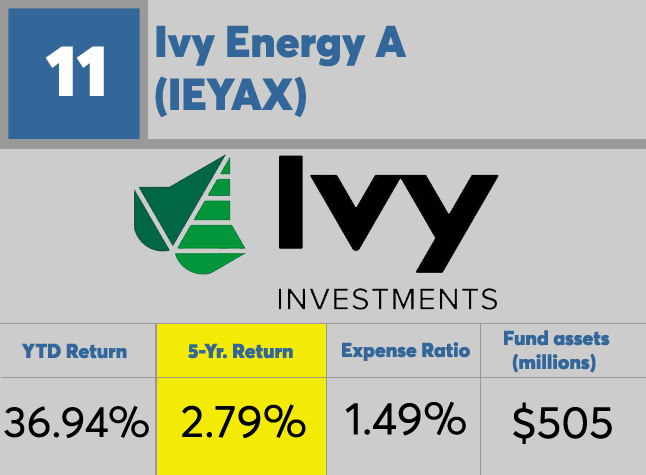

Ivy Energy A (IEYAX)

5-Yr. Return: 2.79%

Expense Ratio: 1.49%

Fund assets (millions): $505

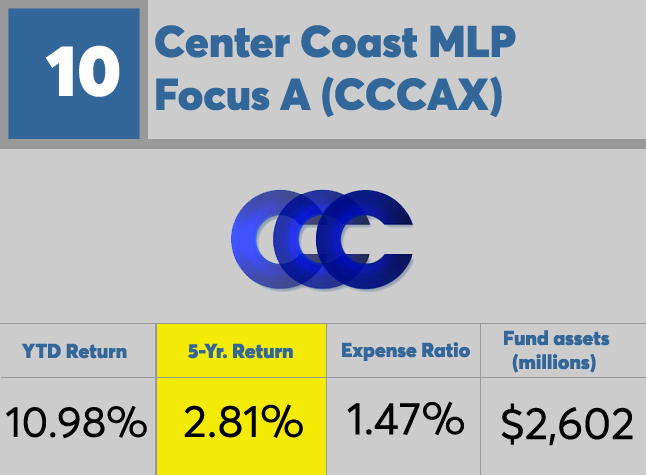

Center Coast MLP Focus A (CCCAX)

5-Yr. Return: 2.81%

Expense Ratio: 1.47%

Fund assets (millions): $2,602

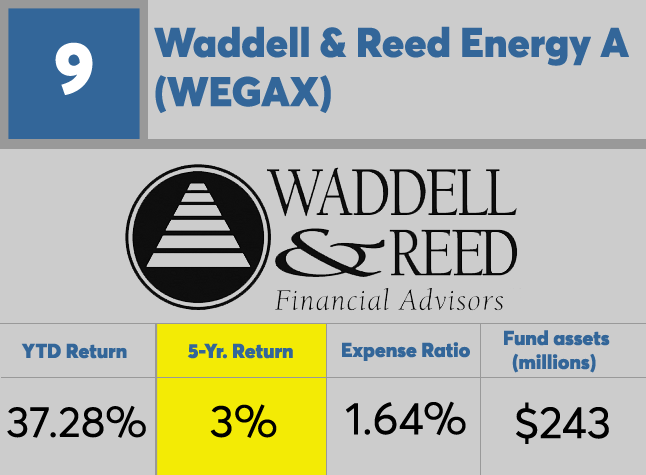

Waddell & Reed Energy A (WEGAX)

5-Yr. Return: 3%

Expense Ratio: 1.64%

Fund assets (millions): $240

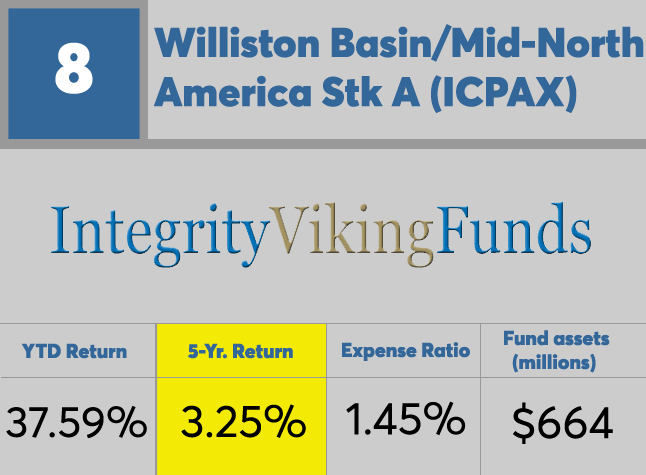

Williston Basin/Mid-North America Stk A (ICPAX)

5-Yr. Return: 3.25%

Expense Ratio: 1.45%

Fund assets (millions): $664

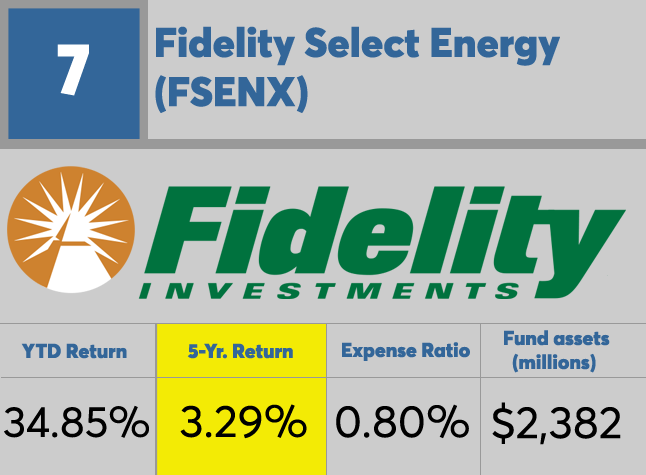

Fidelity Select Energy (FSENX)

5-Yr. Return: 3.29%

Expense Ratio: 0.80%

Fund assets (millions): $2,382

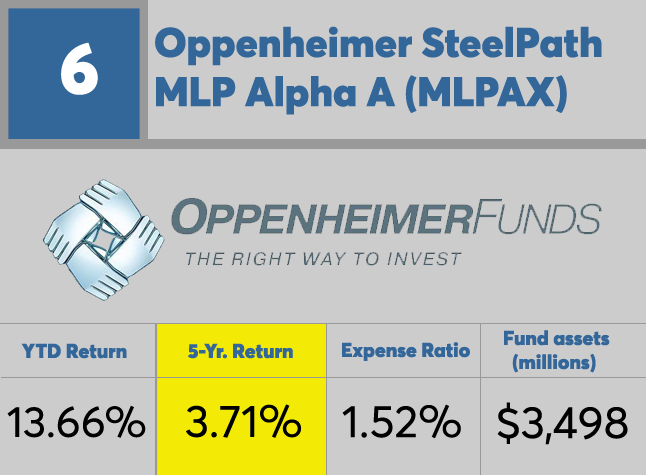

Oppenheimer SteelPath MLP Alpha A (MLPAX)

5-Yr. Return: 3.71%

Expense Ratio: 1.52%

Fund assets (millions): $3,498

Oppenheimer SteelPath MLP Select 40 A (MLPFX)

5-Yr. Return: 3.76%

Expense Ratio: 1.12%

Fund assets (millions): $3,066

Advisory Research MLP & Energy Infras I (MLPPX)

5-Yr. Return: 4.43%

Expense Ratio: 1%

Fund assets (millions): $433

Advisory Research MLP & Energy Income I (INFIX)

5-Yr. Return: 4.72%

Expense Ratio: 1.15%

Fund assets (millions): $881

MainGate MLP A (AMLPX)

5-Yr. Return: 6.21%

Expense Ratio: 1.66%

Fund assets (millions): $1,823

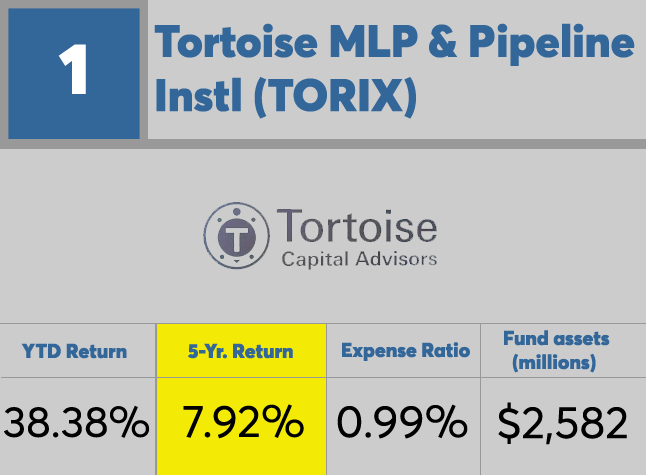

Tortoise MLP & Pipeline Instl (TORIX)

5-Yr. Return: 7.92%

Expense Ratio: 0.99%

Fund assets (millions): $2,582