News flash: Most investors don’t know or care about the differences between the Investment Advisor Fiduciary Standard and the SEC’s Regulation Best Interest. It’s inside baseball and hardly the basis for a major marketing campaign.

Your clients really aren’t focused on who is a fiduciary or not.

They do want to know what you can do for them, how you have treated other clients, and whether you are trustworthy.

And if you tell them you’re not a sales person, they will rightfully chuckle. What is it you’re doing when you ask them to hire you as a financial advisor and to give you their investible assets? Stand-up comedy?

So let’s back up a second. Ever since the SEC adopted Regulation Best Interest as the new standard for financial advisors, industry big-wigs in the RIA camp have been raising hell.

They insist that RIAs merely need to demonstrate the superiority of the fiduciary standard to vanquish their wirehouse opponents. According to their script, wirehouse brokers are product-pushing sales guys and fee-only advisors are disinterested, objective consultants.

But just how plausible is this narrative?

In my view, fiduciary status is not a compelling differentiator for most clients. Investors choose advisors that they like and trust. The regulatory nuances that distinguish an advisor operating under a best interest standard and one governed by a fiduciary standard is too deep in the weeds for most people. It does make for lively and spirited discussion in the pages of trade magazines and at industry conferences, but most investors don’t really care.

-

“We are not delaying and we are not changing the standard,” Chairwoman Susan John says of pressure to weaken the board’s tougher guidelines in line with the SEC’s Reg BI.

July 2 -

Think New Jersey’s proposed rule doesn’t apply to you? Think again.

June 24 -

The SEC predictably came up with regulations that can only be described as a win for brokers.

June 24 -

The state regulator says its proposal is necessary after the commission failed to craft a uniform fiduciary standard.

June 14

Besides, there are plenty of problems with the idea that RIAs can win business by leading with their fiduciary status. First, a business model that an advisor shares with thousands of other RIAs is not particularly compelling. Clients want an advisor to showcase his or her unique value.

And, in my view, disparaging wirehouse advisors doesn’t tell prospective clients why you’re the right choice.

Holding yourself out as a fiduciary doesn’t speak at all to your competence in managing money or in devising a cogent financial planning strategy. This is what investors are looking for.

And frankly, pretending that fiduciaries are mere consultants just doesn’t hold up.

RIAs are clearly salespeople. That’s how they raised all of the assets that they manage and how they attract and retain clients. Anytime you persuade or influence others to undertake a particular action, you are selling. RIAs may have dedicated new business developers on staff or they may use third party marketers to raise assets. RIAs often pay bonuses to their advisors for raising new assets or for the cross selling of in-house managed portfolios. The funny thing about many RIAs is that they are salespeople who don’t think that they are salespeople.

Vilifying salespeople as bad guys is another glaring falsehood. Accomplished salespeople can have a profoundly positive impact on others. Across industries, the very best salespeople are those who can listen to clients, understand their emotions and point of view and then deliver solutions to help them solve their problems. Daniel Pink, in his book “To Sell is Human,” notes that one of the hallmarks of top salespeople is what he terms their capacity for attunement. This is their ability to see the world through the eyes of clients and prospects. He considers this talent a fundamental prerequisite for success in sales in today’s hyper competitive business world.

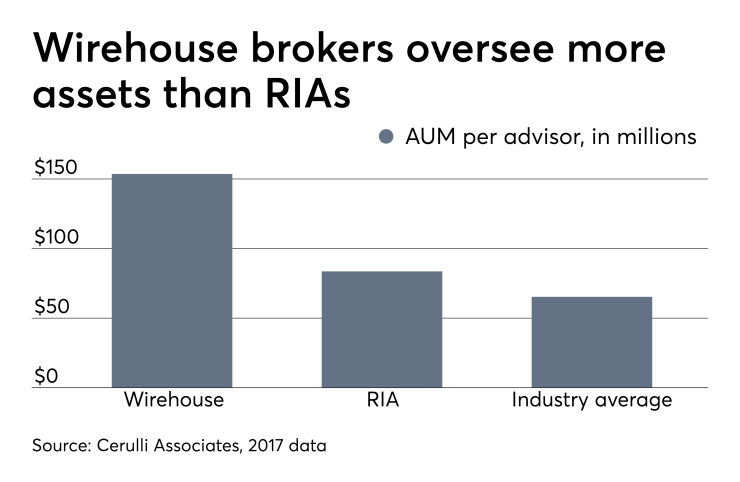

It’s well known that the assets managed by an advisor at the much maligned wirehouses far exceed those typically managed by independent advisors. Top wirehouse teams especially control a disproportionate amount of HNW and UHNW client assets.

At the wirehouses, AUM per advisor tops $150 million — nearly double the $83 million overseen by RIAs, according to 2017 data from Cerulli Associates. (The industry average is $65 million.)

The reason is simple: These high-end advisors have done a good job for their clients and have therefore won the loyalty of a sophisticated and demanding group of investors.

Investors will always choose advisors whom they like and in whom they can have confidence. They’ll continue to gravitate toward those who can make a compelling case for their unique value. Most investors will make this judgement intuitively, perhaps aided by referrals from friends and family. Few will be interested in tedious expositions on the regulatory distinctions between RIAs and wirehouse advisors.