PHOENIX – Will the #MeToo movement come to wealth management?

"A lot has been said about this in other professions, but not so much in ours. But we know those stories are out there," says Jocelyn Wright, chair of the Women's Center at the American College.

The comments, made during a wide-ranging panel discussion on gender discrimination at the FPA's Retreat conference, come as revelations of sexual harassment have rocked other industries.

Influential figures such as Hollywood powerbroker Harvey Weinstein and casino mogul Steve Wynn have had their careers ended amid allegations of sexual misconduct. And several members of the House of Representatives have resigned in recent months over accusations that they too had engaged in misconduct.

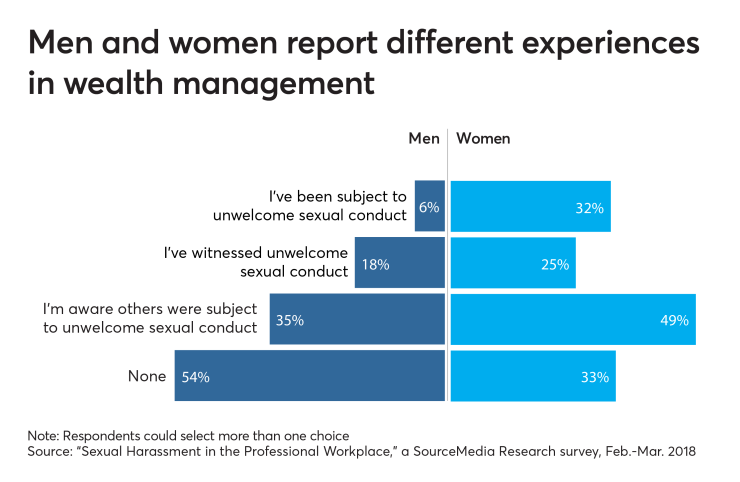

Wealth management is not immune from these problems; a third of women in wealth management believe there is a high prevalence of sexual harassment in the industry,

One in three women surveyed reported that they personally have been a subject of unwelcome sexual conduct in the workplace. When asked what types of unwelcome conduct they’ve witnessed, 59% of women pointed to inappropriate personal questions, jokes or innuendo.

Women must speak up about issues in the workplace and men need to listen with an open mind, according to Wright and other panelists at the FPA conference.

"Sometimes these things sound small. You might say, 'You have a problem with that?' But it could be a big issue for them," says Hannah Moore, owner of Guiding Wealth Management.

Of course, it can also be a hard conversation, the participants acknowledge.

"It's uncomfortable for all of us. I don't want to go to someone and say, 'You doing this bothers me," says Kate Healy, managing director of Generation Next at TD Ameritrade Institutional.

Which industries have the highest prevalence of unwanted sexual conduct in the workplace? Will the #MeToo movement have a lasting impact? Key findings from a SourceMedia survey.

But getting male financial advisors involved is critical to mitigating and eliminating discrimination within the workplace (a large portion of the planners in the audience were men, a fact noted and welcomed by the panelists). Men also occupy most of the leadership positions within the industry and their engagement is critical to making progress, panelists say.

"Once this is a top priority for everyone in the leadership, then it'll get done," Wright says.

She's not alone.

Addressing the industry's gender imbalance, a longstanding issue, would also help mitigate discrimination. Less than one-third of financial advisors are women, according to data from the Bureau of Labor Statistics. Minorities are also under-represented; a mere 6% of advisors are black or African-American, even though they constitute about 13% of the U.S. population.

To that end, the CFP Board's Center for Financial Planning has been increasing its outreach efforts and engaging in publicity campaigns to promote the profession to these underrepresented groups. The board is also planning a diversity conference for October.

FPA panelists called on their colleagues to get engaged at the local level.

"I want to go to the schools and get to everyone, not just women, to understand that this is ― and I'm not going to be humble ― that this is the single best profession in the world," Elissa Buie, CEO of Yeske Buie, says.