As you add planners to your team, how do you know they’re advising clients correctly?

As a firm grows, inconsistent decision-making also increases. That hampers efficiency, effective client service and scalability. This is the product of two factors: variances in judgment, or what I call noise, and inaccurate or inadequate information, processes or technology, which I group under the label of bias. To safeguard an advisory organization, owners and managers need to know how to recognize and overcome noise and bias.

What was that noise?

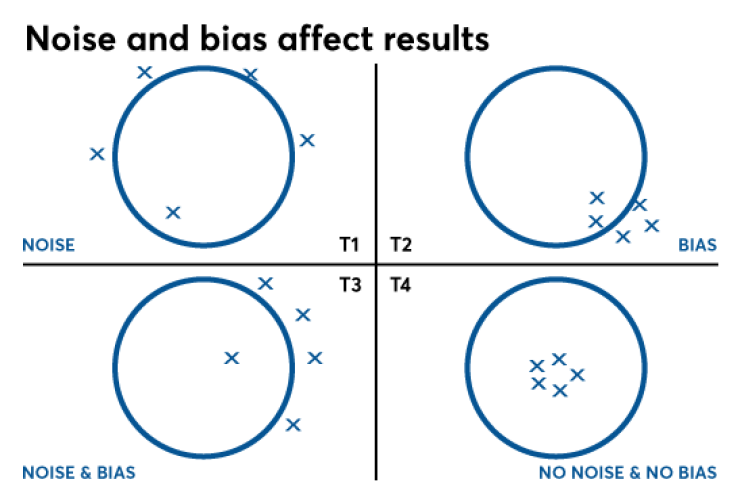

As a youngster, I got into target shooting. I spent nights and weekends learning to fire a single-shot .22-caliber rifle at a paper target 50 feet away and consistently hit a bulls-eye less than ¼ inch across. I learned that poor sight control, known as noise, resulted in Target 1, shown in the diagram below.

I also learned that if I had good sight control but an inaccurate sight on the rifle, the result would reveal bias such as that illustrated in Target 2. At the beginning of my training, poor sight control combined with an inaccurate sight resulted in Target 3, combining noise and bias. Good sight control and an accurate sight resulted in Target 4. Clearly, noise and bias affected my desired outcome.

For advisers to make complex decisions, they need adequate information, formal experience and guiding principles. That makes their situation different from that of a portfolio trader who follows a strict set of rules designed to limit subjective interpretation. Organizations expect consistent outcomes over time from traders following consistent rules, with no bias or noise.

Recent research, however, has shown a problem with this expectation.

This can spell trouble for advisory firms.

Your "custom solution" that isn't

Does your website include the offer of a “custom” or “individual” solution tailored to clients? If so, you’re telling potential clients that your firm can design and deliver exactly what they want. Maybe you can, but can all your advisers do as good a job as you? Before you answer, consider Kahneman’s discovery of the large human variation in judgment-based output (think quality and correctness) that may occur as your advisers work to provide custom services. Are you truly aware of the noise and bias they introduce in client service?

You might still be tempted to answer that you create totally customized products and services for every client. My answer, from a business perspective: I’m unaware of any multi-adviser firm with a competitive fee structure that has remained in business for any length of time giving every client a totally customized, personally crafted financial plan and investment management solution. A high level of customization by itself does not spell success. That approach is inefficient, expensive and downright risky.

Fast-growing firms employ standardized procedures and service offerings to remain cost-competitive while assuring superior levels of quality.

Instead, fast-growing firms employ standardized procedures and service offerings to remain cost-competitive while assuring superior levels of quality. When market demands and business circumstances force changes in service, changes need to be firm-wide. Personalized adjustments need to be non-existent — except when the optimum solution for a specific client must be customized beyond all the approved solutions offered by every adviser or team.

Even though customization introduces human bias and noise, a total robo planning solution isn’t the answer, either.

Simulation planning models show that the most influential factor in financial security comes from the least predictable but most controllable (at least by the client) variable: client behavior, in the form of spending and personal investing. It’s not the variability of investment returns or any other exogenous variable. Put another way, clients can introduce significant bias and noise with their financial actions, creating large variances in otherwise predictable outcomes.

Where customization helps

What can you do to reduce bias and noise while increasing value and efficiency in your firm? The most significant value any adviser can provide is professional, consistent, repeated advice to reduce the impact of bias and noise from clients’ financial behavior. To assure that can happen, every adviser needs to have a high level of interpersonal and communication skills.

To help develop these qualities at my firm, Savant, we encourage every adviser to write, or to speak with local media or at public events, on a regular basis. I’d encourage advisories to do the same. As possible, they should provide mentoring and formal training in interpersonal skills and in communication. Advisers should be aware of speaking opportunities, and their firms should sponsor opportunities, and provide support for presentation development and training.

At Savant, we internally publish our advisers’ media and speaking events, and I recommend firms do the same. It instills a sense of pride in our advisers who represent the firm and reminds every staff member of the importance the firm places on these activities. Recognition encourages advisers to do more.

Employees, regardless of position, should contribute to an internal firm blog. This can provide interesting and valuable insights, and also benefit employees who take the time to craft clear and coherent writing. Advisers and staff can learn to communicate in a concise and straightforward manner, with minimum noise and very little bias.

Written reports to clients, covering performance, analyses and recommendations, should be equally comprehensible. As clearly and simply as possible, state issues, objectives, risk factors and outcomes.

Just as optimum investment management has become harder and harder to customize, so has financial planning advice. If you think there is only one optimum solution for each client, I disagree.

As Dwight D. Eisenhower once said, “Plans are worthless, but planning is everything.”

Experienced planners recognize that things change and stuff happens.

The biggest value you bring to clients is not your custom solution. It’s your willingness and ability to adapt to change and help clients plan for, and face, the unexpected adversities that will come their way. Plan on it.