-

American Portfolios Financial Services, a formerly independent brokerage now under the Osaic umbrella, was accused of not being forthright about its handling of clients' uninvested cash.

December 31 -

A detailed to-do list for SEC-registered firms to build a foundation for compliant and effective anti-money laundering protocols.

December 31 Flagright

Flagright -

A new risk alert calls out firms for improperly disclosing relationships with outside promoters brought in to provide a testimonial or endorsement.

December 19 -

The GENIUS and Clarity Acts and SEC guidance on custody clear a path for advisors recommending digital asset strategies, albeit with expanded diligence protocols.

December 19 Gemini

Gemini -

For the first time in an annual compliance report, FINRA devotes a section to AI risks, including from third-party vendors and scammers.

December 9 -

Henry Robert Gleckler IV's dispute with JPMorgan over his alleged solicitation of his former clients now heads for a resolution before a FINRA arbitration panel.

December 5 -

Nearly all the brokers who dropped their FINRA registration in the wake of tougher rules kept their insurance licenses, according to newly published research.

December 4 -

The fund manager, convicted of fraud by a New York federal jury in August 2024 and sentence to seven years, spent less than two weeks in prison before being released.

December 2 -

After the newly crypto-friendly Donald Trump won reelection, bitcoin jumped over $100,000. Many advisors and even more clients remain skeptical, though.

December 1 -

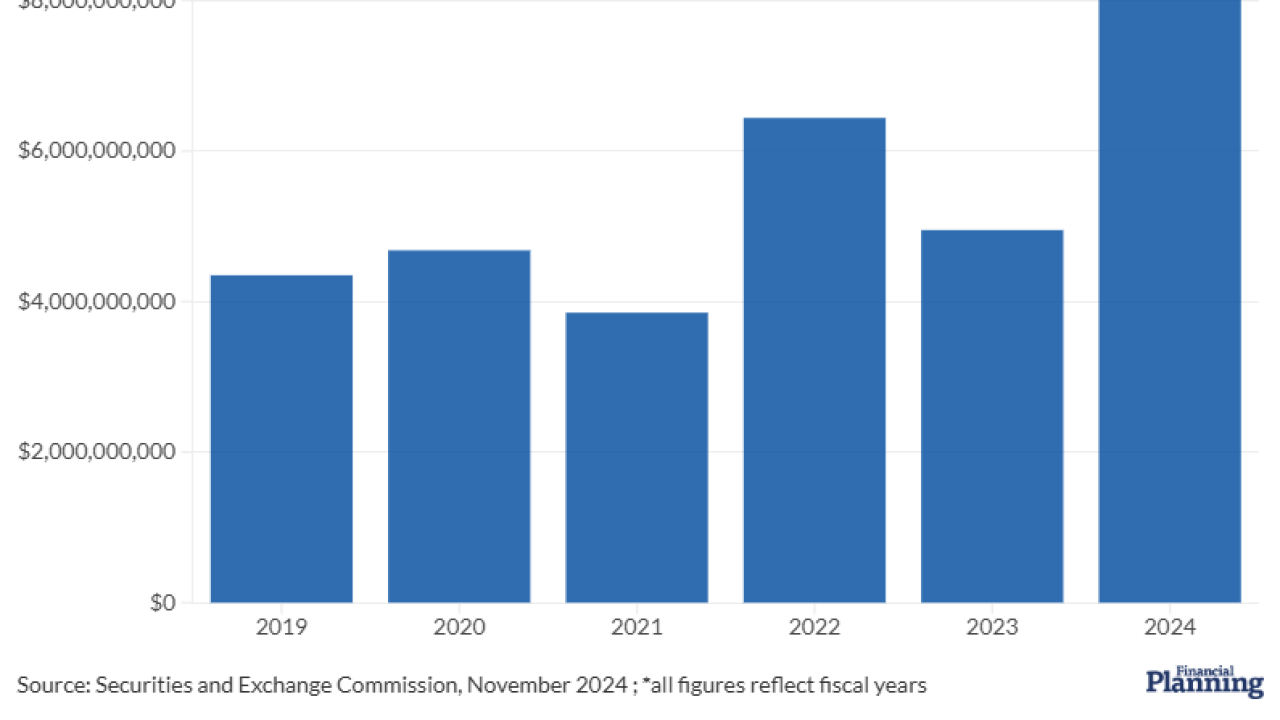

The latest SEC Enforcement Activity report finds that the watchdog agency has only started four regulatory cases against public companies under the current presidential administration.

November 25