8 Things Financial Advisors SHOULDN'T Do on LinkedIn

Here are 8 things financial advisors shouldnt be doing on LinkedIn.

Source: Crystal Thies, co-author of The Social Media Handbook for Financial Advisors

For the text-version of this slideshow,

1. Failing to Archive LinkedIn Activity

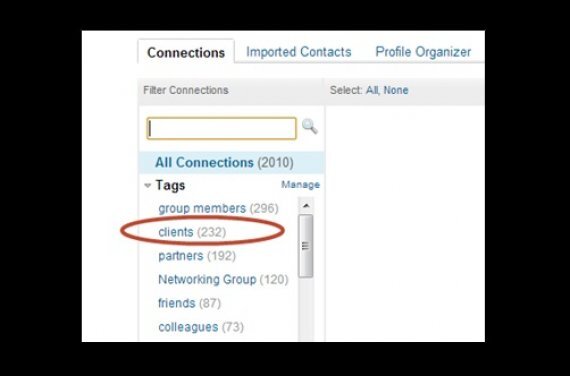

2. Not Connecting with Clients

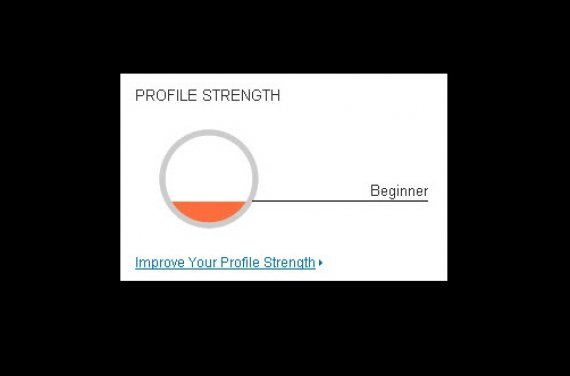

3. Having an Incomplete or "Canned" Profile

Because your LinkedIn profile is about you as an entire person and not just you the advisor, use the sections about community service, volunteer work, etc. to add more dimension to your profile. Be sure not to forget about keywords to search optimize your profile and increase the odds of being found.

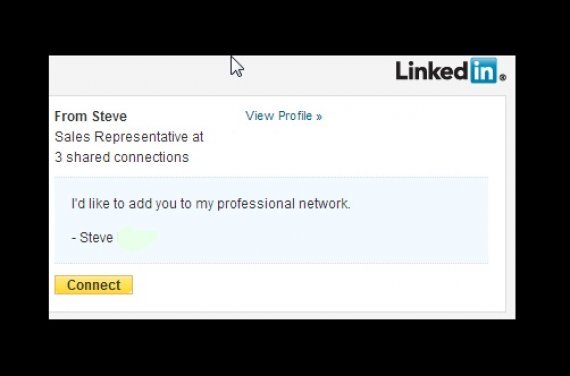

4. Failing to Send Personalized Invitations to Connect

However, remember to use an archiving platform that captures the personal LinkedIn messages in order to be in compliance and capture the communication.

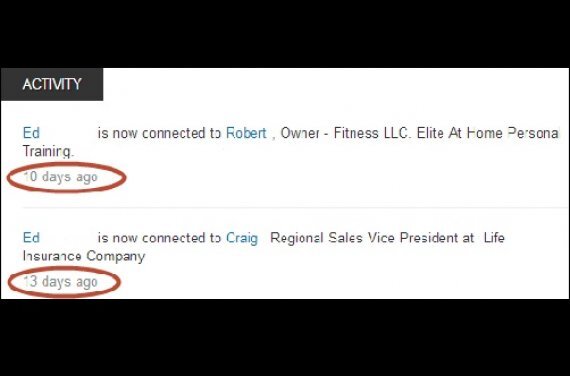

5. Not Keeping up With the Conversation

The SEC and FINRA consider status updates to be "online interactive electronic" content that requires oversight but not prior review. With that said, several large companies are still requiring pre-review or only allowing use of status updates from a pre-approved library.

6. Only Posting Financially Related Status Updates and Selling Too Much

Share information about other topics you're passionate about (more likely to get people to share non-financial content and you than financial education articles). Balance content between that meant to educate your network and that which you want your network to engage with and share.

7. Joining Only LinkedIn Groups Full of Other Financial Advisors

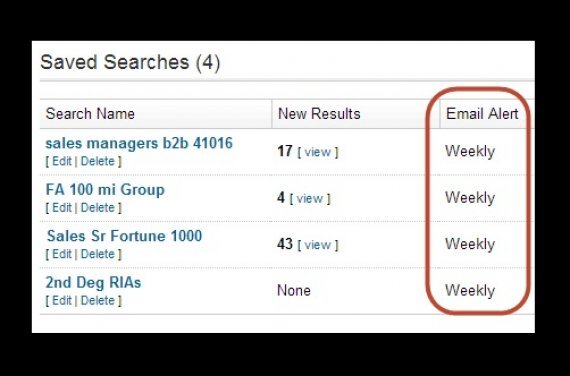

8. Not Setting Up and Saving LinkedIn Search To Find Perfect Prospects

For the text-version of this slideshow,