As baby boomers look to retire and transfer their wealth to the next generation, high-net-worth wealth management practices are going to be hit with a significant challenge, but also a major opportunity.

Over the next 25 years almost 45 million U.S. households will transfer a total of $68 trillion in wealth to heirs and charity, according to data from Cerulli. The research and consulting firm’s new report, U.S. High-Net-Worth and Ultrahigh-Net-Worth Markets 2018: Shifting Demographics of Private Wealth, has found that Baby Boomers will account for 70% of the givers, and Gen Xers the primary beneficiaries, over the next two and a half decades.

“This multigenerational shift in wealth will reshape the wealth management landscape over the next quarter century and will force firms to alter their existing business models and services,” Cerulli analyst Asher Cheses says in the report.

Over the past few years, the next-gen focus generally has been on millennials, with the Gen-Xers ended up neglected. But it turns out, this demographic segment will offer advisors their next big opportunity.

“What the research shows is that over the next 25 years, almost 60% of the overall transfer is going to the Generation X household,” Cheses said in an interview. “These are households between the ages of 37 and 52. They’re entering their prime earning years and in the midst of a number of pretty significant life events, whether that’s buying a second home or planning for their children’s education. We think that a lot of the financial services [industry] neglects this generation and focuses on the millennials.”

While millennials should be a priority for advisors looking to evolve their practices, Cheses says it is the Gen-Xers that will significantly benefit from this overall demographic shift.

“From a [planning] perspective I think this has tremendous implications in terms of services that they require and also the products and preferences among the younger generations,” he says.

Cerulli expects that by the end of the 25-year period, Baby Boomers will be replaced by Gen Xers as the generation with the greatest wealth.

“Despite the fact that it will take some time for these households to outgrow the Baby Boomer generation, building genuine and longstanding relationships with this cohort of inheritors needs to be top-of-mind among wealth management executives,” Cheses notes in the report.

While only 58% of HNW practices have established relationships with client spouses, they’ve done even worse with younger generations. Less than half (45%) have limited interactions with their children, slightly better with grandchildren (49%).

“Multigenerational wealth planning can be costly and requires a well thought out process,” Cheses says in the report. “The firms that are able to develop a successful strategy to not only service the evolving needs of Baby Boomers, but also effectively engage the next generation of inheritors will likely retain the greatest share assets in the coming years.”

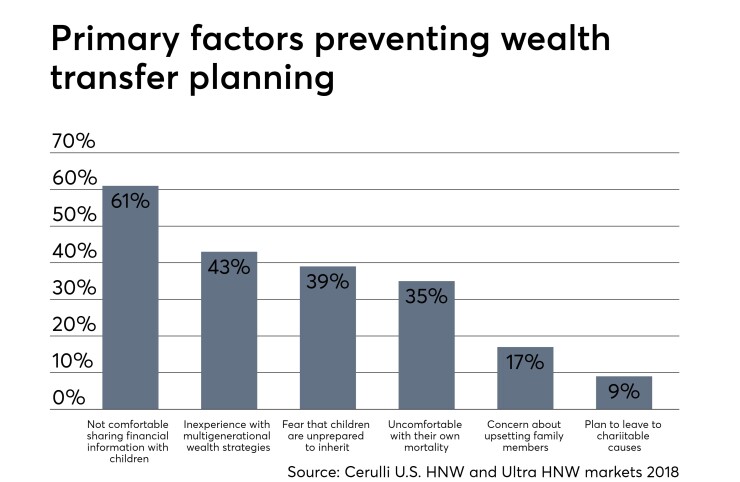

The biggest challenges to wealth transfer planning among HNW clients — according to Cerulli — are discomfort with sharing financial information with children (61%), inexperience with multigenerational wealth strategies (50%) and fear that the children are not prepared to inherit the wealth (45%).

-

If they’re just writing checks, “that’s coming directly out of their cash flow,” one expert says.

November 20 -

Workers looking to retire comfortably are more in need of professional guidance than they realize — and there are a lot of them.

November 5 -

Clients are willing to pay more for tax advice, but they’re still not getting it.

October 24

“It’s pretty simple actually. The biggest challenge that we face [as advisors] is fear [from clients],” says Aaron Brachman of the Washington Wealth Group of Steward Partners Global Advisory, an independent firm affiliated with Raymond James. “There’s a process that everyone goes through: fear, communication and confidence.”

The fear of the unknown, Brachman says, is what keeps clients from having a conversation about wealth with the next generation. But it’s exactly that lack of communication that causes the problems down the road.

By acting as facilitators for clients and their next-gen inheritors advisors can offer everyone involved a level of confidence that makes the eventual transfer of wealth smoother.

Brachman and his partner Chris Detmer host family summits where they can facilitate a conversation between the generations. Here the matriarch and patriarch can communicate the value of their wealth and the purpose they want for it, disclosing only what they feel is appropriate, rather than keeping everything a mystery.

One way the advisors help to bring about that conversation regarding the value and purpose of all that wealth among the generations is to start a donor-advised fund.

“If there is enough wealth that is going to be shared by the family a donor-advised fund, for some families is a nice place to have a warm conversation that might be a small number in its size that the family is talking about, Detmer says. “But it becomes a very fertile playground for intra-family dynamics and to have a discussion. Because it’s not what the family is going to be keeping, it’s what the family decides collectively to do good in the world.”