It's no secret that an aging client base is one of the wealth management industry's greatest long-term challenges. Baby Boomers - the bulk of advisers' existing clients - are steadily entering retirement and drawing down their assets. As this lucrative segment shifts from asset accumulation to distribution, advisers must diversify their client base and acquire some younger clients if they expect to grow their business in the long run.

While many advisers recognize the need to attract young, high-potential clients, our research shows that FAs will face an uphill battle if they don’t improve their technology offerings. That's because these clients have very different - and much higher - expectations when it comes to the digital experience; expectations that many tech-averse advisers will struggle to meet.

Many FAs understand the need to adapt their prospecting strategies to include younger, high-potential investors. In a survey of advisers we conducted last December, 41% of FAs named the HENRY segment - high earners, not rich yet - as target prospects, behind only the mass affluent (45%) and high-net-worth investor (45%) segments.

It's easy to understand why FAs plan to target HENRY investors, which we define as individuals age 45 years or younger, with household incomes of at least $100,000 and with $200,000 or less in investable assets. Many will ultimately evolve into high-net-worth investors.

Our research suggests that HENRYs could benefit from the help of a skilled financial professional. Our 2016 Investor Survey found that one-third (33%) of HENRYs don't trust their own investing decisions, despite the fact that they are predominantly self-directed. And the vast majority (70%) expressed a desire to make investing less complicated - an area where advisers can help.

OBVIOUS OPPORTUNITY

HENRYs represent an obvious opportunity for the advice industry, but their tech-savviness may pose an obstacle to advisers who don't offer a modern, feature-rich digital front-end. Our 2016 Investor Survey found that HENRYs are nearly unanimous in saying their brokerage firm's website is "very important" or "extremely important" to them.

Nearly half - 45% - said they log in to their brokerage account online every day or a few times per week. Mobile investing is also very popular, with 58% saying they used their brokerage firm's mobile app in the past 12 months, versus just 45% of baby boomers. Clearly, advisers must offer robust web and mobile capabilities if they hope to satisfy HENRYs' technology expectations.

Unfortunately, full service brokerage firms, the nation's largest employer of financial advisers, continue to offer inferior digital experiences compared to those seen at hybrid brokerage firms like Fidelity, Charles Schwab and E*TRADE. Over the years, our Brokerage Audit service has found that full service firms' websites consistently trail hybrid brokerage firms by a significant margin.

We grade firms' websites on a four-point scale, from

"Poor" (1) to "Excellent" (4). On average, full service firms barely achieve a "Fair" rating, with a 2.05 score versus 2.89 for hybrid brokerages. The situation is even bleaker when assessing the mobile experience, with full-service firms only averaging a 1.44 score (i.e., a "Poor" grade) compared to a 2.24 for the hybrid brokerage firms.

Given that HENRYs' investable assets are below most advisers' account minimums, applying the current service model and pricing structure won't make sense for FAs. Instead, using digital advice technology can help FAs target and acquire HENRYs in a cost-efficient, scalable manner. Our 2016 Investor Survey found that HENRYs are interested in many forms of digital advice, including low-cost online managed account services that were spearheaded by firms like Betterment and Wealthfront and have since been adopted by many incumbent firms.

Forward-looking FAs should consider offering some form of digital advice as an entry-level relationship with HENRYs who have smaller account balances. Doing so will allow FAs to service these accounts and, crucially, form relationships with these potentially lucrative clients at an early stage in their lives. As these younger investors accrue more assets and begin to face more complex financial issues, FAs can transition them into a more traditional, full-service relationship where they can add more value.

TABLE STAKES

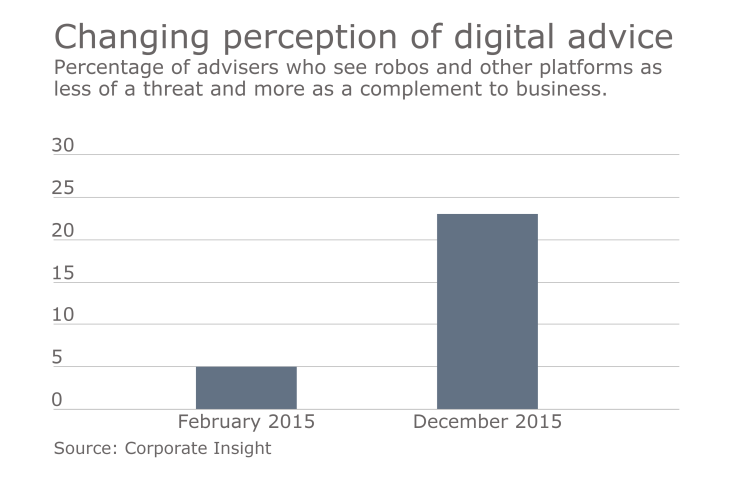

Low-cost, online managed accounts may become table stakes for wealth management firms, a fact that FAs increasingly recognize. We conducted two adviser surveys in 2015 - one in February and one in December - and we saw a significant jump in the number of advisers who consider robo advisers as a potential complement to their business, from 5% to 23%. That said, there seems to be some cognitive dissonance that FAs need to overcome. Though nearly a quarter of FAs think digital advice could be complementary to their business, only 16% plan to integrate it into their current practice, based on our December 2015 Adviser Survey.

CRM, digital account opening and advanced telecommunication technologies can also help FAs succeed with HENRY investors, while minimizing prospecting and customer acquisition costs. In a 2015 survey we conducted of mass affluent investors, we found that frequent communication with FAs is important to younger investors. For this to be sustainable, FAs should leverage CRM software to track contacts and manage messaging more easily and conveniently.

Gen Y and Gen X clients are also open to using video conferencing to supplement in-person meetings with their advisers. Such technology allows advisers to service more clients and expand to other geographies without exhausting the firm's resources.

Younger consumers like HENRYs are known to favor digital channels over in-branch visits when opening accounts. By providing digital account opening services, FAs not only cater to HENRYs' preferences, but also save time which they can allocate to other value-added activities.

Though digital platform improvements can require a significant investment, wealth management firms and FAs must recognize the need for this expense. A modern digital experience will support firms' efforts to diversify their client base and acquire younger, high- potential investors like HENRYs.

This investor segment is experienced with digital investing platforms and has come to expect strong digital capabilities. By offering such features as low-cost online managed accounts, digital account opening, CRM and video conferencing, advisers can improve their chances of capturing HENRY clients in a more economical and scalable fashion.