When I agreed to serve as a volunteer planner for The Jewish Divorce Assistance Center of Los Angeles, I hoped to offer advice to women in crisis, enabling them to rebuild their financial lives. But the surprising result of this service was its powerful impact on my own family.

As I began to help the clients of JDAC, I quickly noticed a common thread: Despite many of these women holding advanced degrees in engineering or law, owning businesses or possessing unique skills (one was a court reporter who could type 140 words per minute), too many lacked even a basic understanding of their family finances. They had been kept in the financial dark during their marriages and consequently had taken no executive role in their family’s financial life.

Some didn’t know if they had retirement accounts, if their homes were owned in trusts or what kind of income they needed to survive. This led them to feel helpless and lost. In one case, a husband informed my client — who had left the workforce to raise their children — that since she didn’t have a job, she didn’t get to know their income. These women were often understandably fearful to leave their marriages, worried that they’d be unable to independently manage their own finances.

It became clear to me, as never before, that knowledge about money was an essential power in relationships. As a mom of twin 9-year-old daughters, it got me thinking — was I guilty of keeping my own daughters in the dark around money? Was I doing enough to educate my girls financially?

AN EARLY START

Even as a young girl, I noticed how open my dad was with me about money. He would spend time teaching me about his passion — investing — and explained concepts such as compound interest and diversification of risk. He discussed the importance of planning for the future and how much he was setting aside to help pay for my college education.

What I now realize looking back on my own childhood, was that my father’s financial lessons around the house gave me confidence and allowed me to understand and embrace matters of money rather than fear them.

So it was after volunteer sessions with several women that I became motivated to start transmitting financial knowledge to my own daughters, as my dad had done with me.

Retail investors increased their allocations to private equity, private credit by a whopping 36% last year as advisors look for diversification and strong returns.

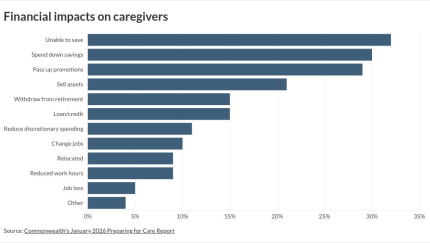

Financial advisors have critical roles for modifying financial plans to cover costs and long-term plans when clients find themselves faced with caring for a family member.

Wescott and Moneta Group present helpful examples of paths for financial advisors and other employees that experts say are essential for growth.

At first, my mini-lessons were casual and focused on broader principles. We spoke about making financial trade-offs, living below your means, and the difference between spending on consumption versus investing for the future.

EMPOWERING THROUGH OPENNESS

Now our conversations have started getting a bit more complex with specific applications to our own family’s finances — how our mortgage works, why we own life insurance and how we save for retirement. My husband and I don’t expect them to grasp everything overnight, but I believe that my willingness to be open with them about money will demystify the subject, inspire their own learning, and ultimately empower them.

Because so many of the women I counseled lacked confidence around money, I was inspired to offer an early boost to my daughters by being open and honest about our finances. Indeed, what started as a decision to try and help the women of my community has led me to take initiative with my own young women and help raise them to be in a position of power to succeed in their relationships, their careers and in life.