Active ETFs: Top Performers Over 3-Years

One challenge is that investors often pursue ETFs in the first place because of dissatisfaction with actively managed options. Another obstacle for fund managers is the requirement to provide daily transparency. Managers are often worried about tipping their hand as they enter and exit positions, which can take a few days.

Sometimes, these investments can get complex. With an ETF that’s actively traded, investors can find themselves in a position of trying to time someone else’s timing, which one analyst says "seems ridiculously complicated." ETFs can provide some tax advantages over traditional mutual funds, especially when the funds sell securities.

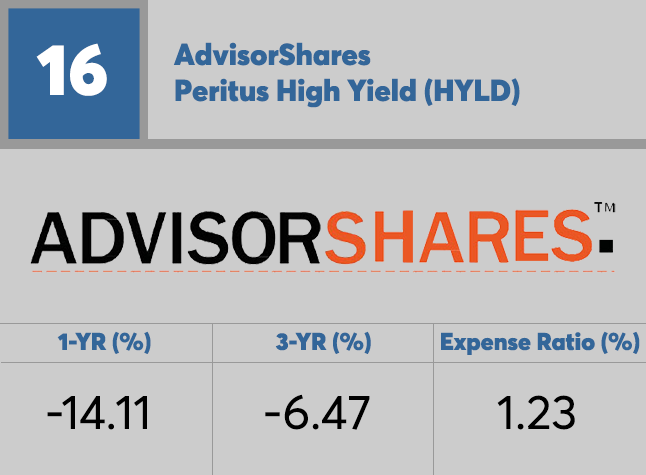

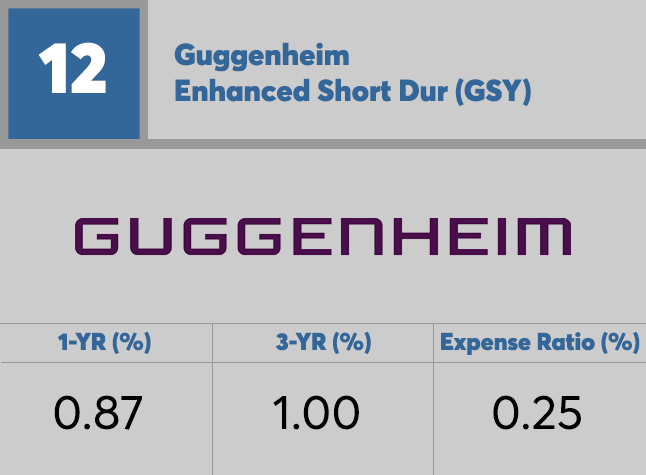

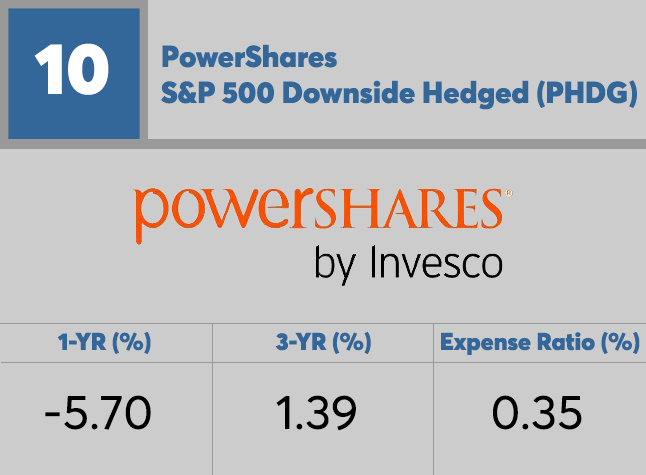

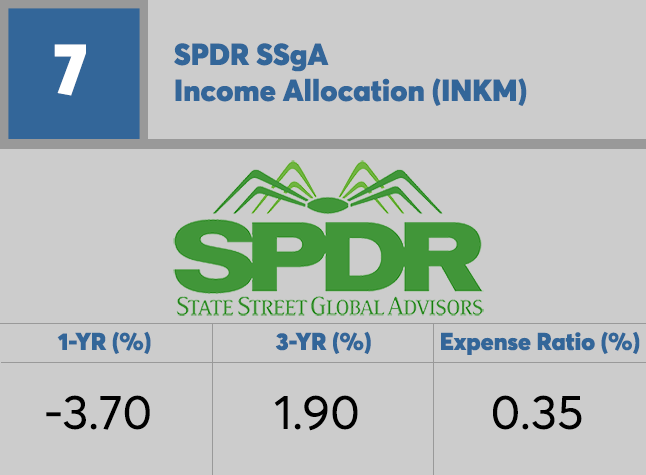

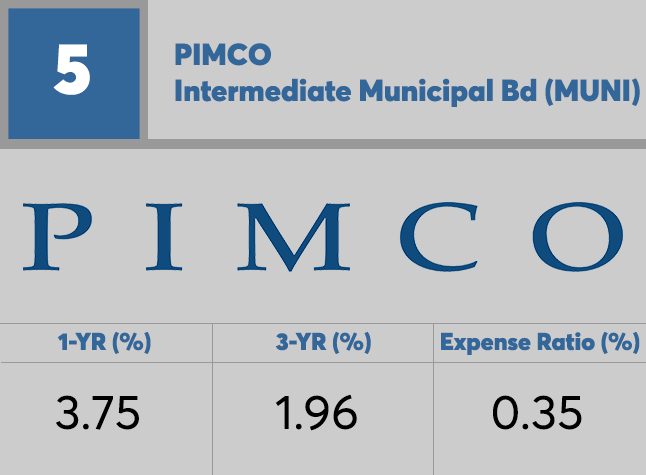

Which funds have outperformed? We ranked the 18 actively managed ETFs with a track record of at least three years and with at least $100 million in assets. Click to see the leaders as measured by three-year returns. For a single-page version, click here. All data from Morningstar.

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years

Active ETFs: Top Performers Over 3-Years