Business plans are important. Through 15 years of building my firm, I’ve created many and have them all. Looking back at those well-thought-out plans now, I just laugh, laugh, laugh. Not because the plans weren’t good — they were just seriously misguided. What should I have done differently?

Coming from medicine to financial planning and having failed at finding a planner who I felt would meet our needs, I had a big picture idea of what I wanted to create. Basically, it was important to provide comprehensive financial planning, of which investment management would be only one part of my broader services.

During my initial training, I asked questions of many other advisors I met through NAPFA and the FPA. Their advice was invaluable, which is one reason I recommend everyone stay active in their professional societies. Based on their suggestions, having a fee-only firm and not selling any products made the most sense for what I wanted to do.

The other big decision was how to charge. The large majority of fee-only advisors who provided comprehensive planning charged based on assets under management. A small but growing number charged hourly fees. A few rare outliers charged a retainer or flat fees.

I talk too much to do hourly planning, and I didn’t want clients to watch the clock as we talked about important details of their life. At the time, I couldn’t wrap my head around retainers, so I went the AUM route. My business plan had a three-year goal of taking care of 20 doctors. I hoped to manage $20 million in assets and make $200,000 per year, but I didn’t want to work too hard.

As I reflect on this plan years later, I’m ROFL! (Rolling on the floor laughing).

What a huge mistake: My initial clients came from my running community and physician coworkers. I quickly learned that some people have a lot of money to manage and the planning is easy, whereas others have very little to manage and the planning is hard. I felt this made my AUM fee unfair to my clients with significant investable assets and unfair to me for my clients with very little money and a lot of planning needs. I had to change my business plan.

Every article on compensation was suddenly interesting, and I quickly devoured them. One article by Bob Veres stood out in particular. It was about the retainer model as the model of the future. I again reached out to the collective brain of NAPFA and an organization now known as the Alliance of Comprehensive Planners. I overhauled my business plan, and after two years in business, I started the change to a flat-fee model based on client complexity.

The practice runs wild: There were many parts to my initial business plans — operations, marketing, revenue and expense projections. At that time, I was a solo practitioner with plans to work from home. Remember, I was only going to take care of friends and coworkers. My initial plan was for slow growth in the first year to make sure I could competently manage a practice and to create good processes.

A nice side effect happened from my involvement in NAPFA — I received a ton of referrals from being only one of two NAPFA members in Jacksonville, Florida — a city of a million people! All of a sudden, I was being called by people I didn’t know. Working from home also became a challenge. I was getting so busy that I couldn’t put the work away. So I updated my business plan yet again. I bought an office, and the expense projections significantly changed. My plan for taking home $200,000 in compensation, three years into the business was laughable.

My involvement in the profession also created challenges. I organized talks on the intersections of health and personal finance for my study group. These became very popular, and I ended up attending many conferences. Handling client care from the road became a challenge.

Reining it in: In 2007, I made one of the smartest moves of my career and hired a coach. Working with

My initial plans were done on an Excel spreadsheet and each section coded in Easter-egg pastels outlining my many moving parts. I squished most of it into eight-point type. Yes, you can laugh some more.

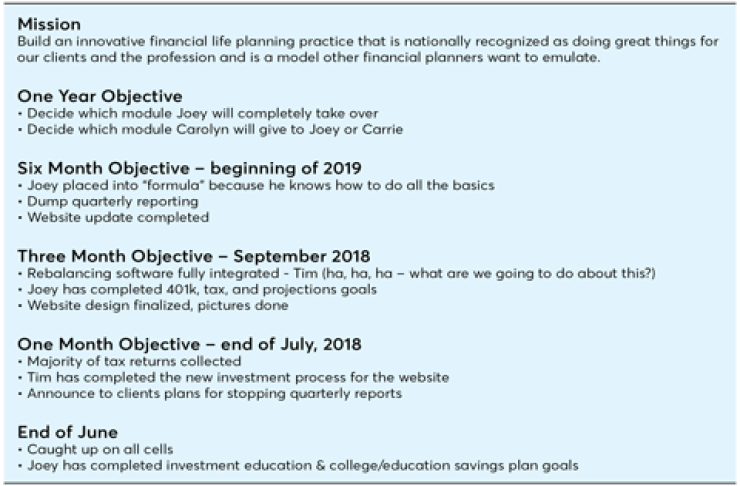

The best part of that business plan was the vision. Numbers change, assumptions fail and sometimes things don’t work out. But if you have a guiding mission, there will always be the touchstone to direct you on what needs to be done next in your business. My mission? Build an innovative financial life-planning practice that is nationally recognized as doing great things for our clients and the profession and is a model other financial planners want to emulate.

We worked to create an ensemble firm based on a holacratic method of governance. Each hire had to agree to the mission and participate in making it a reality.

From complexity to simplicity: Our convoluted one-page business plan in eight-point type in Excel was still too much. We moved to a one-page plan in 12-point type and bullet points in Word. The first section was our core values — simplify life for everyone and act with integrity at all times. Our mission is the second section. We then outlined what we would accomplish in five years, three years, one year, then nine, six, and three months.

Research firm Spectrem Group tracked new highs in 2017 across the mass affluent, millionaire and UHNW segments.

The five- and three-year goals never sat well with any of us. Our work with clients proved that predicting the future was a fool’s game, and the further out you try to predict, the more likely you are to be wrong. A couple of years ago, we made a drastic change and now only do goals over one to 12 months. It is so refreshing. Our plans are simple, obtainable and stay congruent with our mission and core values.

After we moved away from making bogus predictions for the future, we were able to focus on concrete actions that make us better, guide our direction and create a great business that will hopefully become a legacy for future advisors and the profession.