Financial Advisor Confidence Outlook

The Financial Advisor Confidence Outlook (FACO) is a monthly index published on Financial Planning that surveys hundreds of financial advisors to understand their forward-looking perspective on the economy and plans for client asset allocations. This index provides a snapshot of the economic landscape and provides a peer view into client advising choices for the coming month.

In this index, advisors are asked to share their outlook on six core economic indicators: the overall economy, the global economic system, government policy, their asset allocation, their client's risk tolerance, and their practice performance. From these responses, a score is developed to take into account the balance of positive and negative outlooks. These scores are then averaged to create the overall outlook score: a value from -100 to 100 with -100 being the most pessimistic outlook possible, 0 being a neutral outlook, and 100 being the most optimistic outlook possible.

The FACO (June, 2023 – present) is a reimagined version of the Retirement Advisor Confidence Index (June, 2011 – May, 2023).

The 6-3 Supreme Court ruling against one of President Donald Trump's signature economic policies was consequential, but experts say volatility is unlikely to be over.

-

Financial advisors say they are increasing client portfolio allocations to international stocks in the latest Financial Planning survey.

February 10 -

Nearly two-thirds of advisors surveyed this month said that internal training programs or workshops were offered by their firms.

February 6 -

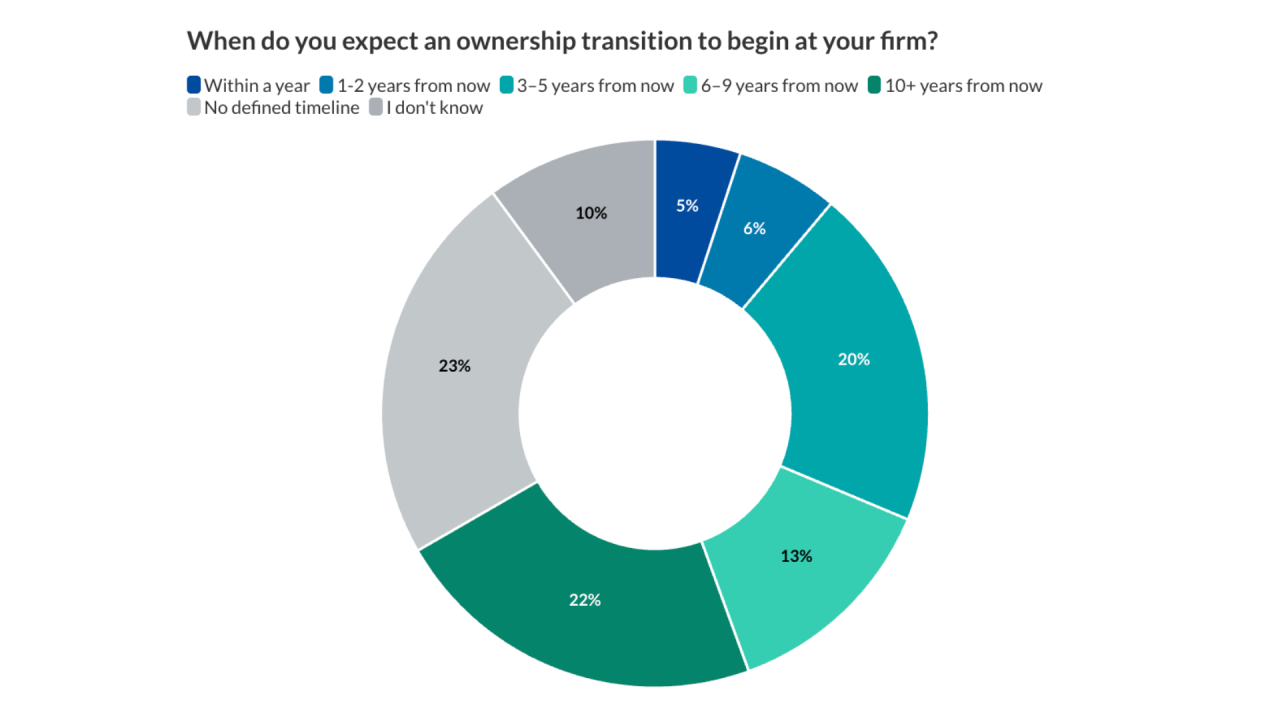

Many advisors haven't yet begun putting together an exit plan. Experts say there are common features and defined timelines that can help make it work.

January 26 -

Advisors know that a transition plan is important, but many fall into the trap of procrastination.

January 23 -

The recent fall in the price of bitcoin and other cryptocurrencies is likely to blame, experts say, but don't expect that decrease to continue forever.

December 19 -

Findings from iterations of Financial Planning's Financial Advisory Confidence Outlook show which assets have stood the test of time.

November 17 -

One-third of financial advisors say balancing personalization with growth is the hardest trade-off for them to manage. Doing so successfully means making hard choices about what's most important for clients and the business.

November 14 -

Less than a third of firms have a formal, documented plan in place, according to this month's Financial Advisor Confidence Outlook survey. Experts say this is a dangerous state of affairs.

November 13 -

Political instability and other pressures are feeding some clients' portfolio fears, advisors say in this month's Financial Advisor Confidence Outlook.

November 12 -

Across more than two years of advisor surveys, industry worries have evolved dramatically. Yet certain themes continue to capture attention.

October 31