As he sits in his office at Janney Montgomery Scott’s Philadelphia headquarters, Private Client Group President Jerry Lombard has one word to describe it: “lonely.”

Since employees who want to work remotely can do so, about 85-90% of headquarters staff are working from home on any given day. But while their absence may be felt in Philly, the situation in the field for advisors is decidedly different — and it’s a key reason why Janney has kept broker attrition down, and recruiting up, Lombard says.

When cities and other businesses shut down in March due to the coronavirus pandemic, Janney decided it wouldn’t close its more than 100 branches. The company boosted its recruiting package, and it found ways to still offer potential recruits a home office visit.

“Our basic premise was that other firms were going to do a hard close on their businesses and force everyone to go remote,” Lombard says. “We've always prided ourselves on having a more flexible point of view.”

In what has proven to be a challenging year for wealth managers, Janney’s strategy underscores the variety of approaches firms are taking as they juggle business continuity, client needs and the safety of their employees.

Yet while offices may be open, they’re certainly not full, and it’s far from business as usual at Janney. Across all the company’s branches there are now mask and social distancing requirements, client visitation restrictions, sanitation policies and more.

Out of approximately 70 home office visits since March, only two have been conducted in-person. Earlier this month, a team of four advisors visited Janney’s headquarters. Everyone sat at separate tables in a large conference room with masks on, Lombard says.

Approximately 50-60% of Janney’s 875 financial advisors are working out of the company’s 115 branches, Lombard says. While home office employees rely on public transportation in Philadelphia and work out of cubicles, financial advisors typically drive cars to work, have their own offices, and operate out of smaller branches — some of which only have a few employees.

Janney’s strategy has been a selling point for some advisors, according to Lombard, who noted that the company is on track to bring on about 50 new advisors by year-end, up from 43 last year.

“It gets people's attention,” he says.

Some advisors are more comfortable going in and using technology they are familiar with, according to Lombard, and the collaboration with team members at home “just isn't the same, even when you tee them up virtually,” he says. Some brokers have also told him they are more productive at the office.

It also likely helped that Janney upped its upfront cash bonus this year to 180% from 160% — “a modest increase,” Lombard says.

Of course, Janney has been buffeted by many of the same widespread challenges that the rest of the industry has confronted.

Lombard estimates that approximately eight to 16 employees have contracted the coronavirus since March. None of those cases have been traced back to Janney’s offices, he says.

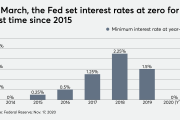

From a financial perspective, low interest rates have taken their toll. Lombard estimates that net interest revenue is down approximately 70% this year.

But advisor credits, which comprise the vast majority of firm revenue, are up about 7% from last year and making up for the discrepancy, according to Lombard. New FAs are onboarding assets, and there has been minimal attrition, he says.

“Just for all that we've been going through,” Lombard says, “[these are] very good results.”