If a client wants to go to cash to remove risk from their portfolio, do they really mean they want to reallocate their portfolio to a money market account?

To be sure, a client with a long-term investing horizon is generally not benefitted by bailing out of a well-diversified, multi-asset portfolio, particularly if the equities market incurs steep losses. In such cases, a client would be locking in losses rather than allowing their portfolio to eventually recover, and many advisors would likely tell them to stay the course with their long-term investment plan.

But in those cases when a client demands that all or part of their portfolio be moved to cash, there is another alternative: Investing in a diversified fixed-income portfolio, including both U.S. and international bonds, and cash products such as money market funds, savings accounts and CDs.

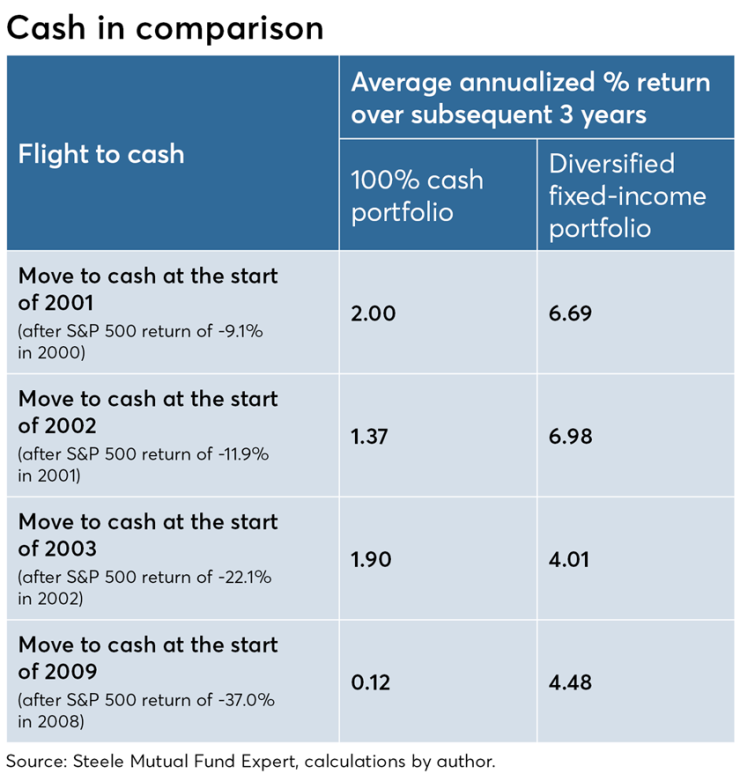

Here we’ll explore the performance of two fixed-income portfolios following four declines in the U.S. equities market over the past 20 years. The first is an all-cash portfolio and the other is a diversified fixed-income portfolio that includes three types of bonds, as well as cash (with no equities in either bucket). I’m not advocating your clients completely bail out of the stock market in favor of either portfolio, but if they insist on going to cash, the results shown here may help you encourage them to consider a diversified array of fixed-income asset classes.

In this analysis, the performance of U.S. bonds was represented by the Barclays Capital U.S. Aggregate Bond Index, TIPS were represented by the Barclays U.S. Treasury U.S. TIPS Index, non-U.S. bonds by the Barclays Global Treasury Index (unhedged) and cash by the 90-day U.S. Treasury bill. Taxes were not accounted for.

The first U.S. equity market decline we’ll examine occurred in 2000, when the S&P 500 lost 9.1%. If a client reacted to that loss by going entirely to cash at the start of 2001, they would have experienced a subsequent three-year annualized return of 2% over the next three years, as shown in “Cash in comparison.”

Let’s now assume the client fled out of their normal diversified portfolio of equities, diversifiers and fixed income, and repositioned their investments in a diversified fixed-income portfolio consisting of 40% cash, 20% aggregate bonds, 20% TIPS and 20% non-U.S. bonds. This portfolio was rebalanced at the beginning of each year to bring each asset to its predetermined percentage allocation. The three-year annualized return in this case was 6.69%, or more than three times higher than the all-cash portfolio.

What if a client went to cash at the start of 2002 (after a rough equity year in 2001, in which the S&P 500 lost 11.9%)? Over the next three years, the all-cash portfolio produced an annualized return of 1.37%. Had the same client built a diversified fixed-income portfolio, they would have experienced a three-year annualized return of 6.98%.

Next time frame. After a third year of equity losses, the client shifts entirely to cash at the start of 2003 (after a deflating loss of 22.1% in the S&P 500 in 2002). After three years in cash, they experienced an annualized return of 1.90%. Alternatively, the diversified fixed-income portfolio generated a three-year annualized return of 4%.

Fast forward to recent memory — after being gutted with an S&P 500 loss of 37% in 2008, the client runs, not walks, to cash at the start of 2009. Over the subsequent three years, the all-cash portfolio generated a paltry 0.12% annualized return, while the diversified fixed-income portfolio produced an annualized return of 4.48%.

Perhaps some clients may assume diversification primarily applies to equity investments. Not so. The fixed-income portion of a portfolio is clearly benefitted by diversification as well. Rather than hiding in cash, a diversified fixed-income position has demonstrated generally positive annual returns that materially outperform cash for the most part.

Was the diversified fixed-income portfolio riskier than an all-cash portfolio? Yes. The annual returns of an all-cash portfolio were always positive over the past 20 years, whereas the diversified fixed-income portfolio had two small calendar-year losses (as shown in “Fixed on return”).

From 1999 to 2018, however, a diversified fixed-income portfolio outperformed an all-cash portfolio by 166 basis points, with only a slight increase in the standard deviation of annual returns (3.06% vs. 1.94%). The point here is that both standard deviations are extremely low when considering the standard deviation of the S&P 500 over the same time period was 17.5%.

So is it always the wrong move for a client to go to cash? No. However, staying there for too long can be a problem for clients who need safety combined with some degree of performance that can stay ahead of inflation. And, of course, the more time a client has, the more they should be willing to take on some risk in their portfolio.

As can be seen in “Fixed on return,” an all-cash portfolio had a better return than the diversified-fixed income portfolio in six years out of the past 20. Thus, for particularly cautious clients, another asset allocation option is to have an all-cash bucket that’s paired with a diversified fixed-income bucket.

This analysis should not be construed as recommending clients should abandon their overall asset allocation strategy that includes a wide variety of asset classes. Rather, prudence would suggest an investor should always have a portfolio that has both engines (equities and diversifiers) and brakes (fixed- income assets).

For younger and/or more aggressive clients, the investment portfolio would likely emphasize the engines by assigning larger allocations to a wide variety of equity and diversifying assets. Nevertheless, the younger client also should have some exposure to the brakes.

For older and/or more conservative clients, the preservation elements of the portfolio will likely have larger allocations. Conventional wisdom often suggests that cash would be the predominant preservation asset. However, clients who insist on fleeing to cash as a result of equity market mayhem will often be better off moving to a diversified fixed-income portfolio, at least in the longer term.