Two different years-old reports from industry researchers and the academic world offer predictions and analysis that are surprisingly suited for today’s world. And the current generation of decision-makers would be wise to heed those lessons.

Harvard University business historian Alfred Chandler wrote The Visible Hand in 1977, taking his cue from the invisible hand concept that Adam Smith introduced in his famous treatise the Wealth of Nations two centuries earlier.

Chandler’s Pulitzer Prize–winning book described how the definable, controllable factor of management exerted a more powerful influence than amorphous, free-wheeling, invisible market forces. He showed that managers running large enterprises exerted a far greater influence in determining size and concentration in American industry than capital or market forces.

With Chandler’s findings in mind, I researched our industry and considered my business future. First consideration was another report from Undiscovered Managers, a mutual fund, that forecast a shocking decline in profit margins and consolidations. (Undiscovered Managers initially sought out unappreciated businesses, and has now evolved into the Undiscovered Managers Behavioral Fund, which selects small-cap stocks based on behavioral finance factors.)

I was struck by several things by their report. First, the principal author was bright, focused and well-educated. This was not a lunatic forecasting that the sky was falling. Also, the report’s message was in agreement with the findings of a long line of research on business evolution, including Chandler’s assertion about the power of management in dealing with business challenges.

Still, the report ignited a firestorm of controversy because it stated profit margin compression, firm consolidation, the emergence of niche practices and a host of financial woes for small practices were coming. Today, we continue to observe the same forces at work.

Undiscovered Managers followed up a year later with a prescriptive report including their recipe for success: Find a niche or get big.

Develop Niche Services

The whole thing sort of disappeared after that, but that does not mitigate the overall message for today’s businesses.

Chandler’s description of the managerial revolution continues to occur in our business with increasing rapidity, so these issues are something you should keep in mind.

A substantial amount of business research shows maximum profits depend on business strategy, organizational structure and where the firm fits in the marketplace.

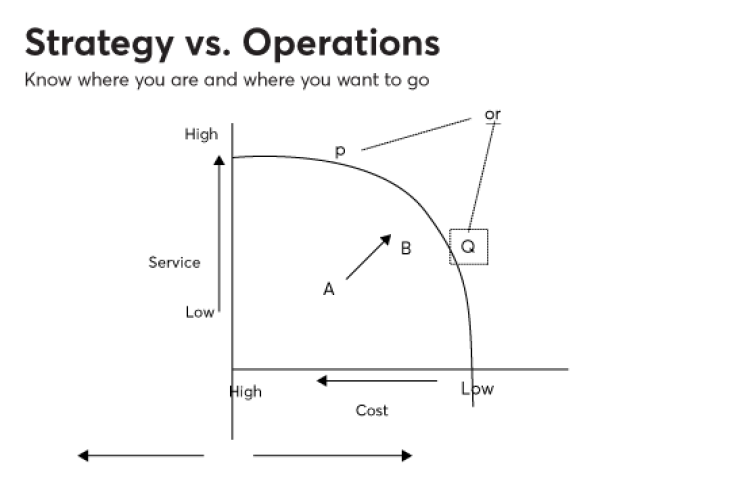

But knowing difference between strategy and operations is key. Attempting to improve service quality and reduce the cost of that service fall under operational effectiveness. On the other hand, the decision to offer high-quality service at a high price, or lower quality service at a lower price is a strategic positioning choice.

Think of your business as an investment portfolio, where you are striving to position it on the edge of the “efficient frontier.” Some decisions move you around the efficient frontier; others move you toward or away from the frontier. You cannot be at two points on the curve at the same time. Simply put, you can’t operate two very different businesses optimally using the same operational model.

What does all this mean for you and your business? Simply expecting higher profits without understanding where you are in your marketplace is a grand waste of time. Analyzing profit margins must be done in the context of your organizational structure and profitability drivers. Otherwise, it doesn’t lead to practical business ideas. Different organizational models with different profit margin structures will work fine—if you know which one is right for you.

Competition will force the inexorable drift from firms that once practiced cutting edge operation to becoming commoditized. If your firm continues to do the same thing year after year, you’ll find yourself becoming less competitive and profitable.

Here’s what we decided at our firm:

• Studying industry surveys, we recognized we were at the higher margins of our industry.

• We confirmed how we operate in the financial planning market: an established, knowledgeable firm (a “gray-hair” firm) based on a comparison of our company’s operating practices and financial characteristics.

• We understood we could not compete with the Walmarts of our world (embodied by the major brokerages like Merrill Lynch), unless we changed organizationally to exactly like them.

• We realized we couldn’t have it both ways—we could only complete as high-margin or high- volume using the same organization.

• We also recognized doing nothing would start our drift to becoming commoditized.

Invest in Expertise and Research

After that bit of self-analysis, here was our reaction. We made a long-term strategic decision stay in the forefront of the industry technically and intellectually. Our advisors would become experts, publishing professional contributions in journals and white papers based on solid research. This translated into knowing a great deal about what we could put into practice. (The gray hairs were showing.)

Then we would share our expertise with colleagues and consumers across the nation by writing and speaking about it. We made existing clients and prospects alike aware that we know our stuff as well as anybody in the country, backing that up with research and practical application of our skills. And we added more services in the gray-hair areas, such as sophisticated 401K services and tax preparation as stand-alone profit centers, and less-costly/less-sophisticated services for smaller clients in another profit center.

These efforts are ongoing. We continue to research, examine, and, when appropriate, install the best organizational, marketing and financial practices used by other firms operating with similar structures.

KNOW WHERE YOU ARE AND WHERE YOU’RE GOING

The industry continues to change. These changes are typical of every maturing industry, and there’s not much you can do about the big trends. On the other hand, there is plenty you can do with your business to take advantage of these changes if you recognize where you fit in the marketplace and operate accordingly.

To do so, you need to get very real with your business. Where do you fit in the marketplace? Not sure? Hire an expert to look at it and tell you where you are—and where you should be. Be sure to examine where you are and where you want to go.

After deciding where you want to go, consider how to get there. Maybe you can transition into a highly competitive “commodity” or “procedure” firm. Or, how about combining with other firms to be a procedure firm? (If you can’t beat ’em, can you join ’em.)

Realize that if you really want to be a “gray-hair” firm by being a bonafide expert, it’s going to take a lot of work if you’re not there now. Remember, relatively few firms will operate and maintain themselves at this level.

Set Long-Term Profit Goals

And bear in mind, it’s total profits, not profit margins, that are important. How you consistently increase profits depends on your form of organization, which depends on your strategic goals and long-term vision for your business.

Whatever you do, don’t just sit there. The invisible hand is becoming easier to see each day.