(Bloomberg) — Morgan Stanley's heavier focus on wealth management continues to pay off for CEO James Gorman.

The unit delivered record revenue in the most recent earnings, despite reduced activity from retail investors and persistently low interest rates for most of the quarter. With rates forecast to climb and a potential resurrection in transactions by individual investors, this figure should reach a new high in 2017.

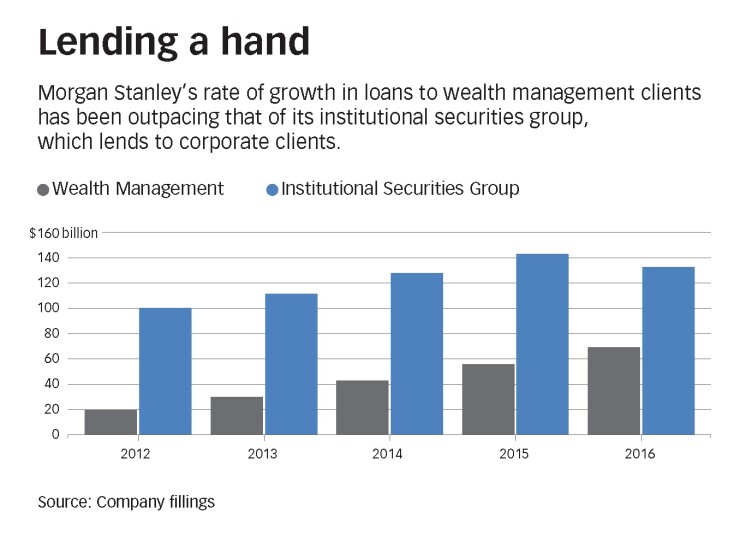

One area of focus is the firm's loans and lending commitments to wealth-management clients, which climbed 24% from a year earlier to $69 billion. Any replication of that momentum should help the firm offset any declines that may befall its institutional securities unit, which makes loans to companies, and saw its overall commitments fall nearly $10 billion (or 7%) to $133 billion from 2015.

Increased lending isn't the only tool that Morgan Stanley is using to bolster its wealth-management business, which accounted for 44% of its 2016 revenue. The bank is also

Morgan's slight decline on Tuesday (along with other U.S. bank stocks) doesn't reflect its results, the position of its business or its ability to hit a targeted return on equity of 9% to 11% by 2017. Rather, the sector's tumble is being chalked up to uncertainty about tax reform under President-elect Donald Trump. Indeed, a day later the decline has been reduced to just a blip, and the firm continues forward with its solid developments in wealth management.