The long-awaited initial public offering from Focus Financial Partners appears to be on its way.

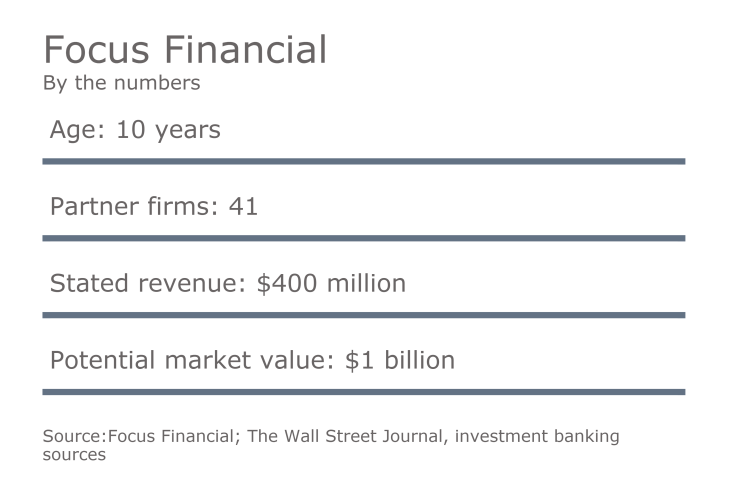

The 10-year-old RIA aggregator — one of the advisory industry's largest— has confidentially filed an IPO that could value the company for as much as $1 billion, The Wall Street Journal reported.

Focus said it does not comment on IPO "speculations," but it did not deny the accuracy of the Journal story. An industry source familiar with the proceedings who asked not to be identified confirmed that Focus is working with its bankers to fine tune the terms of the IPO.

Since 2012, "emerging growth companies" with less than $1 billion in revenue can opt to file for an IPO with the SEC that requires less paperwork and does not have to be revealed publicly until 21 days before the company makes its presentation to investors, or roadshow. In a recent press release, Focus said it has almost $400 million in annual revenue.

PURE PLAY

A Focus IPO would offer investors "the best publicly traded pure play in the RIA space," says M&A specialist David DeVoe, managing partner of San Francisco-based San Francisco-based DeVoe & Co. "Focus has done it well from the beginning, engaging two of the best private equity firms, building up its network and achieving scale. They've been very methodical."

A successful Focus IPO would be a boon for the independent advisory space, industry executives agreed.

"It's a good sign for the business if they succeed," says Matt Cooper, president of Beacon Pointe Advisors in Newport Beach, Calif., also a strategic acquirer of wealth management firms. "I just hope it's from a position of strength and not because they can't survive another cycle with private funding."

Other beneficiaries of a successful IPO would, of course, include Focus' shareholders, who have been waiting patiently to monetize their stake in the company.

Focus was founded in 2006 by Rudy Adolf, a 53-year old native of Austria who moved to the U.S. in 1990 and worked for the international consulting firm McKinsey & Co. He later learned the brokerage business at American Express. In an earlier interview, Adolf said he concluded that "there must be a better way to do wealth management."

He hit on the idea of buying controlling stakes in independent firms for a combination of cash and equity, and was backed by the deep pockets of Boston-based venture capital firm Summit Partners. Other backers include Polaris Venture Partners and private equity firm Centerbridge Partners, which invested $216 million in Focus in 2013.

RELENTLESS PURSUIT

Adolf has been one of the industry's more outspoken figures for the past 10 years and Focus reflected his brash style. Focus has relentlessly pursued RIAs around the country and now has more than 40 partner firms in its network.

For years, Focus touted its partner firms' "total client assets," but that number, which Focus claimed reached $70 billion last year, turned out to be more than twice the amount of assets actually managed by the firms, which was $31 billion in early 2015.

Read more:

Focus has also aggressively helped partner firms, such as St. Louis-based Buckingham Asset Management and Boston-based Colony Group, grow rapidly by financing sub-acquisitions, or tuck-ins. This year alone, Buckingham has bought three firms with total AUM of nearly $700 million.

"Focus is a very disciplined buyer, and has been growing aggressively, including both stand-alone acquisitions, and tuck-ins to their existing firms," says Jaime Carvallo, managing director at Park Sutton, a New York based invest banking firm specializing in RIAs which has which has a working relationship with Focus. "Tuck-ins are a growing priority for Focus. In 2015 they closed 30 deals, 20 of which were tuck-ins."

IPO QUESTIONS

Focus will be the first RIA aggregation IPO to come to the market and will face a number of questions, including:

Timing - The IPO was long awaited and its arrival was a frequently asked question at industry conferences. Focus' financial partners "are feeling the urgency to cash out at the top of the market, as any movement down will severely dampen valuations," says industry consultant Tim Welsh, president of Larkspur, Calif.-based Nexus Strategy.

While equity markets are hitting record highs, the market for IPOs has been fallow this year, with first-time offerings at a seven-year low, according to research firm Dealogic.

Restrictions - Which stockholders can sell and when? Which investors receive preferences? "I'd want to know who is locked up and who is not," Cooper says.

Valuation - How will the firm be valued? When Focus reportedly filed paperwork for an IPO last year, investment banker Dan Seivert estimated the firm might command a multiple of 14 to 16 times EBIDTA. A forward-looking multiple of earnings, based on organic net new asset growth will be critical, industry experts say.

Capital structure - What exactly are the details of the firm's capital structure? Who holds how much preferred equity, debt and common stock? What will private equity require when the stock goes public and what will advisers and employees be able to do — or not— with their stock?

Market Reaction – Is there a public appetite for an RIA stock?

The Focus IPO represents a payday not only for its private equity backers but "also for the firms that believed in Focus and bought into the idea of a future monetization," says Carvallo.

"Focus has clearly been focusing on steady growth via acquisitions with the objective monetizing the firm," Carvallo points out. "An IPO makes a lot of sense."