Our

The industry is ripe for disruption, and it is highly probable that the world we operate within, the types of clients we meet and the portfolios we manage will look nearly unrecognizable in the coming years as a result of the DeFi movement. If you think about the influence of crypto in many facets of life over the last 10 years alone, it’s easy to see how the rapidly increasing public desire for the economic change DeFi represents has already begun to reinvent our economy.

DeFi is based on the core ethos that financial systems should not be controlled by intermediaries, but rather governed by peer-to-peer networks and permissionless infrastructure through smart contracts and blockchain technology. That’s a mouthful, so let me break it down.

DeFi providers aren't controlled by intermediaries, such as banks, governments or other institutions, and therefore are disrupting traditional financial services by building alternatives to the systems we’ve relied upon for decades — in some cases centuries — while also building entirely new products. Through DeFi, savings, lending, trading, insurance and other areas of the financial world can operate autonomously — no banks or brokers required.

How is this possible? The short answer: code. More specifically, by using decentralized software known as smart contracts. These contracts automatically execute actions when predetermined conditions are met. They have many use cases but are often used to automate workflows and execution — eliminating the fees, headaches and extra time often spent when working with third parties. These smart contracts operate on transparent, peer-to-peer networks, also known as blockchains. Run by code, not people, blockchains reside online; anyone with an internet connection has access to blockchains, and subsequently to DeFi.

To believers in cryptoassets' promise, this level of public accessibility to financial records and resources opens a world of possibilities to those who have historically been underserved by our traditional systems, which have excluded them from participating fully in the economy by way of various barriers to access and entry.

Due to the global, online, decentralized nature of the space, anyone has the ability to build. It is an inherently inclusive system, designed to diminish inequities among those in it. Demand for this revolution shows that the landscape is evolving at a rapid pace, and it can often feel hard to keep up. Client portfolios will not look the same in five years as they do today. That makes being tuned in to how the financial world is changing that much more important to delivering quality, accurate advice to clients.

Here are seven areas in which DeFi is changing the industry landscape that you should keep your eyes on:

- Asset Management: Investment decisions and trade execution can be brought on chain (blockchain) thereby lowering fees, susceptibility to human biases and friction as a result of human interference in the decision-making process. Smart contracts — the self-executing, code-based protocols that operate on blockchains — are used to automate deployment of capital into predetermined strategies in a way that increases transparency. Like in the traditional world, decentralized asset managers offer a variety of solutions. Examples include IndexCoop, Enzyme Finance and Domani Protocol.

Credit: Collateral-based lending solutions, which in the past have provided investors with eye-popping yields vs. their traditional counterparts, have seen high levels of interest and participation from investors. These solutions calculate rates based on supply and borrowing demand of supported assets. Examples include Aave, Compound Finance, Cream Finance and Fulcrum.

- Cryptodollars: Also referred to as stablecoins, these are dollar-pegged assets on a spectrum of counterparty risk that allow participants to save, earn and trade regardless of fiat-denominated banking access. These cryptoassets are pegged to a less volatile asset, typically fiat money in their most traditional forms, but can also be backed by asset portfolios. Examples include USDC, Tether and MakerDAO (DAI).

- Derivatives: With new markets come new derivatives of said markets. Similar to the traditional world, options, futures, cash-margined trading and other derivatives products are being developed by decentralized applications. Examples include Synthetix and Opyn.

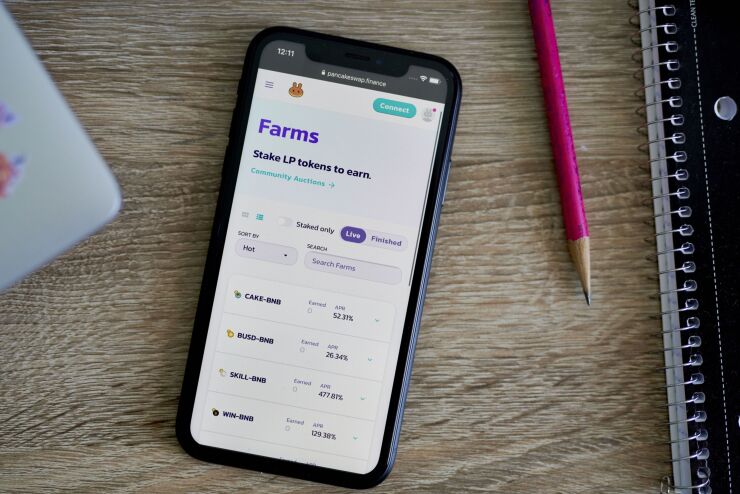

- Exchanges: Permissionless, peer-to-peer decentralized exchanges (also known as a DEX) allow anyone to make trades and create markets between two or more cryptoassets. DEXs also automate liquidity provisioning. In the spirit of decentralization, middlemen are not required to execute trades, and there is no order book due to automated market-making. Examples include SushiSwap, Bancor, PancakeSwap and Uniswap

- Gaming: A not-so-obvious area that financial advisors should keep an eye out for is the explosive growth of play-to-earn gaming on decentralized networks. Participants play online games with the opportunity to be rewarded with cryptoassets as they go. The gamification of DeFi has brought a large number of new entrants to the asset class. Axie Infinity, the largest player in the space, has a market cap of over $5 billion, and 24-hour volumes of over $250 million (per coinmarketcap.com as of Dec. 12). Examples include Axie Infinity and Decentraland.

- Insurance: Just as investors want coverage in traditional finance (TradFi), there is high demand for coverage of deposits into the smart contracts of other applications in DeFi. This coverage is coordinated by digital insurance protocol cooperatives. Examples include Risk Harbour and Bridge Mutual.

Down the road five or 10 years from now, this list may become outdated with the rate of accelerated change happening in the industry. While we are undoubtedly heading toward a period of explosive, systemic and technological innovation in the next decade, it’s important to take it one step at a time, and this is a great place to start.