Want unlimited access to top ideas and insights?

The CARES Act mandates were enacted with the best of intentions, but the law’s waiver of penalties for premature withdrawals from 401(k) savings accounts may hurt the very American workers and families the act is supposed to help.

Under the

With more than 22 million Americans filing unemployment claims over the last month — setting a grim record — it is obvious that the COVID-19 outbreak’s impact on our country’s economy has been devastating. But although millions of Americans are in need of an emergency cash injection, their retirement savings should be the last source they tap, after all other options have been exhausted. Even if penalties and taxes are waived, premature

The CARES Act positions Americans’ 401(k) savings as sources of emergency liquidity. In addition to the destructive impact of cash-outs on the amount of income participants can enjoy in retirement, some in the financial services community are looking to benefit from this well-intentioned government gesture by convincing people to invest the $100,000 they are entitled to withdraw sans penalties.

For example, one real estate development fund has executed an advertising campaign encouraging Americans to withdraw the full $100,000 under the CARES Act, and invest that sum with them to achieve a 10% return. This option, the advertisement assures investors, will help them earn back capital they have lost in the coronavirus-driven market downturn.

This type of misleading offer can be devastating to retirement savers. Cashing out far less than $100,000 can significantly deplete a client’s savings for retirement. According to our research, a hypothetical 30-year-old who cashes out a 401(k) savings balance of $5,000 today would forfeit up to $52,000 in earnings the sum would have accrued for them by age 65, if we assume the account would have grown by 7% per annum.

Encouraging Americans to withdraw as much retirement account savings as they can under the CARES Act to invest what is supposed to be emergency liquidity is unethical, at best, as well as seriously misleading and dangerous.

Cashed-out retirement assets, and the extra savings they would have yielded had they

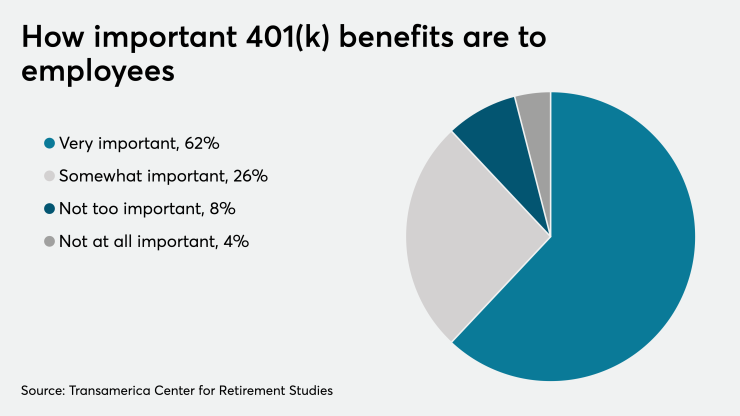

According to a

A study by the

Plan sponsors and financial advisors should use this time to prepare email communications and digital content explaining how cash outs, even if made under the CARES Act, can diminish clients’ retirement prospects. Participants should be reminded that their retirement savings should be considered a last resort for meeting emergency expenses, especially during the present crisis. In addition, sponsors and recordkeepers can educate participants about the importance of keeping as many of their hard-earned retirement savings as possible in the U.S. retirement system, and

Your clients will thank you when they turn 70.