It now appears possible – likely, even – that the effective date of the Department of Labor’s fiduciary regulation will be delayed.

Whoever is the incoming Secretary of Labor appointed by President-elect Donald Trump can put out a notice for comment to do just that for up to a year or longer.

What happens then is anybody’s guess. One possibility would be legislation that either pre-empts and overrides the Labor Department's rule, or prevents the department from expending federal funds on anything having anything to do with the rule. In any case, with Trump in the White House and Republicans controlling both chambers of Congress the rule is almost certainly going to be replaced.

My opinion… good riddance.

The Labor Department's fiduciary standard was written by bureaucrats who don't understand the way financial markets work or what individual clients need, and who cynically and unfairly painted the entire financial advice industry as conflicted merchandisers of unsuitable products.

But that doesn't mean the momentum towards more fully fiduciary wealth management practices will end. Nor should it. Wealth management firms, including both broker-dealers and RIAs, have uniformly and consistently supported a fiduciary standard of care for financial advisers who provide advice to individual clients. I testified to Congress to that effect during the writing of the Dodd-Frank Act.

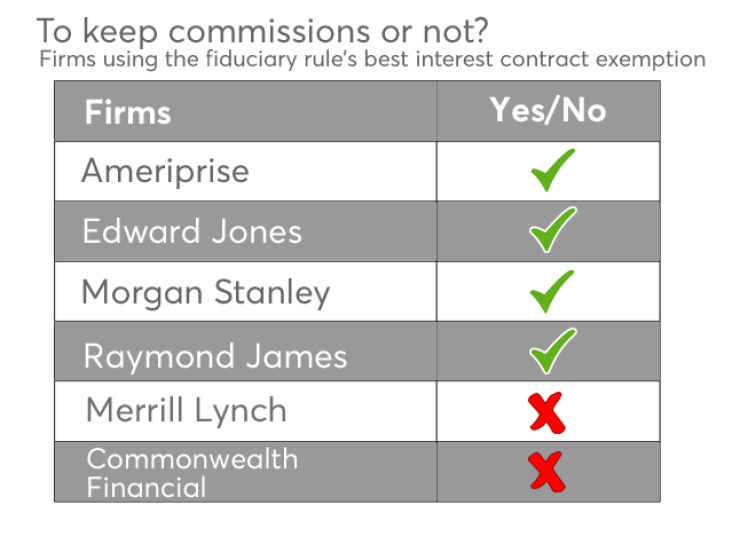

Many wealth management firms, faced with an upcoming implementation date, have already made changes to their business models that will probably endure, whether or not the rule is withdrawn. For example: Merrill Lynch’s decision to eliminate commission-based advice in retirement accounts, and Morgan Stanley’s decision to stop offering back-end recruitment bonuses tied to production on retirement accounts.

The best financial advisers have for years been retooling their practices to minimize conflicts and better align with evolving client needs and expectations.

What's needed isn't wholesale repudiation of a fiduciary standard. Fully fiduciary wealth management is the business model of the future. It is the final stepping stone on a decades-long journey along the path to professional wealth management.

What’s needed, instead, is a better approach to a fiduciary standard.

This alternative path would more fully preserve clients' access to the full range of products and services they enjoy today. It would protect individuals’ ability to choose what kind of adviser they want to work with, and preserve clients’ ability to pay the way they want to pay for advice and services – with fees, or commissions, or a combination of the two.

-

A federal judge categorically rejects claims by an insurance group that the agency overreached. The ruling "sets the tone" for other suits nationwide, an investor advocate says.

November 5 -

"There are ways to potentially be cute with it. You could potentially cut out retirement business from the back-end bonuses," says an ex-Merrill Lynch executive who works in the independent space. "Cute doesn't usually work when it comes to regulators."

November 2 -

Unlike its rival, Morgan will keep commission-based retirement accounts under the new regulation's best interest contract exemption.

October 26

This better approach would be simple and principles-based, instead of one that requires thousands of pages of confusingly impenetrable rules that conflict with existing regulations. It would also apply to all types of client accounts and activity, not just retirement accounts.

And what’s needed is an approach written by regulators who know what they're doing in financial markets – like the SEC, which was given the authority to do just that by the Dodd Frank Act.

Let’s see if, given the chance by a new Secretary of Labor, the SEC can shake off six years of fiduciary dithering, get their act together and come up with something better than the ill-informed, misguided regulation the Labor Department was about to impose on beleaguered retirement savers and the advisers who care about them.

I’m certain they can.