9 Steps to Grow Your AUM With LinkedIn <br><br>

Heres what their surveys (in partnership with FTI Consulting and Cogent Research) found:

-- 62% of financial advisors actively prospecting on LinkedIn over the past year converted new clients from that process.

-- 32% of the financial advisors who converted new clients from LinkedIn had $1 million or more in new assets under management from new clients.

-- There are 5 million affluent investors with $100,000 or more in investable assets and 73% of them use LinkedIn to research investment decisions.

-- The ultra affluent investors with $5 million or more in investable assets are 157% more likely to trust articles shared on LinkedIn and 37% more likely to trust information shared by their LinkedIn network.

-- Finally, 52% of affluent investors say that they would interact with financial advisors via social media, but only 4% currently are being engaged by financial advisors online.

So, how can you use this to your advantage?

Crystal Thies, the LinkedIn Ninja, has developed a great system to mine the 401k rollover gold mine that is LinkedIn. A large percentage of the LinkedIn membership is people in transition looking for a new job. If they are in transition, then there could be a 401k that may need to be moved from their past employer.

The best part of this technique is that those who are not yet allowed to be using social media for business purposes can use it without being out of compliance You simply have to have a LinkedIn profile (even if it doesnt identify you as a financial advisor) and a decent sized LinkedIn network (at least 100 people).

Source: Crystal Thies is an online networking trainer and consultant known in social media circles as the LinkedIn Ninja.

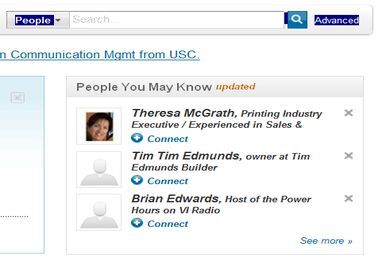

Step 1: Go to the Advanced Search<br><br>

Step 2: Type These Terms in Keyword Box<br><br>

"in transition" OR "new opportunity" NOT financial NOT finance and NOT investment

Step 3: Enter Zip Code, Set Proximity Range<br><br>

Step 4: Check the Box for 2nd Connections<br><br>

Step 5: Click on the Search Button<br><br>

Step 6: Review Your Connections<br><br>

Step 7: Strategically Analyze Your Options<br><br>

Step 8: The Referral Request<br><br>

How you approach your connection about the referral really depends on the strength of your relationship with them. If its someone you know well, it should be relatively easy since they know who you are, what you do, how well you do it, and they hopefully want to help you. If its someone you dont know well, then youre going to have to be more subtle or that could also be an excuse just to get to know them better before asking about the prospect. Ive found that a message similar to that below often works very well:

Dear Connection,

I noticed that you were connected to Jane Smith on LinkedIn and that Jane is currently in between career opportunities. As you may or may not know, I help people in transition take control of the few things in their financial lives that they can control during these often turbulent times. I was wondering if you would be open to talking to me about your relationship with Jane and if it would be appropriate for you to introduce the two of us. I would be happy to meet you for coffee or lunch or schedule a phone call at your convenience.

If your relationship with Jane is not such where you would be comfortable approaching her about this topic, please feel free to say so and know that there are no hard feelings. If there is ever anything I can do to help you or your business, please dont hesitate to ask. I look forward to hearing from you.

Warmest regards,

Me

Step 9: Talk to Your Connection; Set Up Introduction<br><br>

The ultimate success of the technique really depends on your relationship building and communication skills. I can show you all the prospects you need on LinkedIn, but if you cant build the relationship in order to effectively gain access to them, then youll never succeed.

I also seriously caution against trying to contact the prospects cold and drop the name of the connection between you. You will likely not get a warm welcome and will quickly burn bridges with your connections.

The best part is that once youve developed this search you can save it and LinkedIn will email you every week with the latest prospects that meet your criteria. Imagine that potential 401k rollovers landing in your inbox every single week without you lifting a finger!

Also see:

7 Facebook Basics for Financial Advisors

10 Critical Social Media Tips for Advisors

Getting Social: The Rules

10 Steps to Twitter Success for Financial Advisors