You’ve been working on establishing your independent advisory firm for a while now. Logo and company name? Check. Website and collateral materials? Check. Legal matters handled and office space secured? Check.

Now comes one of the most important parts in the process: telling your clients about your transition. Especially right now, it’s crucial to engender confidence and trust in your clients even if you’ve been building relationships with them for some time.

Here are some tips from me and my team, offered after more than 20 years in the trenches with breakaway brokers and a select group of independent advisors.

1. Tell your clients why going independent matters to them, and to you.

Don’t assume your clients understand the difference between independently owned financial advisory firms and the wirehouse or broker-dealer world. Explain it to them in clear, concise language.

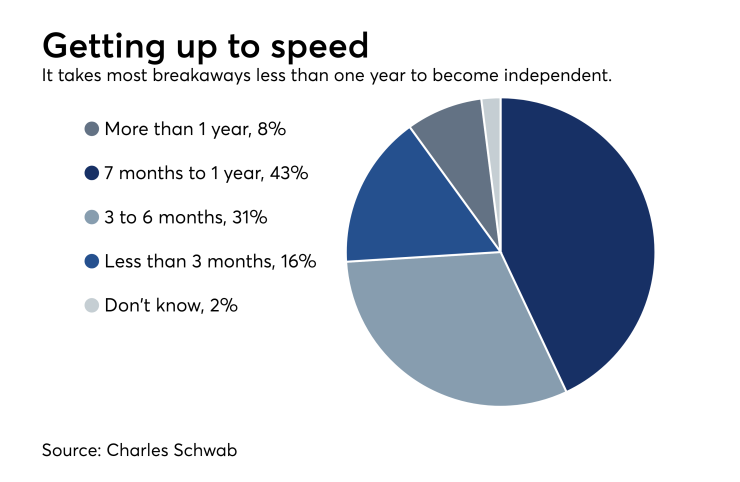

Here’s a good jumping-off point from Charles Schwab’s

Help clients understand why it is in their best interests, and yours, to make this change now. Your clients want you to succeed, and if they know why this move will help you help them, they will be all for it.

2. Be excited! This is really great news

After working double time for … how many months now ... you may be experiencing battle fatigue. But your clients must feel your confidence and excitement, so get that second wind and spend the time needed to craft a passionate and compelling announcement. Tell them how you treasure your relationship with them and that you look forward to maintaining the personalized, results-oriented service they have received from you over the years. Emphasize that although you may have a new look — including a new logo, website, social media, phone number, office and email addresses — that you and the team they’ve come to know and trust will remain the same.

If you can do this via video, so much the better. Your clients want to see your smiling faces and hear directly from you. Here’s a

3. Talk about your custodian, technology and other partners.

As an RIA, you will have the freedom to choose the custodian, technology and other partners you believe are best suited for your clients. Let your clients know that after careful review of all the possible firms, why you selected so-and-so and such-and-such providers. For instance: “Their platform will provide a sound and stable foundation for us to enhance the personal advice and support you have come to expect from us.”

You may not be affiliated with a big name brokerage firm once you cut the cord, but you can reassure your clients that their assets will be held by an independent custodian, that you’ll be using the latest technology and relying on other partners (e.g., practice management consultants) to ensure the well-being of your clients and your firm.

Finally, let your clients know that you will be personally reaching out to answer any questions they have and to share more about how you believe these exciting changes will bring you closer to your mission of serving them for the long haul.