Best pay for the $400K advisor

"It wasn’t a year to make a lot of big changes," says compensation consultant Andy Tasnady, who points to "the unsettled nature of the marketplace due to the DOL rule."

Each year, On Wall Street compiles an analysis looking at the starting payouts at wirehouse, regional and national brokerage firms for advisors at four different production levels. Core payout grids remained largely untouched across the country even though firms have changed investment platforms in response to the

"They’ve been making tiny tweaks to bonuses, but the core comp hasn’t changed for most people," says Tasnady, who helped prepare this year's compensation analysis.

To be sure, regional brokerage firms are not known for annually tweaking compensation plans, a practice long common at wirehouses. Raymond James, for example,

"Traditionally, every year they started changing the grid around and people felt a loss of sense of control. Advisors would get mad and leave. So now the major wirehouses leave their grids intact. Firms have realized that giving producers a slightly different grid every year is a losing strategy, because you're always going to lose people when you do that," Elzweig

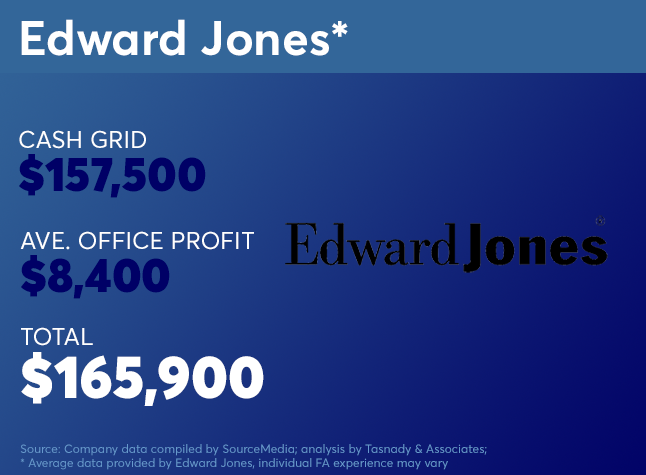

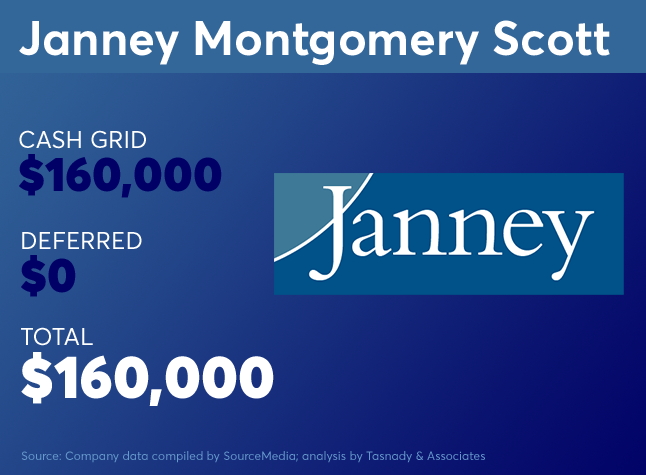

Scroll through to see how compensation plans compare in 2018.

To see last year's compensation analysis, please click

Data was collected by SourceMedia and analysis conducted by Tasnady & Associates.

A number of special policies are not included here since they do not affect 100% of the population evenly and therefore are more haphazard to compare. Individual results can vary dramatically, based on the mix of business and policies at each firm. For example, pay can rise from special bonuses and fall from penalties such as discount sharing, small client limits and ticket charges

Assumptions for basic pay (prior to special policies/contingent bonuses):

- 25% in individual stocks; 25% in individual bonds, 25% in mutual funds; 25% in fee-based (wrap accounts, managed accounts, etc.)

- Year-end basic bonuses are shown in deferred totals.

- Length of service is assumed to be 10 years.

- Assumes no bonuses from growth, nor asset-based bonuses, or other behavior-based awards.

Does not include: T&E expense allowance, discount sharing or ticket charge expense assumptions, small household or small ticket policy assumptions, or value of any options awards.