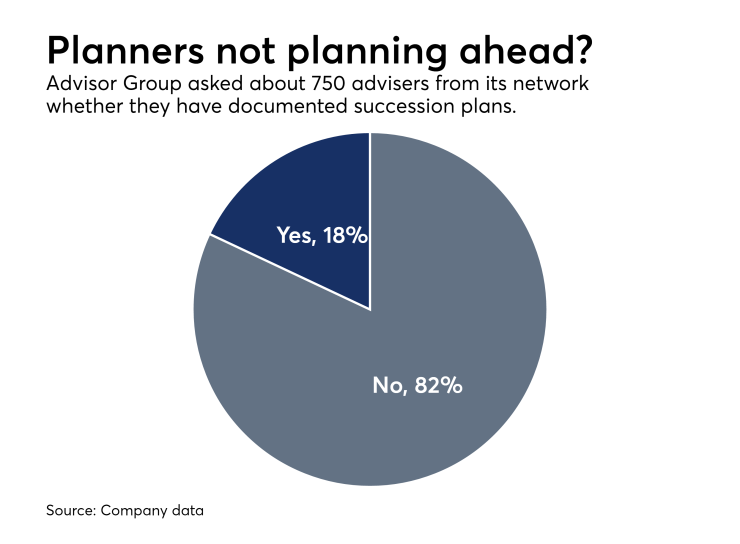

A year ago this month, Advisor Group asked the planners affiliated with its network of independent broker-dealers if they had documented succession plans. The results from the 744 who responded weren’t particularly unusual, but that’s what made them disheartening. Almost 82% of the survey respondents said no, they hadn’t created a plan. The reason? More than half said they “couldn’t find the right person,” according to the survey.

“Unlike a lot of businesses where you just sell to the highest bidder, these businesses are built on human relationships,” Advisor Group CEO Jamie Price told me during a visit to Financial Planning’s New York offices last month. “These advisers are really emotional about it. It’s not like selling a widgets factory.”

So the firm took matters into its own hands. It began

-

Two of its Royal Alliance firms form a $2.5 billion powerhouse.

March 8 -

There are more CFPs over 70 than there are under 30. The board's Center for Financial Planning looks to fix that with new diversity and internship initiatives.

February 15 -

The former Aspiriant CEO joins DeVoe & Co. to launch a new transition service.

March 13 -

To survive, planners must be willing to change in these five areas, according to the popular industry expert.

February 3

The advisers who received that help are the lucky ones. Countless firm founders are still paralyzed when it comes to appointing an heir apparent. They’re even stuck on what kind of succession they’d like to see, whether it be an internal transition or a merger with another firm. The indecision has far reaching ramifications. Among them, clients may refrain from referrals if they don’t have a clear sense of who will handle accounts when their adviser retires, FP Senior Editor Ann Marsh tells me.

Marsh, who wrote this month’s feature, “

Sure, that’s a tall order. Fortunately, no matter where advisers are in their career, it’s never too late to start planning, Marsh says.

“Many firms put into place stopgap solutions with key man or other insurance policies,” Marsh tells me. During her reporting, Marsh spoke with several firms that have been relying on these strategies until their internal succession plans are fully operational. “That can be the right way to go until you sort your strategy out,” she says. Among other approaches, “hire a succession consultant or enroll in a custodian’s transition program to put the mechanics of succession in place.”

Whatever you do, she says, “get started.”