Covering the diversity and inclusion beat at Financial Planning the past three years has left me somewhat desensitized to questions based on spurious reasoning. These queries range from whether the industry needs diversity (it does), whether sexual harassment is a problem at conferences (it is), and even some readers saying that covering conversations and events about diversity and inclusion is nonjournalistic propaganda (it's not).

How can women and minorities feel comfortable in an environment where they have to listen to someone — who is widely considered an industry titan — deliver remarks like that?

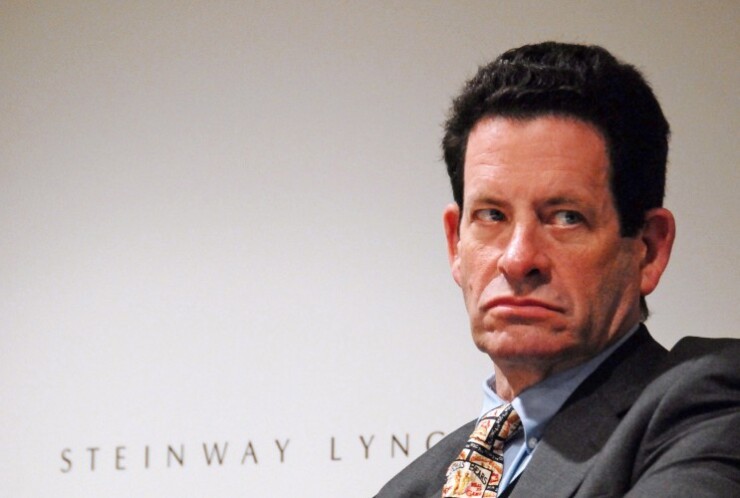

Reporters have an ethical obligation to separate fact from opinion. Granted, this subject often requires us to sift through rightfully emotional responses. After Ken Fisher's derogatory — and frankly unacceptable — comments were exposed by Lake Avenue Financial CEO Alex Chalekian, heated conversations erupted on wealth management Twitter (aka FinTwit) about how women are treated at industry conferences. For me, reaching a conclusion that Fisher's comments were offensive was fairly straightforward: He rudely compared recruiting wealthy clients to picking up a woman at a bar. It appears Fisher has not reserved offensive comments for women: In the past, he criticized Abraham Lincoln for his role in abolishing slavery, according to a

Which is why my jaw dropped when I read author

"Has our estimation of women really plummeted this far? Women in finance — among the most tough-minded professionals — ‘feeling excluded,’ scrambling for smelling salts in the face of a dumb joke?" Shrier writes.

Shrier would have us believe that feeling offended by Fisher's comments is a sign of weakness. "I understand disliking Mr. Fisher’s simile. But allowing a clumsy remark to keep you from pursuing a career? Where are the weak-willed women who would allow it?"

When it comes to the wealth management industry's diversity problem, the numbers do not lie. Data show that a mere 23% of CFPs are women. That percentage is even more dire for people of color.

Shrier attempts to reduce Fisher's off-color comments to merely the difference between men and women. She also claims that a one-two punch of ageism and political correctness has prompted his fall from grace. "Ah, but that too is a sin — acknowledging differences between men and women," Shrier writes. "And this reveals Mr. Fisher's greatest frailty of all: He is 68. He still believes men predominantly approach women, and that you need to charm a woman to get into her pants. How quaint."

I could easily write a separate opinion piece on why that sentence is messed up. But whether Fisher holds traditional ideas about dating, these comments have no place in a professional setting. And Shrier’s assertion doesn't even register as a plausible excuse for his previous racially charged comments. Granted, his audience was dominantly male and white. But how can women and minorities ever feel comfortable in an environment where they have to listen to someone — who is widely considered an industry titan — deliver such remarks?

Shier made a poor choice when she used the backlash against Fisher as an analogy to advance her argument, especially considering her article demonstrates a lack of knowledge about the wealth management industry. She implies Chalekian may be attacking Fisher out of ill will because of his status as a competitor. But comparing Chalekian’s $90.2 million RIA to the multibillion-dollar behemoth that is Fisher Investments is akin to suggesting that a small mom-and-pop burger joint could compete with McDonalds. It just doesn't make any sense.

While I understand the mission of any editorial opinion vertical is to showcase as many different opinions as possible, I am surprised The Journal published a piece on Fisher by someone who doesn't seem to fully grasp the impropriety of the situation.

Society in general — but especially the industry — needs to do better. This backward opinion column is harmful. Pieces like these shift the conversation away from how we should improve and instead give fuel to those, like Fisher, who benefit directly from keeping the status quo.