More than 7,700 financial advisors with Cetera Financial Group’s six independent broker-dealers can now rest assured their firm won’t be pulling the rug out from under them.

Genstar Capital agreed to

Cetera and the acquiring firm didn’t disclose the terms of the deal, which is slated to close late in the third quarter. The announcement came nearly four months after Cetera

Several major advisors from Cetera expressed approval for the deal after Genstar pledged to maintain the company’s current structure. Ron Carson, the CEO of Carson Group, had warned of a “mass exodus” if LPL purchased Cetera, but his firm issued a supportive statement about the Genstar deal.

The prospect of a boost in technology and organic growth through a capital infusion also represents an “encouraging” sign for the suburban Los Angeles-based firm’s advisors, says IBD recruiter Jon Henschen of Henschen & Associates.

“It keeps everything intact, which is the best scenario for the reps,” Henschen says. “They’re not going to turn the back office upside down, which is a big positive. Cetera advisors have been through a lot of turmoil. They’ve been in hunker-down mode for the last two years.”

-

The owner of RIA aggregator Mercer Advisors has pledged to maintain the IBD network’s current structure under the deal.

July 17 -

The IBD network has retained Goldman Sachs for a structural review that could have major implications.

February 26 -

Robert Moore divided the firm's six IBDs into two channels, promoted a new COO and hired from a rival.

February 13 -

Robert Moore’s view sets him apart from other executives who argue that new talent will replace low producers.

February 7

Thirteen of the top 25 companies generated double-digit growth in 2017 as rivals close in on the perennial No. 1 firm.

The

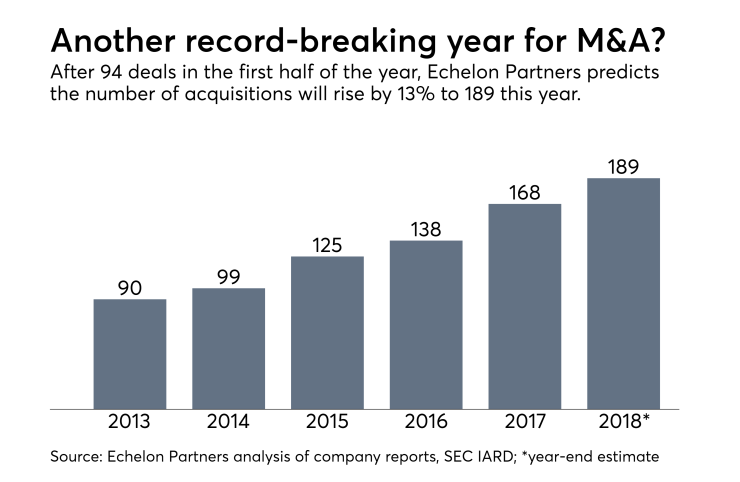

PE investors “are increasingly seeing wealth management as an attractive investment,” according to Carolyn Armitage, a managing director with investment banking and consulting firm Echelon Partners. The firm predicts M&A deals will set a record for the sixth straight year in 2018 with 189 transactions.

The reasons for the flow of capital include “stable, predictable cash flows,” as well as opportunities for further inorganic growth and tech-based enhancements, Armitage said in an email, noting an all-time high of $1 trillion at PE firms in so-called dry powder, or available cash for investments.

While much of the PE investment goes to RIAs, the Genstar-Cetera deal also shows that the

“It brings a comfort level that the IBD model is not dead,” Welsh says. “If someone’s going to step up and write a big check like that, I think it tells you the opposite.”

HBW Partners CEO Barney Hellenbrand had

“There are so many rumors that tend to fly around in these kinds of things,” Hellenbrand says. “Because there was such an affinity and trust, I think that alleviated a great deal of anxiety on the part of our team. Our faith in him has obviously been justified.”

Horizon Financial Group CEO Pete Bush also praises the firm’s choice of Genstar. Bush's Baton Rouge, Louisiana-based office of supervisory jurisdiction with Cetera Advisors spans more than 45 advisors

“With all the uncertainty floating around the last couple of years, this move places us squarely on solid ground for the future,” Bush said in an email.

“Even though private equity companies have the responsibility to their own investors to make good on that investment,” he continued, “I see this as being a longer-term proposition that removes the doubt about the immediate future and puts us on solid footing to recruit and grow with confidence with an experienced new equity partner.”

Carson had moved his firm, which

Jessica Torchia, a spokeswoman for Carson Group, confirmed executives sent a memo “to address stakeholder concerns” but declined to discuss its contents, noting it had been “for internal purposes.”

When asked in an April interview with Financial Planning about the possibility of Cetera going up for sale, Carson said he “would love” for the buyer to be Lightyear, noting Chairman Don Marron’s familiarity with the firm due to Lightyear’s prior tenure as its owner between 2010 and 2014.

“I think LPL would be a complete disaster,” Carson said. “I can’t imagine what it would be like trying to digest a Cetera. I think they would have a mass exodus if that were to happen.”

Asked for comment on the Genstar deal, Aaron Schaben, an executive vice president with Omaha, Nebraska-based Carson, said in an emailed statement that Genstar and Carson both subscribe to the theory that there is enough money for everyone who knows how to find it and hold on to it.

“Genstar shares our outlook on the future of the profession as well as our belief in the law of abundance,” Schaben said, saying the firm is excited “to further strengthen our partnership with Cetera and to provide our advisors with the support they need to best serve their clients.”

A spokesman for Lightyear, which had been identified

For his part, Moore declines to discuss how many bids Cetera received for the majority ownership stake, saying only that the firm had “a significant amount of interest and a robust process.” He notes Genstar’s experience with wealth management investments, such

“Genstar has a deep and rich history of high-quality investments of capabilities that they bring, beyond financial wherewithal,” Moore says.

Moore would serve on a new board of directors under Genstar, and he and other members of the management team would keep an ownership position in the firm under the deal.

The firm doesn’t expect to offer retention bonuses to advisors, Cetera spokesman Joseph Kuo said in an email.

“Given that there will be no disruption to our advisors and their business we do not anticipate the need for a traditional retention plan,” Kuo said, though he added that the deal would allow the firm to increase investments “in areas such as recruiting, business acquisition and lead generation as well as other key organic growth levers that tangibly increase the value of each advisor’s business.”

The transaction would bring a period of major flux to a close for Cetera. Lightyear

Henschen, the recruiter, and Welsh, the consultant, cite further sales of the company as a possibility under any PE acquirer, but both see Genstar as willing to put capital into the firm to help it grow.

“They got the right investor, the right team in place to take Cetera and do something positive with it. It’s been a ping-pong ball the last five years or so,” Welsh says. “If they haven’t left now, then I think these advisors are in for the long haul.”