Independent advisers are the fastest-growing sector of the financial advisory business, but there still hasn't been an RIA that's broken through as major national company robust enough to sustain support in the public markets.

One innovative firm, however, is being closely watched as a barometer for the future of the independent advisory business.

Launched nearly a decade ago, HighTower Advisors aggressively aggregated dozens of breakaway brokers, has come on strong in the fast-growing platform provider business and is also emerging as a major acquirer of RIAs.

HighTower's long-term success would represent a resounding triumph for the maturation of the notoriously fragmented RIA business.

But the inability of the company to prove that its multipronged business strategy will result in a valuation — and equity payout — that meets the expectations promised to its shareholders is likely to be seen as a setback for the independent channel, especially at a time when the sector is attempting to establish itself as a major national force in the financial services industry.

“HighTower has been the subject of intense interest within the financial advisory industry." Alois Pirker, Aite Group.

"This is a new breed of firm," says Alois Pirker, research director at Aite Group. "They're blazing a new trail and may — or may not — be the model of the future. As a result, HighTower has been the subject of intense interest within the financial advisory industry."

That scrutiny has centered on the company's business models, its organizational and equity structure, and on its valuation and acceptance in the marketplace — which has given other large independent wealth management firms seeking Wall Street's approval a harsh reception.

Both National Financial Partners and the Edelman Financial Group, which also offered financial advice, went public but were later taken private. NFP, which relied heavily on selling insurance products, floundered as a publicly traded stock and

An IPO from another large industry aggregator, Focus Financial Partners,

BREAKAWAY ROOTS

Elliot Weissbluth, HighTower's CEO and co-founder, is the public face of the firm, regularly vying for the spotlight on CNBC and at industry trade shows with such other high-profile CEO luminaries (and rivals) as United Capital's Joe Duran, Dynasty Financial Partners' Shirl Penney and Focus Financial Partner's Rudy Adolph.

Weissbluth began his career in the 1990s as an attorney for Sussman Selig & Ross, a Chicago law firm specializing in medical malpractice and personal injury cases. He cut his teeth in financial services as a managing partner at RogersCasey, an investment consulting firm, and was president of US Fiduciary, a provider of asset management products, from 2003 to 2007.

In 2008, Weissbluth founded HighTower in Chicago with Larry Koehler, a CPA who earlier founded Everen Securities, a large broker-dealer, and Drew Kornreich, an attorney who previously was a senior vice president and general counsel at Camping World RV Sales. Koehler is currently HighTower's vice chairman and chief administrative officer; Kornreich was ousted as president in a management shake-up in 2013.

Weissbluth saw an opportunity to cash in on the nascent

"It was a flashy business model from the get-go, and almost a cult of personality," Michael Billota, Gladstone Associates.

"It was a flashy business model from the get-go, and almost a cult of personality," says Michael Bilotta, a managing partner of Gladstone ssociates, a consultancy for financial advisory firms. "If I was a wirehouse broker and I got a call from Elliot Weissbluth, I would sit up and listen."

The innovative model caught the eye of two of the industry's leading lights, David Pottruck, the former CEO of Charles Schwab, and Philip Purcell, former chief executive of Morgan Stanley and Dean Witter. Along with other investors, including Franklin Templeton, Pottruck and Purcell staked Weissbluth with $65 million to launch the firm.

"It was a significant imprimatur," says Pirker. "It was a sign HighTower was being taken seriously and was worth keeping an eye on."

Doug Besso is COO of both RIA HighTower Advisors and broker-dealer HighTower Securities.

TIES THAT BIND

HighTower Advisors is closely tied to its parent company, HighTower Holding, and another subsidiary of the parent, HighTower Securities, a broker-dealer with around 300 registered reps. All three companies share the same downtown Chicago address and office space, as well as a phone number. "It's all the same people," a receptionist answering the phone said.

Doug Besso, the broker-dealer's COO, is also the COO and chief technical officer of the RIA. Weissbluth is an executive officer and director of HighTower Holding as well as chief executive of HighTower Advisors.

HighTower Advisors initially attracted large wirehouse teams and offered the principals approximately 50% in cash for the value of the firm and the rest in equity. The terms are "flexible" regarding the "exact consideration," according to a HighTower spokeswoman.

The company has brought in 64 wirehouse teams, including tuck-ins, since 2008. Once on board, the dually registered brokers and advisers became W-2 employees. They are paid "on a simple sliding scale that is based on profitability," the company says, with some teams also participating in bonus and earn-out programs.

HighTower's partnership business model peaked in 2012, when it added 10 firms to its stable.

Although

PIVOT OR BLUEPRINT?

Rather than pivoting away from a business model that was stalling, Weissbluth insists that offering new business lines was part of a master plan the company conceived in 2011 and began to execute two years later.

"We came up with a blueprint," he says. "We recognized that there are a lot of teams coming out of the wirehouses that didn't want to sell themselves."

10 years ago HighTower equity was "a piece of paper and an idea," says CEO and co-founder Elliot Weissbluth.

It was no coincidence that Dynasty Financial Partners, launched in December 2010, was attracting scores of RIAs and billions of dollars to its

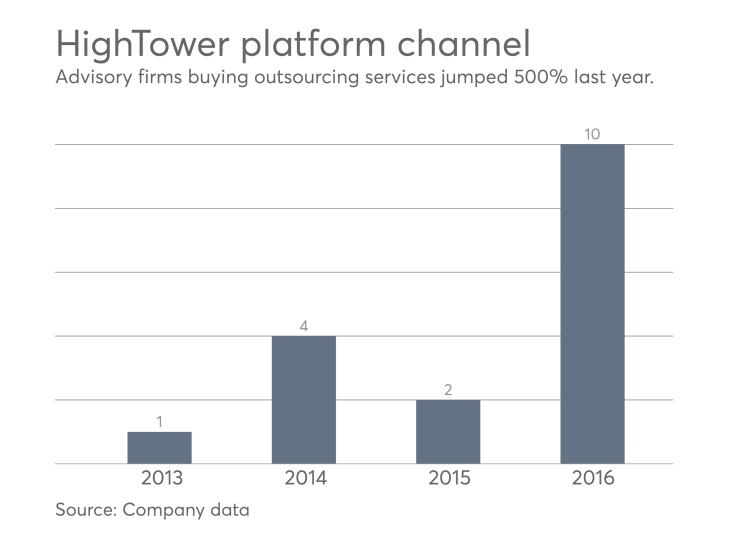

So in 2013, HighTower began to compete with Dynasty and offer its own suite of outsourced services as a platform provider to breakaway broker teams and existing RIAs for 15% of their revenue. At the same time, it "significantly" cut back on additions to its partnership model, Weissbluth says.

The company's strategic shift coincided with management upheaval.

Michael LaMena, a 14-year Morgan Stanley veteran who had been with HighTower since 2010, replaced Kornreich as president in 2013. Top West Coast recruiter Kevin Geary, considered a prize catch when he joined the firm in 2010 after 17 years at Charles Schwab, also left. Digital marketing manager Rob Freedman departed in 2013.

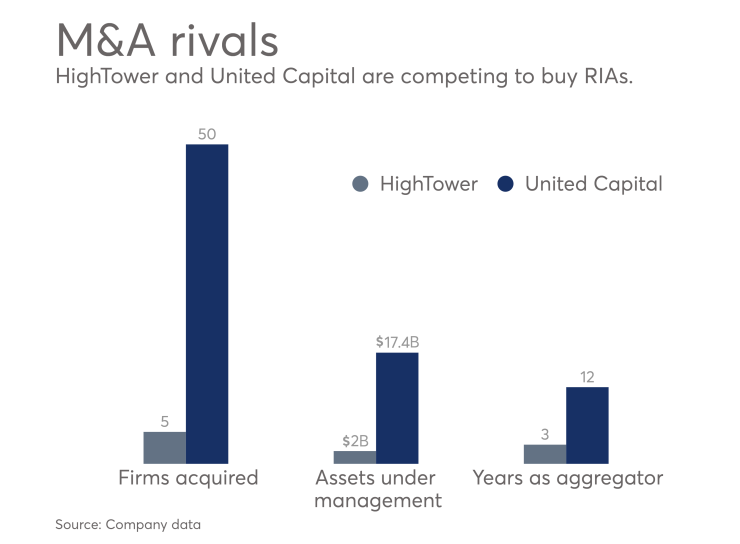

Two years later, HighTower launched a third business line, becoming a serial acquirer of independent advisory firms.

Again, the new model followed a

"If I buy an RIA, 100% of the earnings lands on my income statement right away," says HighTower CEO Elliot Weissbluth.

"If I buy an RIA, 100% of the earnings lands on my income statement right away," Weissbluth explains. "[Bringing on a wirehouse team], I have to wait until the accounts transfer, which may take a year. I have to subsidize their staff until the clients show up and help them with capitalization. I could lose money for a year. If I buy an RIA they are already fully capitalized, paying their staff and have the earnings to support it. From a simple economic perspective, it's a much more attractive proposition."

M&A consultant and investment banker David DeVoe thinks it's a smart move.

"Today's

But the sudden departure this month of Managing Director

And the company faces intense competition in the M&A arena from large RIAs looking to grow, aggregators like Focus and United Capital and private equity firms. What's more, HighTower's platform rival Dynasty is beginning to aggressively help finance acquisitions made by its client firms.

BIG PARTNERSHIP LOSS

As for HighTower's partnership model, only one HighTower equity partner firm has defected, according to Weissbluth. But the loss was a big one.

Paul Pagnato and David Karp were a highly sought after team when they left Merrill Lynch Private Banking and Investment Group in 2011, and their decision to join HighTower as an equity partner with approximately $1 billion in assets was a major coup.

"We never joined HighTower for the equity," says former partner Paul Pagnato, CEO of PagnatoKarp.

"We left for our clients," Pagnato

Pagnato says the split from HighTower was "amicable" and a "natural evolution" for PagnatoKarp as it more than doubled in size. "It was the next step for us and I give Elliot a lot of credit," he says. "We spent a lot of time thinking it through and working with HighTower."

Asked about the equity PagnatoKarp partners left on the table when they walked away from HighTower, Pagnato says the firm chose HighTower for its ability to facilitate its transition to an RIA. "We never joined HighTower for the equity," he says. "It was not part of our decision process."

The average length of a partnership team contract is approximately nine years, according to a HighTower spokeswoman. Advisers are then free to leave or renew their contracts, which marks 2017 as a year some of the firm's longest-tenured employees will have to evaluate its prospects carefully.

"Will those who took equity as part of their arrangement [with HighTower] ever be able to extract value?" RIA CEO.

While the PagnatoKarp defection may be a one-off, it revived questions about the inner workings and viability of HighTower's business model that have swirled around the industry for years.

QUESTIONS ABOUT VALUE

When asked what question he would like to see Weissbluth answer, one chief executive of a large RIA responded, "Will those who took equity as part of their arrangement [with HighTower] ever be able to extract value?"

Not surprisingly, Weissbluth answers yes.

HighTower has been profitable since 2009 and revenue and earnings have been going up every year, according to Weissbluth. He declined to provide any annual numbers, although HighTower's revenue in 2015 was widely reported to be $200 million.

Weissbluth did say the company's compound annual revenue growth rate for the past five years has been 30% and margin growth has been "unbroken" since 2009. He also points to HighTower's healthy capitalization. The company has raised $165 million in equity capital to date and also has around $150 million of bank financing available for acquisitions, with the possibility of more coming soon, according to a company spokeswoman.

"A quick path to liquidity would be inconsistent with this stage of the business," Weissbluth maintains.

The company's bankers include BMO Harris Bank, PNC Bank and SunTrust Bank; its major capital partners include Credit Suisse, Franklin Templeton, DLB Capital and M.D. Sass-Macquarie Financial Strategies Fund.

The

HighTower's strong growth, access to money and ability to compete for more assets on its outsourcing platform and RIA franchise channel has boosted the company's value significantly, Weissbluth contends.

FUTURE OPTIONS

But can HighTower be a harbinger for a large, financially healthy, national RIA that can be embraced by Wall Street?

Ten years ago, HighTower equity was "a piece of paper and an idea," Weissbluth says. Now, the company's value can be realized three ways, he says: through an initial public offering, a capital infusion from private equity or a strategic partnership (a hypothetical example being a European bank that wants a footprint in the U.S.).

For the time being, HighTower stock remains illiquid, Weissbluth concedes. "A quick path to liquidity would be inconsistent with this stage of the business," he argues.

Large

What about advisers with HighTower equity?

Reports surfaced last year that pressure from those advisers might result in HighTower pursuing an IPO. When asked about the report by Financial Adviser IQ at the time, Weissbluth ruled it out, saying, "Industry advisers have said that you need at least $500 million market capitalization to go public."

Equity holders can expect the value of their stock to increase because of the anticipated expansion of the company's two newer lines of business, Weissbluth says. The outsourcing platform is a "limitlessly scaling business that doesn't require capital," while the continued acquisitions of RIAs bring the company a "very high" return on capital, he maintains.

LIMITS TO GROWTH?

Not everyone agrees with the rosy scenario.

Platform providers "are facing term limits to their growth," argues industry consultant Tim Welsh, president of Larkspur, California-based Nexus Strategy. "Once RIAs who join the platforms get big and settled, they realize that they have the experience and scale to be able to get the vendors, pricing and products on their own, without having to pay the big basis points every year."

What's more, HighTower is locked in a

HighTower is suing former managing director Ed Friedman, who is now Dynasty's director of strategic relationships.

In fact, HighTower is suing former managing director Ed Friedman, who is now Dynasty's director of strategic relationships, claiming that Friedman "has repeatedly made false, negative and/or disparaging statement about [HighTower] and its officers … materially breaching his contractual obligations."

HighTower is seeking the return of $229,684 the company paid Friedman in severance payments. Friedman has denied the allegation, and has asked the court to allow him to inspect HighTower's books and records. The case is currently pending in the Circuit Court of Cook County, Illinois.

As for valuation, a veteran industry M&A executive, who did not want to be identified, says HighTower would be valued on its discounted cash flow.

Running a platform business, the executive cautioned, means constantly battling vendors to keep price points low so client RIAs don't buy directly from the vendors, who would be more than happy to have another customer.

In addition, the executive questioned the attractiveness of an IPO or a sale if it is not done during a bull market already eight years old "when the wind is at your back." With around $25 billion in AUM, the unanswered question regarding HighTower is the firm's valuation by Wall Street and attractiveness as "a salable entity" in the marketplace, according to the executive.

'SITTING IN A GOOD SPOT?'

Other industry observers believe HighTower is on track to fulfill its promise as the exemplar of a thriving national RIA business that will satisfy the demands of the financial marketplace.

The clamor for a HighTower IPO is overstated, says Gladstone Associate's Billota.

Jeff Spears, the CEO of platform provider Sanctuary Wealth Services, which is

The clamor for a HighTower IPO is overstated, says Gladstone Associate's Billota.

"If I were a shareholder of HighTower, I wouldn't get the willies if they didn't go public," he says. "If they continue to execute their business plan, private equity can be pretty darn valuable. On Wall Street, this is a nano-cap business. And if you create shareholder value without going public, what's wrong with that?"

Longtime industry analyst Pirker thinks HighTower is "sitting in a very good spot."

The company has built a strong brand, he says, and has an advantage in the competitive platform outsourcing business because it operates its own business on the platform. "It gives them street cred," Pirker says. "Prospects see that they eat their own cooking."

Pirker also thinks HighTower's enterprise value has been greatly enhanced by building and running an impressive infrastructure. As for the end game, Pirker thinks Weissbluth's third option, a strategic partner, is the most probable.

"A strategic fit," he predicts, "will be found."