Overall, the inflows slightly surpassed the outflows, $201 billion vs. $196 billion. But following the flows shows that index funds and ETFs won the lion’s share of new investor money. Indeed, of the seven funds that gained investor cash, six were passive. And of the 13 that lost investor cash, eight were active.

Of the five passive funds that incurred outflows, in three cases it amounted to less than 5% of the fund’s total assets.

Scroll through to see the 7 funds with inflows and 13 with outflows. All data from Morningstar Direct.

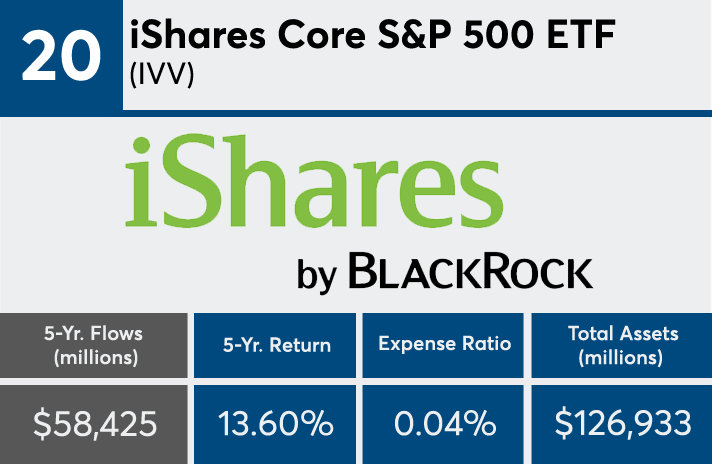

20. iShares Core S&P 500 ETF (IVV)

5-Yr. Flows (millions): $58,425

1-Yr. Returns: 18.82%

5-Yr. Returns: 13.60%

Expense Ratio: 0.04%

Total Assets (millions): $126,933

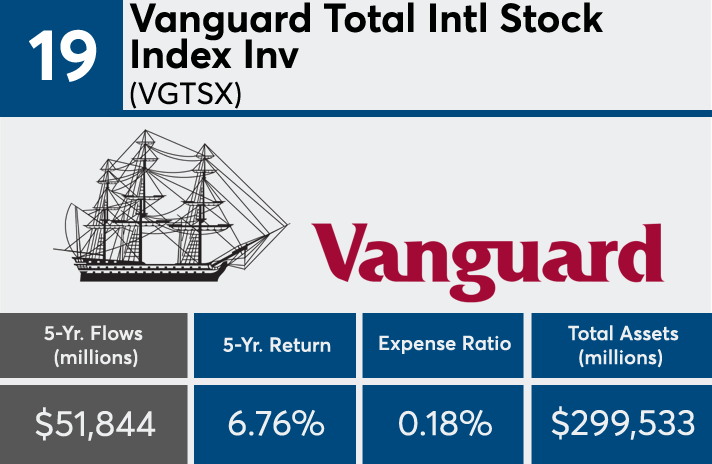

19. Vanguard Total Intl Stock Index Inv (VGTSX)

5-Yr. Flows (millions): $51,844

1-Yr. Returns: 20.93%

5-Yr. Returns: 6.76%

Expense Ratio: 0.18%

Total Assets (millions): $299,533

18. SPDR S&P 500 ETF (SPY)

5-Yr. Flows (millions): $43,970

1-Yr. Returns: 18.73%

5-Yr. Returns: 13.53%

Expense Ratio: 0.10%

Total Assets (millions): $243,661

17. Vanguard Total Bond Market II Idx Inv (VTBIX)

5-Yr. Flows (millions): $32,363

1-Yr. Returns: 0.83%

5-Yr. Returns: 2.14%

Expense Ratio: 0.09%

Total Assets (millions): $135,100

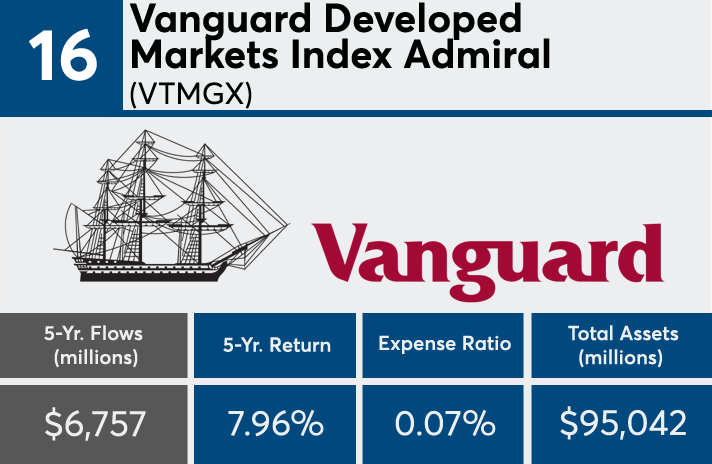

16. Vanguard Developed Markets Index Admiral (VTMGX)

5-Yr. Flows (millions): $6,757

1-Yr. Returns: 20.42%

5-Yr. Returns: 7.96%

Expense Ratio: 0.07%

Total Assets (millions): $95,042

15. American Funds American Balanced A (ABALX)

5-Yr. Flows (millions): $4,321

1-Yr. Returns: 13.22%

5-Yr. Returns: 10.06%

Expense Ratio: 0.60%

Total Assets (millions): $116,840

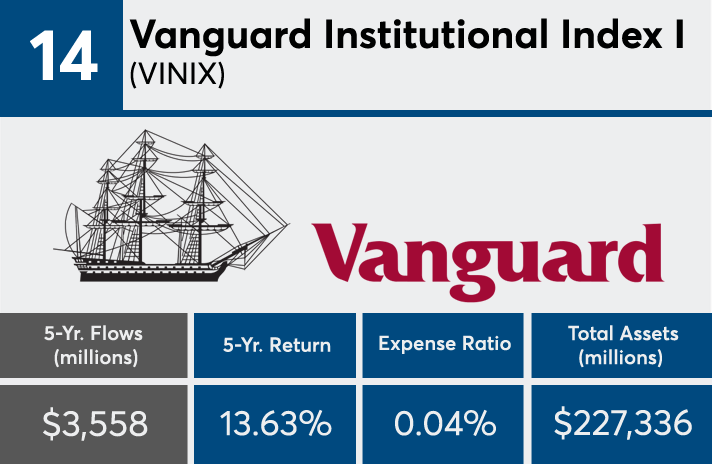

14. Vanguard Institutional Index I (VINIX)

5-Yr. Flows (millions): $3,558

1-Yr. Returns: 18.83%

5-Yr. Returns: 13.63%

Expense Ratio: 0.04%

Total Assets (millions): $227,336

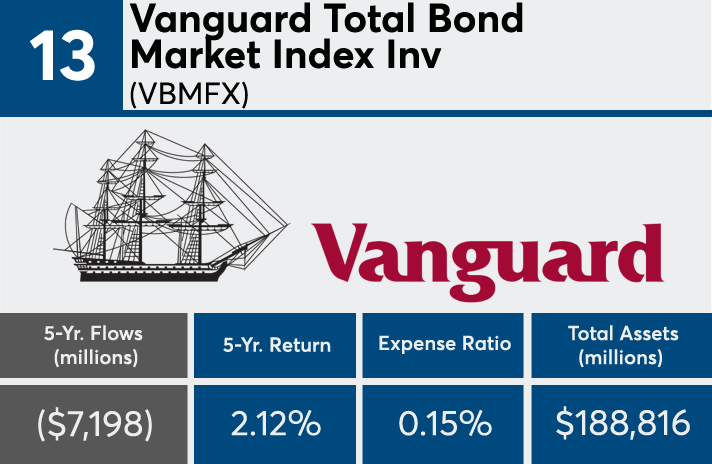

13. Vanguard Total Bond Market Index Inv (VBMFX)

5-Yr. Flows (millions): ($7,198)

1-Yr. Returns: 0.79%

5-Yr. Returns: 2.12%

Expense Ratio: 0.15%

Total Assets (millions): $188,816

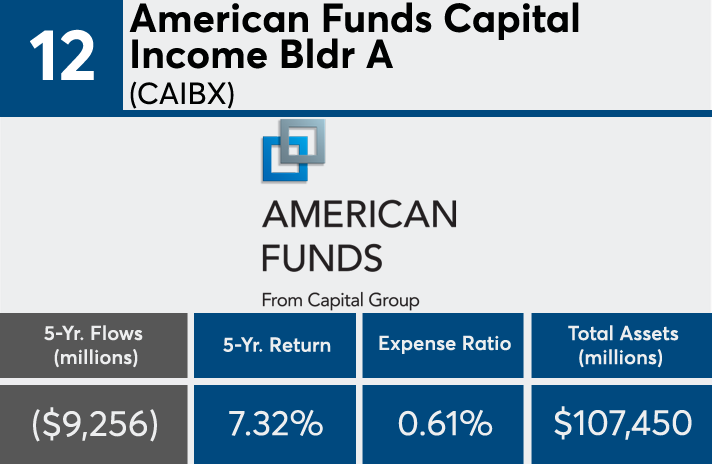

12. American Funds Capital Income Bldr A (CAIBX)

5-Yr. Flows (millions): ($9,256)

1-Yr. Returns: 10.82%

5-Yr. Returns: 7.32%

Expense Ratio: 0.61%

Total Assets (millions): $107,450

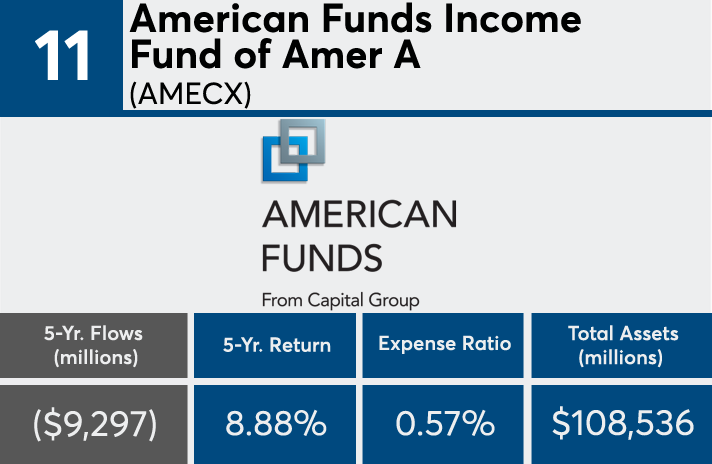

11. American Funds Income Fund of Amer A (AMECX)

5-Yr. Flows (millions): ($9,297)

1-Yr. Returns: 11.84%

5-Yr. Returns: 8.88%

Expense Ratio: 0.57%

Total Assets (millions): $108,536

10. American Funds Fundamental Invs A (ANCFX)

5-Yr. Flows (millions): ($9,379)

1-Yr. Returns: 20.98%

5-Yr. Returns: 13.83%

Expense Ratio: 0.62%

Total Assets (millions): $90,370

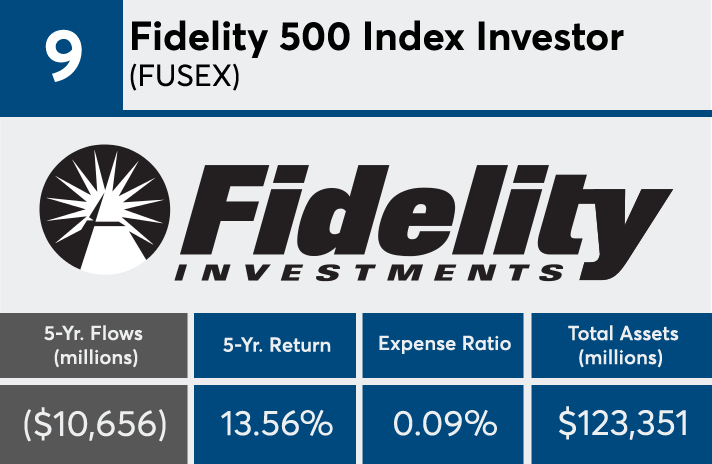

9. Fidelity 500 Index Investor (FUSEX)

5-Yr. Flows (millions): ($10,656)

1-Yr. Returns: 18.76%

5-Yr. Returns: 13.56%

Expense Ratio: 0.09%

Total Assets (millions): $123,351

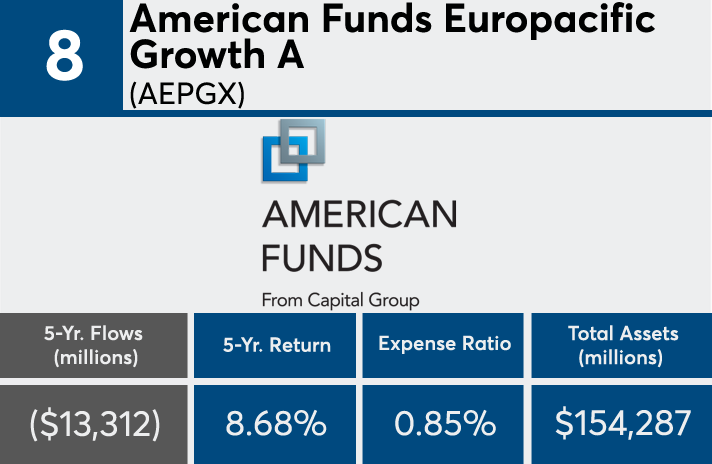

8. American Funds Europacific Growth A (AEPGX)

5-Yr. Flows (millions): ($13,312)

1-Yr. Returns: 20.91%

5-Yr. Returns: 8.68%

Expense Ratio: 0.85%

Total Assets (millions): $154,287

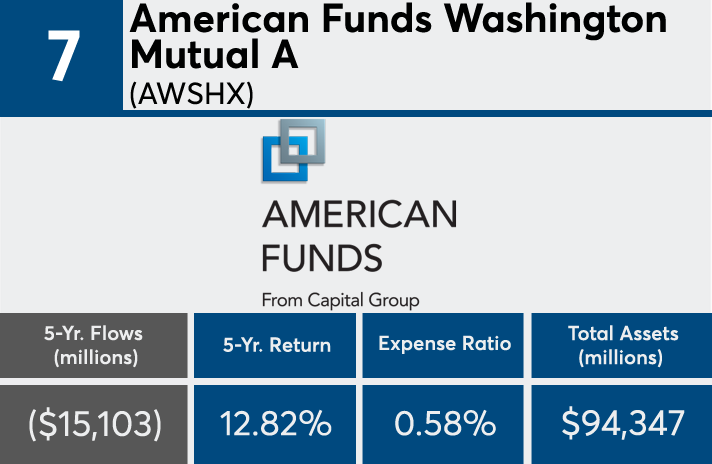

7. American Funds Washington Mutual A (AWSHX)

5-Yr. Flows (millions): ($15,103)

1-Yr. Returns: 18.76%

5-Yr. Returns: 12.82%

Expense Ratio: 0.58%

Total Assets (millions): $94,347

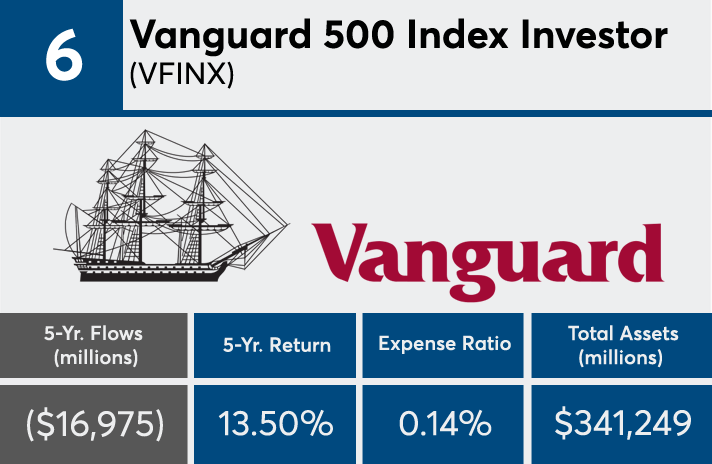

6. Vanguard 500 Index Investor (VFINX)

5-Yr. Flows (millions): ($16,975)

1-Yr. Returns: 18.70%

5-Yr. Returns: 13.50%

Expense Ratio: 0.14%

Total Assets (millions): $341,249

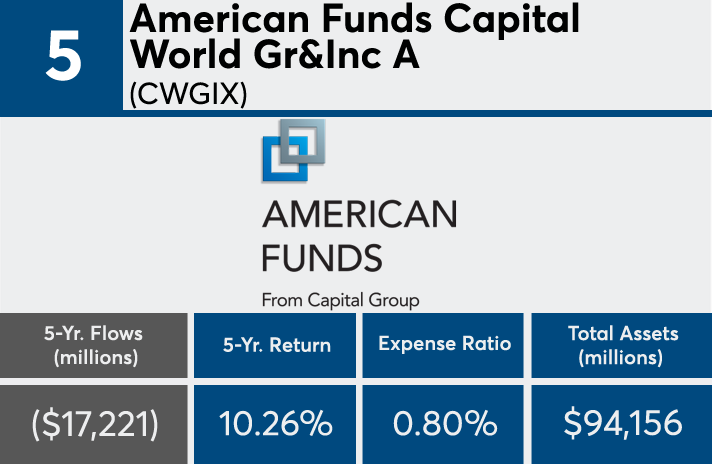

5. American Funds Capital World Gr&Inc A (CWGIX)

5-Yr. Flows (millions): ($17,221)

1-Yr. Returns: 18.73%

5-Yr. Returns: 10.26%

Expense Ratio: 0.80%

Total Assets (millions): $94,156

4. Vanguard Wellington Inv (VWELX)

5-Yr. Flows (millions): ($19,469)

1-Yr. Returns: 13.25%

5-Yr. Returns: 9.78%

Expense Ratio: 0.25%

Total Assets (millions): $101,502

3. Vanguard Total Stock Mkt Idx Inv (VTSMX)

5-Yr. Flows (millions): ($20,043)

1-Yr. Returns: 18.55%

5-Yr. Returns: 13.34%

Expense Ratio: 0.15%

Total Assets (millions): $603,645

2. American Funds Growth Fund of Amer A (AGTHX)

5-Yr. Flows (millions): ($22,948)

1-Yr. Returns: 21.30%

5-Yr. Returns: 14.51%

Expense Ratio: 0.66%

Total Assets (millions): $168,049

1. Fidelity Contrafund (FCNTX)

5-Yr. Flows (millions): ($24,853)

1-Yr. Returns: 23.98%

5-Yr. Returns: 14.18%

Expense Ratio: 0.68%

Total Assets (millions): $117,322