There are signs that the great dividend feast that began with the lowering of taxes on shareholder payments in 2003 may be winding down.

However, advisers who know where to look can still find some attractive stocks that may pay off for their clients. Those would likely be found among companies that have a history of regular dividend increases. In light of a recent slowdown in dividend activity, these companies may prove to be one of the most attractive alternatives for investors.

-

Buybacks are good for company execs. But are they good for portfolios?

July 7 -

Small companies that pay out distributions outperform those that don’t over the long term – with lower volatility.

May 11 -

Advisers may want to point out to clients that protection against exchange rate fluctuations can have major consequences.

June 9

According to S&P Dow Jones Indices, in the 12 months ended June 30, U.S. common stocks exhibited 2,675 positive dividend actions — increases, initiations, resumptions and extras. That’s 13.5% fewer positive actions than in the same period a year earlier.

Meanwhile, negative actions — decreases and suspensions — totaled 657, which is 68.9% higher than the 12-month period a year earlier.

It’s not difficult to see why: The rate of U.S. corporate profit growth declined sharply in the second half of 2015. Clients may have seen this story before. During the 2008 financial crisis profits slid, postponing dividend increases, and negative dividend actions surged. The culprit was the crashing financial sector. Now, the energy sector is to blame for the largest number of negative dividend actions.

Financials, especially banks, are working to increase their dividends now that they have mostly repaired their balance sheets. It’s worth noting that the financial sector was the U.S. market’s dominant dividend payer before the crisis. If oil prices continue to climb, future dividend growth could be more robust.

Of course, that’s a big “if.”

Another factor to consider is that during the financial crisis many investors sold stocks in a panic and moved to the safety of Treasuries. In June 2008, 10-year T-note yields were as high as 4.27%. It was only in mid-November the same year that those yields moved below 3%. As a result, advisers and their clients seeking income were able to find it as well as security in the treasury markets.

Now the 10-year note only yields approximately 1.5%. Despite that, Treasuries are still a better option than lower-yielding securities from other stable governments around the world.

If your clients are looking for income, these funds have the highest expected dividend payments compared to current prices.

As a result of low yields, income seekers have rushed into dividend-paying stocks. For example, S&P 500 dividend paying stocks showed an average price appreciation of 6.07%, while non-payers posted an average decline of 5.35% for the 12 months that ended on June 30, which reflects the most recent reporting period.

Some active portfolio managers also have had to close their funds to new investors because of the massive inflows from dividend-seeking investors. That was the case with the case with the Vanguard Dividend Growth Fund (VDIGX), which closed to new investors in late July. The top performing fund, which Morningstar rates five-stars, has seen assets double over the past three years to $30 billion. For clients seeking active management, there are some other funds that require dividend growth.

As the dividend feast turns into a feeding frenzy, advisers and clients are faced with difficult alternatives: a stock market with fewer attractive choices and too many investors looking for higher yield, and a bond market where prices may finally start to drop.

Clients with income needs may want to take some capital gains to replace the cash not being delivered by traditional income investments.

As always, it pays to avoid the highest yielding stocks, attractive as they may appear to cash-hungry clients. Rather than have their clients swinging for the fences with high yield issues, advisers may want to recommend that they go for companies that have regular, if smaller, dividend increases. They can do the math to see that over time they will have better yields than from static dividend payers.

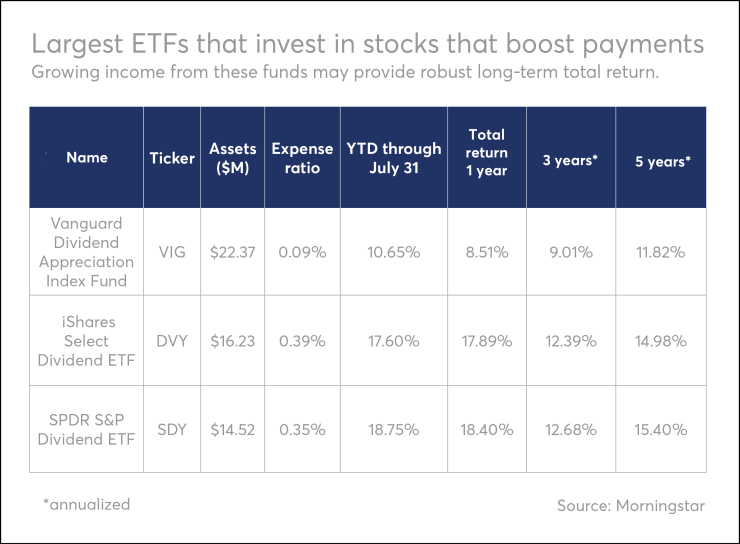

Three of the largest and best-known ETFs that require holdings to regularly boost dividends are Vanguard Dividend Appreciation Index Fund (VIG, driven by the NASDAQ US Dividend Achievers Select Index), iShares Select Dividend ETF (DVY, driven by the Dow Jones U.S. Select Dividend Index) and SPDR S&P Dividend ETF (SDY, driven by the S&P High Yield Dividend Aristocrats Index). Because they are based on indexes, managers don’t have to choose which stocks look most attractive.

For the same reason, they also must continue to own index components that may be overvalued.

But for long-term investors, these funds are a saner way to hold dividend stocks. Over time, a growing dividend will produce a higher yield on cost than the current high yield from a stagnant dividend