Advisors on the move: 28 of the biggest most recent jumps

Wells Fargo, Merrill Lynch, UBS, and Morgan Stanley all lost some talent, while RBC, Janney Montgomery Scott, Raymond James, and Ameriprise have each added to their pool of planners. The uncertainty surrounding the future of the Broker Protocol played a role in many advisors’ decisions.

Morgan Stanley surprised the industry when it exited the pact, which was struck in 2004 in order to allow a legal framework for breakaway advisors.

Almost 1,700 firms signed the Protocol.

Both UBS and Citigroup have also withdrawn from the accord. One team that oversaw $1.2 billion at UBS left to join J.P. Morgan Securities, making their move just before UBS's planned exit from the

“I think it could be the beginning of the end of the protocol, and that would be bad for advisors and their clients,” Ross Intelisano, an attorney at New York law firm Rich, Intelisano & Katz,

Scroll through our slideshow to see 28 of the largest recent advisor moves.

For a look at our previous roundup,

Wells Fargo loses more talent as Raymond James nabs $250M team

The new hires include former Wells Fargo advisors Alan Williams, Thomas Hunter and Susan Crunk. They operate their newly independent practice in Brentwood, Tennessee.

The group previously generated $1.8 million in annual revenue, according to Raymond James.

Read more

Red-hot RBC nabs a $250M advisor from UBS

Timothy Woods joined the regional firm’s Des Moines, Iowa, office as senior vice president and branch director, according to the company. The 34-year veteran is accompanied by Jennifer Lynn Poe, senior branch service manager.

Read more

Wells Fargo keeps losing them — $1B team joins Baird

Margaret R. Price, Sarah K. Springer, and Grant F. Shearer now operate from Baird's new office in Anchorage, Alaska. It's the regional brokerage firm's first wealth management office in the state.

Read more

UBS recruiting sweep nets $1.4B advisors

In Indianapolis, James Schillaci, Kevin Johns and Brian Wenstrup left Merrill Lynch where they previously oversaw about $335 million and generated $2.3 million in annual production, a spokeswoman confirms. They report to manager Jon Ramey.

The team had been with Merrill since 2008, according to FINRA BrokerCheck records. Prior to Merrill, they worked at Hilliard Lyons.

Read more

Ahead of UBS protocol exit, $1.2B team jumps to J.P. Morgan Securities

The six-member group, led by Kurt Sylvia, joined J.P. Morgan Securities in Palm Beach, Florida, a company spokeswoman confirmed. Sylvia said they made the move in part because of J.P. Morgan's platform and resources.

Sylvia, an industry veteran of 24 years, had been with UBS since 2008, according to FINRA BrokerCheck.

Read more

RBC is at it again, snags $190M Wells Fargo advisor

Gelfand will be serving the high-net-worth and retirement services marketplaces.

“After considerable due diligence, I decided to join RBC Wealth Management because of the global resources of RBC coupled with the small-firm culture,” Gelfand said in a statement.

Read more

Under protocol pressure, $250M UBS team jumps to Steward Partners

Advisors David Bernacchia and Darren DeQuatro had been considering a move for about a year, but they moved up their planned departure after UBS announced it would join Morgan Stanley in leaving the industry accord, which permits departing brokers to take basic client contact information.

Read more

Ameriprise nabs $354M advisors from Wells Fargo, Commonwealth

Former Wells Fargo advisor Michael Huffman has joined Ameriprise with approximately $219 million in client assets. He joined the firm in Mesa, Arizona.

Commonwealth’s Heath Bartlett managed $135 million in assets. He joined the firm's employee channel in Lexington, South Carolina.

Read more

20-something broker brothers launch RIA, M&A platform

Max and Lucas Winthrop of Boston-based Winthrop Wealth Management moved the firm’s advisory assets off LPL’s corporate RIA and into a new one with LPL as its primary custodian, Winthrop announced. The new RIA also includes a proprietary M&A platform.

“With our new hybrid RIA, Winthrop Wealth Management enjoys a greater degree of independence and flexibility than was ever possible before,” Max Winthrop said in a statement. “This change supports our growth strategy and our commitment to delivering unparalleled client service.”

Univest taps advisor to be CIO

Timothy Chubb now oversees investment management across the Souderton, Pennsylvania-based firm’s bank, RIA and broker-dealer lines of business, the company announced. Univest acquired Chubb’s former company, Girard Partners, in 2014, and it now has more than 50 offices in three states.

“I’ve always been committed to helping clients explore a better way to achieving their financial goals,” Chubb said in a statement.

“That starts and ends with a continuous education on the financial markets, economy and how that impacts their long-term aspirations. In this new role, I look forward to providing this thought leadership for Univest and translating that into effective investment strategies for our valued clients.”

$600M practice joins Woodbury Financial from Girard Securities

Partners Michael Matrise and Tom Polzin of Matrise, Polzin & Company, also known as MPC Advisers, joined Woodbury in Brookfield, Wisconsin, their new BD announced. The 43-year-old firm has more than 2,500 clients.

“We’ve grown in this industry for over 40 years, and during that time we have never strayed from our mission of placing clients’ interests above all else,” Matrise said in a statement.

“When selecting a partner for affiliation, our overarching priority was to find a firm that held these same values, and that would work with us to ensure our client service remained top-notch.”

Headline: Large LPL producers merge practices into $875M firm

Jack Hillis of Hillis Financial Services and Mike Allard of CalBay Investments

“Mike and I have known each other for 40 years and we share a passion for client service with the belief that we have an obligation to serve our clients’ best interests at all times,” Hillis said in a statement.

“By bringing together the complementary strengths of our two firms, we can increase our scale and depth of expertise to offer more value to our clients today and into the future.”

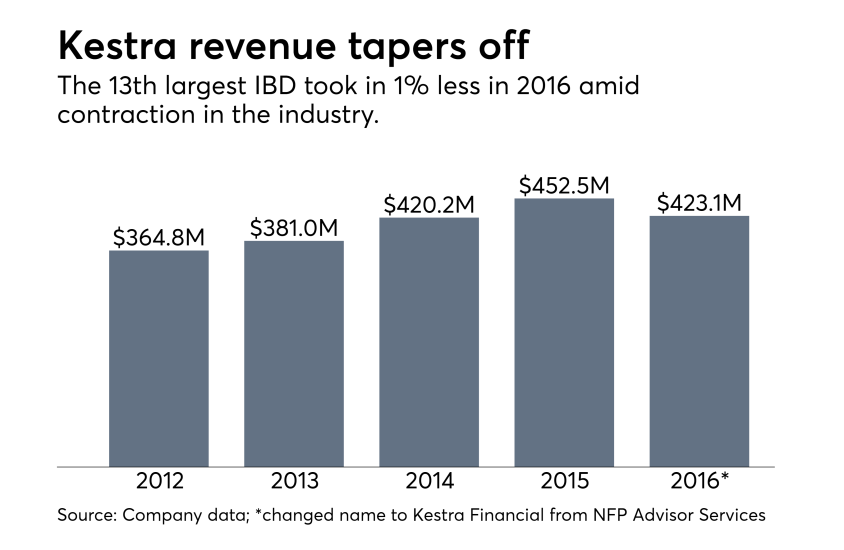

Kestra picks up $400M firm from Cadaret Grant

Thom Shumosic’s MidAtlantic Retirement Planning Specialists, which has 12 advisors in seven offices, joined Kestra in Wilmington, Delaware, the firm’s new BD

“Kestra Financial’s next-generation technology, abundance of resources, and track record of helping advisory practices like ours grow is what spurred us to partner with the organization,” Shumosic said in a statement.

LPL retains $530M firm after National Planning Holdings deal

Thomas and Robert Fross of Fross & Fross Wealth Management will join the largest independent-broker dealer in The Villages, Florida, the Fross brothers announced. The practice includes four producing advisors and 11 full-time staff members.

The brothers also own an advisor consulting firm called Platinum Advisor Strategies.

“We were very impressed with the forward thinking of the firm on things like technology and marketing,” Robert Fross said in a statement. “We are particularly excited to be able to leverage LPL’s proprietary research and its high-net-worth capabilities, which offer a level of sophistication that will add tremendous value to our business.”

Raymond James lands advisors with over $700M

Six wirehouse advisors joined Raymond James from Merrill Lynch and Morgan Stanley ― with the latter career changes occurring just prior to Morgan Stanley's

Raymond James’ newest hires say they moved for better corporate culture and capabilities. Four joined the St. Petersburg, Florida-based firm's employee side, while two joined the independent side.

"I liked the fact Raymond James owns a bank and is not owned by one," former Merrill Lynch advisor Arthur Springer said in a statement.

Read more

$380M National Planning group departs for Ameriprise

Phil Wood’s team, which oversees $380 million in assets under management, has opted to join Ameriprise Financial, leaving SII Investments. SII is one of the four broker-dealers in the NPH network, which also includes National Planning, Invest Financial and Investment Centers of America.

Wood says he made the decision to join Ameriprise for three reasons: “First, the firm's values and history of focusing on client needs. Second, we wanted the financial planning and technology resources that only a large, self-clearing firm can offer. And finally, we wanted a firm who would partner with us to help grow our business,” he said in a statement.

Read more

$327M advisor joins Raymond James’ Alex. Brown

James Sheehan left UBS prior to the firm's

The St. Petersburg, Florida-based firm has been an aggressive recruiter of advisor talent in recent years, and the Alex. Brown unit has not been an exception. In August, Alex a $500 million team from Morgan Stanley, also in New York.

For his part, Sheehan said he had been considering a move for some time. He was drawn to Alex. Brown and Raymond James for several reasons including its technology and culture.

Read more

Wells Fargo loses 5 advisors with over $400M in AUM

Among the recent moves are two veteran advisors who bolted to join RBC’s offices in Raleigh, North Carolina. Joseph Friend and Ross Gordon have 29 and 43 years of industry experience, respectively.

Janney Montgomery Scott, continuing its own hiring streak, scooped up another three advisors from Wells Fargo. The Philadelphia-based firm announced four new hires with a combined $260 million in client assets — three of which came from the wirehouse.

Ronald Gaillard joined the firm's office in Newtown, Pennsylvania. He oversaw $76 million in client assets, according to his new employer. Thomas Hagigh, who managed $78 million, has joined Janney's Baltimore office. And Stephen Zales has joined the firm's branch in Wyncote, Pennsylvania, also managing $78 million in client assets.

Separately, advisor David Varela, who has 24 years of industry experience and manages $48 million in assets, left Raymond James to work at Janney’s

Boston office, a spokesman said.

Read more

Raymond James sweeps up advisors with nearly $1.4B

Like its fellow regional and independent broker-dealers, Raymond James has been on a

Among the new hires are Michael Zizmer and Newton Jones. While at UBS, they oversaw about $440 million and generated annual fees and commissions of more than $3.2 million, according to their new employer.

They bolted from UBS and officially registered with Raymond James on November 30 — the day before the wirehouse exited the protocol, an industry trade agreement that permits brokers to take basic client contact information when switching firms.

Read more

LPL hybrid practice adds $100M advisor from Wells Fargo

Scot Lance joined Eric Aanes’ Larkspur, California-based Titus Wealth Management, the firm announced. Lance, who also previously worked at Merrill Lynch, Lehman Brothers, UBS and Bank of America, now serves as a managing director at the hybrid practice.

“Joining Eric and the Titus team offers me the opportunity to be a part of a growth-minded practice while keeping my independence as a financial advisor,” Lance said in a statement.

J.P. Morgan Securities loses $700M team to hybrid RIA

William Christian, Tammi Lauder, and brothers Michael and William Lent will now serve wealthy clients and institutions at Fieldpoint Private, which is based in Greenwich, Connecticut.

The team was drawn to the firm because it is able to deliver all of the advice, products and services of a large firm, but with a “nimbleness, creativity, and client-centricity that doesn’t exist on the Street,” says Fieldpoint CEO Robert Matthews.

Read more

Ameriprise grabs $141M advisor from Stifel

Mark McGrath spent 10 years working at Stifel, according to FINRA Brokercheck. He had previously worked three years with Ryan Beck & Co after starting his career at Morgan Stanley in 1992.

“Ameriprise is an industry leader in financial planning. People are living longer than ever before, and it’s important for clients to have a retirement plan, regardless of their current age,” McGrath said in a statement about the move. “With Ameriprise, I’m able to offer tailored advice and solutions to help meet their goals no matter where they are on the age spectrum.”

Woodbury Financial grabs three firms with $500M from National Planning, SII Investments

Woodbury grabbed two Independence, Missouri-based firms — Bill Evans and Terri Steele’s Evans and Steele Financial and Martin Tax & Financial Services — from National Planning, according to the firm.

Michigan-based partner firms Platinum Wealth Management Group and Integrated Wealth Management also joined Woodbury from SII Investments. The three groups have more than $500 million in assets under administration.

“The veritable influx of new advisory firms we've experienced this year is reflective of the strong industry reputation that we have built for delivering excellent service, and a tailored approach that enables us to support firms' divergent and specific needs,” Woodbury CEO Rick Fergesen said in a statement.

Wells Fargo poaches new director from Eaton Vance

Newly hired director of portfolio strategy and alignment within client experience and growth, John Crowley, has joined the firm from Eaton Vance. Most recently Crowley served as vice president of Eaton Vance Management and portfolio manager of Eaton Vance’s value team.

Crowley’s “vast knowledge and experience will prove valuable as we continue to help our clients reach their goals through the fulfillment of our fiduciary duty and commitment to clients,” Wells Fargo Advisors’ head of client experience and growth Heather Hunt-Ruddy said in a statement.

Verdence Capital Advisors’ team is growing

Verdence was formed in July of 2017 and manages approximately $2 billion in client assets. Horneman’s role will be to publish detailed research on both global and domestic markets for the firm.

“Megan brings an expertise that will greatly influence affluent investors, investment boards and members of high-net worth family offices,” Verdence CEO and Partner Leo Kelly said in a statement. “Her overall market expertise will fit perfectly within the culture of our group.”

Janney’s fixed income team gets new leader

Company veteran Vivian Altman will be responsible for banking, strategic planning, coordinating execution with underwriting and sales, and expanding Janney’s Public Finance presence.

“Vivian is one of the most highly respected and experienced professionals in the public finance industry,” said Tom Bajus, Managing Director, Head of Fixed Income. “Her proven track-record of success and leadership, coupled with her more than three decades of industry knowledge, make her the ideal candidate for this role.”

Kestra Private Wealth Services grabs $68M firm

John Hebert, Brandon Hebert, and Jeffrey Hebert of Modernize Wealth joined the firm in Chandler, Arizona, Kestra

“Modernize Wealth provides clients with a holistic planning experience, and as part of that, we want to be associated with a firm that offers us the freedom to utilize state-of-the-art technology. We found those resources – and more – in Kestra PWS,” John Hebert said in a prepared statement.

Read more