Capital One Investing launched a hybrid robo adviser, making it the latest brokerage firm to venture into the digital advice space.

The move is intended to hit a sweet spot with clients, according to Yvette Butler, president of Capital One Investing, the brokerage arm of Capital One. Bank clients want digital tools but also access to a human adviser when they have more complicated needs or questions, she says.

"I think a lot of times the dialogue sounds like it's an either or. It's not. In our research, we are seeing that all generations are embracing technology and that they want both the human adviser and the digital tools to help them feel empowered," Butler says on the sidelines of SourceMedia's annual In|Vest conference in New York.

Capital One is embracing both what the clients want as well as new technologies that have been rapidly changing how investment advice is delivered to clients, Butler says.

"What we are realizing is that customers want their financial life to catch up with digital life," she says.

This year has seen a number of financial services firms roll out digital advice offerings or ink deals with existing robo adviser firms. In May, UBS partnered with technology developer SigFig to create digital tools for the wirehouse's approximately 7,100 advisers. And in February RBC, which has about 1,900 advisers, reached a similar deal with BlackRock's FutureAdvisor.

Blockbuster industry deals and unforeseen shifts in client attitudes are altering future forecasts for digital advice.

Capital One's offering – called Advisor Connect – is staffed by experienced advisers, most of whom have the CFP designation, Butler says. Clients can call the advisers when they want investment advice from a human.

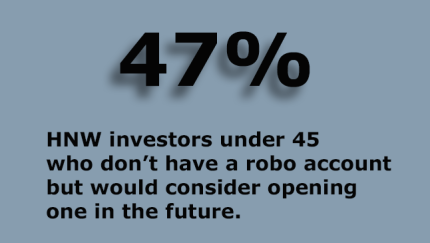

Butler says the firm's annual investor surveys have helped inform how they designed their robo hybrid offering.

"We got a lot of insights that customers are really interested in having digital advice but also having access to human advisers for when they move or get an inheritance or retire. They want access to someone who can help them achieve their goals," she says.

During periods of market volatility, 75% of investors prefer to receive advice from a financial adviser, according to the firm's latest survey.

Clients can access the firm's Capital One Advisers Managed Portfolios with a $25,000 investment; the firm charges a 0.9% annual advisory fee. Butler says the brokerage does not sell proprietary funds.

The technology was developed in-house.