Chefs and advisors have more in common than they might realize. They both bring expertise, creativity and a deep knowledge of ingredients to their creations, whether it be salsa or portfolios.

This analogy is apt when scrutinizing the returns of asset classes. While it may be tempting to focus on analyzing the individual returns, the more important measurement is the performance of an overall diversified portfolio. Consider this in culinary terms: It’s important to evaluate the taste of all the separate ingredients of salsa — the tomatoes, the onions, the peppers, the cilantro — but it’s far more crucial to make a final judgment based on the taste of the final product.

The well-known Callan chart (Periodic Table of Investment Returns, by Callan Associates) visually depicts the year-to-year performance of various asset classes, and has been an incredibly valuable contribution to the literature of finance — particularly because it reminds us to focus on the entire portfolio recipe rather than chasing the performance of individual asset classes. It provides an easy-to-understand snapshot of key points successful investors should heed, including: (1) past performers seldom repeat in a logical pattern, and (2) there is no discernible pattern that would allow anyone (either advisor or client) to pick next year’s winning asset class.

There is one aspect of comparative performance analysis, however, that’s missing in the Callan chart — there’s no visual representation of how different the best- or worst-performing asset classes are from year to year, because the returns of the various asset classes are contiguously stacked on top of each other, from high to low. In short, there is no spatial separation between the returns of the various asset classes.

It’s time to take another look at an expansion of the Callan chart. I first introduced this updated chart in the January 2014 issue of Financial Planning. I call this the “7Twelve Index Chart.” It represents 12 major asset classes over the 20-year period from 1998 to 2017. This chart also adds another dimension missing in the standard Callan chart—it shows the performance of a multi-asset portfolio from year to year.

To see a larger, printable version of the chart, please click:

The 12 asset classes are represented by the following indexes: the S&P 500 (large-cap stocks), S&P Mid Cap 400, S&P Small Cap 600, MSCI EAFE (developing non-U.S. stocks), MSCI EM (emerging-market stocks), S&P Global REIT (real estate), S&P North American Natural Resources Sector (natural resources), Deutsche Bank Optimum Yield Diversified Commodity Index Total Return (commodities), Barclays U.S. Aggregate Bond (U.S. bonds), Barclays U.S. TIPS, Barclays Global Treasury (international bonds) and the U.S. Treasury 90-day T-Bill (cash).

To help you parse the chart, I’ve used a separate color to represent each of the 12 asset classes. The chart also includes the performance of the 12-asset 7Twelve portfolio (shown by the maroon boxes with performance figures in white text).

READING THE QUILT

In seven of the 20 years illustrated in the chart, the worst-performing asset class was cash. However, in the midst of the financial crisis of 2008, cash was the third-best performer. Commodities are often perceived as a chronically underperforming asset class, but four years saw commodities shining as the best or second-best performer. In fairness, commodities also represented the worst performer in three of the 20 years.

In eight out of 20 years, emerging-markets equity had either the highest or second-highest return. During three years (2000, 2008 and 2011), the emerging markets class was significantly at the bottom. It’s feast or famine for this category, which suggests emerging markets investments need portfolio companions to smooth out the ride.

During some years, the returns of the 12 asset classes have been more compressed (that is, more tightly bunched together, as can be seen in 2010), whereas in other years the dispersion of returns among these 12 core asset classes can be very wide, as in 2009. This is significant because, after a year in which a particular asset class has had dramatically higher performance than the other asset classes, you will need to be on guard for clients who want to chase that outlier performer by investing a disproportionate amount of their portfolio in last year’s winner.

As you examine the chart you will note that only once did an asset class repeat as the winner (real estate in 2000 and 2001). In short, this type of performance chart is clearly signaling us not to chase last year’s winner.

As with the traditional Callan chart, the 7Twelve Index Chart reveals a patchwork of performance — hence it’s often referred to as a performance quilt. One of the purposes of this type of visual representation is to remind us that performance across a wide variety of asset classes is highly variable. Also: 1) past winners are not necessarily the winners the next year, 2) past losers are not necessarily next year’s losers and 3) the variation of return from high to low can be remarkably large.

Interestingly, the performance of the multi-asset portfolio ranged from the fourth-highest return (2007) to the tenth-highest return (2015). Generally speaking, it was in sixth, seventh or eighth place — exactly what we would expect from a broadly diversified portfolio when compared against all of its separate ingredients.

The fact that a broadly diversified portfolio produces a middle-of-the-road return is more than just a mathematical reality; it also represents a great challenge.

CONSIDERING THE CHALLENGES

So what are the specific challenges of navigating a multi-asset strategy?

1. A broadly diversified portfolio will never be the best performer in any given year when compared against all of its constituent ingredients. Of course, the upside is that it will never be the worst performer either, when compared against its individual ingredients.

For clients (and possibly advisors) who need to own the winner each year, a diversified portfolio will not be a satisfying solution. Of course, how one actually owns the winning asset class each year still remains an unsolved mystery. Even if a person could own the winner in most years, they will most certainly spend some time owning the worst performer in other years.

2. The performance of a broadly diversified portfolio (or any portfolio, for that matter) will be benchmarked against some standard of performance — and the typical standard is the S&P 500. The S&P 500 is perhaps the most well-known investment index on the planet. But does it represent the correct performance benchmark for a client who has a portfolio that includes U.S. stocks of all sizes, non-U.S. stocks, domestic and non-U.S. bonds, REITs, commodities, etc.?

The answer is no. Nevertheless, the S&P 500 will be used as the benchmark precisely because it is so broadly published and advertised.

When someone asks you, “How’s the market doing?” do you generally respond with an answer that reflects how the S&P 500 is performing? If so, you are tacitly agreeing with an assumption that the S&P 500 reflects the representation of all markets—which it clearly does not.

Perhaps a better response would be a follow-up question something along these lines: “Which market are you referring to? The bond market, the emerging stock market, the U.S. large-cap market, the TIPS market?” And so on.

In summary, incorrect benchmarking is one of the great challenges when building a broadly diversified portfolio. A multi-asset portfolio should behave differently than the S&P 500, because it contains many ingredients absent from the index. So it’s highly ironic that a multi-asset portfolio would be criticized for behaving differently than a single-asset-class index such as the S&P 500.

To return to our gastronomic analogy: It’s sort of like being critical of salsa for tasting different than tomatoes.

IS AVERAGE PERFORMANCE REALLY AVERAGE?

So is middle-of-the-road performance good enough? Interestingly, the S&P 500 finished the 20-year period from 1998 to 2017 with an average annualized return of 7.20%, while the 12-asset 7Twelve Portfolio had a 20-year annualized return of 7.34%.

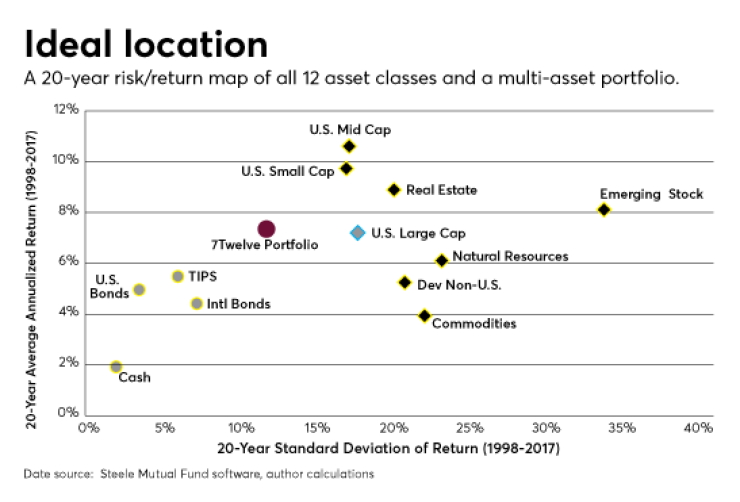

Raw performance is clearly important to clients, but so is volatility. Remember 2008? As shown in the “Ideal Location” chart, the risk/return location of the 7Twelve Portfolio is more attractive than the location of U.S. large-cap stock, due to the fact that the 7Twelve Portfolio is much closer to the coveted northwest (or upper-left) quadrant of the graph.

The risk/return coordinates of the other asset classes are also provided. The location of the maroon dot is arguably one of the ideal combinations of risk and return. As we might expect, the four fixed-income asset classes (cash, U.S. bonds, international bonds and TIPS) have a lower standard deviation of return, but lower returns as well. As a result they are below and to the left of the 7Twelve portfolio, indicating lower return and lower volatility.

Of the remaining eight asset classes (equity and diversifier indexes shown by diamonds), only four had a higher return than the 7Twelve Portfolio, but each of those had higher volatility. The other four indexes (U.S. large cap, natural resources, developed non-U.S. stock and commodities) had lower returns and higher risk than the 7Twelve Portfolio — indicating they produced an inferior risk/return tradeoff over the past 20 years.

What’s the final lesson here? Well, it’s all about the salsa, baby — the performance of an entire portfolio, while also taking risk into account, is far more important than the separate measurement of the asset classes that make up the portfolio. And while the diversified portfolio will never be the best performer, it also won’t be the worst.

In the end, there is nothing average about middle-of-the-road performance.