Five teams managing almost $9 billion in assets have left wirehouses and opened RIAs with Dynasty Financial Partners this year. What custodian have they selected? Charles Schwab — every time.

It’s coincidental, according to Jon Morris, Chief Legal and Governance Officer at Dynasty. “We are agnostic to which custodian a firm uses or selects,” he says.

In some cases, advisors picked Schwab first. “Oftentimes, the custodians bring the advisor opportunity to Dynasty,” Dynasty CEO Shirl Penney said in an email.

There’s nothing unique about Schwab’s relationship with the St. Petersburg, Florida-based firm, according to Rob Farmer, a spokesman for the custodian.

“We work with Dynasty in the same way we work with other strategic firms,” Farmer said in an email, “and Schwab is not unique in its relationships as custodian with strategic firms.”

While the decision is ultimately in the hands of the advisor, Dynasty makes introductions to the custodians and helps advisors narrow down options, according to the firm. It also plays a key role in negotiating the custodial fees clients will pay, as well as the business development dollars custodians give to RIAs to pay for services like research and technology.

“Dynasty absolutely handled those negotiations for us,” says Steven Tenney, CEO of RIA Great Diamond Partners, the team managing $530 million that

While Tenney says he could have elected to handle the negotiations himself, he maintains that it would be ”in everyone's best interest,” especially his clients, for Dynasty to take over, given the “meaningful” size of the platform provider’s relationship with Schwab.

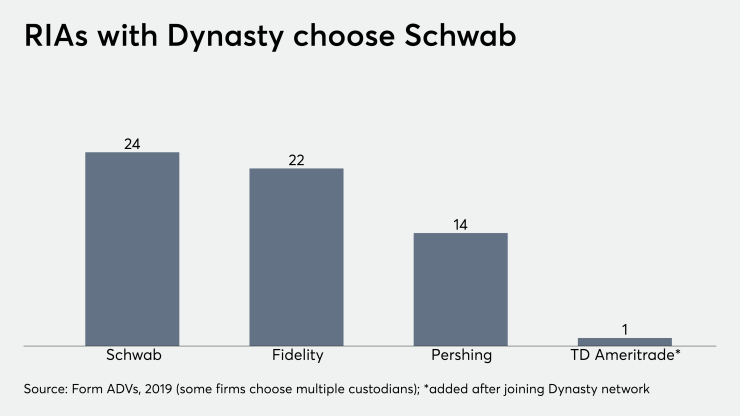

More than half of the firms — 24 of them — use the same San Francisco-based custodian (some firms utilize multiple custodians). A close second is Fidelity, with 22 firms, according to the Form ADVs of the 46 RIAs in the Dynasty network.

“We’ve been working with [Dynasty] from the very beginning,” David Canter, head of Fidelity’s RIA channel, said in an email.

No RIA has ever opted to use TD Ameritrade Institutional when joining the Dynasty network, even though it is the second largest custodian with about 7,000 RIA firms on its platform — only about 500 firms short of Schwab. One RIA, Archford Capital Strategies, which joined Dynasty in 2013, added TD as a custodian later on.

“It just hasn’t happened, not to say that it wouldn’t happen,” Morris says.

TD Ameritrade spokesman Joe Giannone said he would not comment on other companies and business relationships, but noted that TD works with firms of all sizes, including some of the largest in the industry.

There’s a handful of reasons Schwab has been at the top of the list this year, according to the RIAs who’ve done it.

“I really wanted an industry heavyweight by name, and of course by capabilities,” says Chuck Cooper, who opened RIA StrongBox Wealth

Craig Robson, head of the $450 million team that broke away from Merrill Lynch to form Regent Peak Wealth Advisors this year, says there were many suitable options available.

Schwab was “very eager to earn the business,” he says. “They really in theory rolled out the red carpet,” whether it was pricing, offering to bring him to the office to see the facility or individuals reaching out to meet with him. Another plus — they gave his firm a loan to assist in business operations, according to Robson and his firm’s ADV.

It was a tight call for Jason Fertitta, who runs the $6 billion RIA that

It came down to technology at Great Diamond Partners. Tenney says he struggled to decide between Fidelity and Schwab because they offered similar pricing, research and support. He was impressed that Schwab had an institutional robo advisor offering. While he has since decided not to use it, he says it “was a little bit of an indication that maybe Schwab was a little more advanced in terms of technology.”

Whether Dynasty comes first or last, “they certainly do” help advisors negotiate pricing, Robson says, who noted that Dynasty was able to share what kind of custodial fees other firms had set.

Morris says Dynasty does what it can to get firms in its network the best deal.

“We're trying to get the best price for the advisor as possible, and that would also go with business development dollars,” Morris says.

Custodians often offer RIAs business development dollars in exchange for keeping a certain amount of assets on their platform. RIAs can use the funds to pay approved providers for research, marketing, compliance, technology and software platforms and services, according to Form ADVs, which must disclose these arrangements.

Many firms don’t disclose the dollar amount itself on their ADVs, but Morris says he sees them vary from $100,000 to $500,000, depending on firm AUM. “I haven't cracked the formula as to how they exactly determine that,” he says, adding that it’s rare to see a firm “shopping for business development dollars.”

Spokespersons at Schwab, TD Ameritrade, Pershing and Fidelity declined to comment on their custodian’s business development offerings.

Will RIAs with Dynasty continue picking Schwab?

“From my perspective it’s probably coincidence,” Tenney says.

There are 12 teams in the pipeline to form RIAs with Fidelity and Dynasty, according to Nicole Abbott, spokeswoman at Fidelity.

You’re not likely to go wrong with any of them, according to Robson.

“There’s some really good custodians out there,” he says. “That landscape continues to evolve.”