Starting your own practice takes time, money … and some fraught decisions, according to seven advisors familiar with the experience.

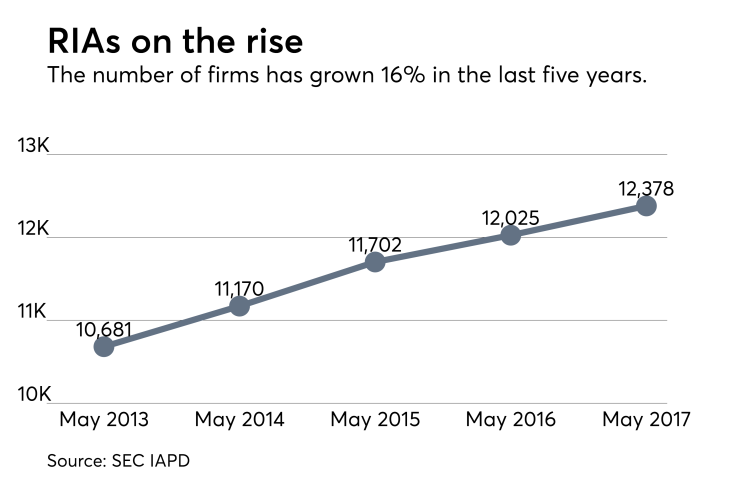

Just some of the challenges they faced: What types of business models and technology to use? How to set fees? How long can a new firm expect to be unprofitable? They are questions that an increasing number of planners are grappling with: The number of RIAs has jumped 16% in the last five years to 12,378, according to the SEC.

There are certainly attractive reasons to confront these dilemmas head on, the seasoned advisors said in a series of panels at NAPFA’s spring conference. New tools have made starting a firm easier, allowing planners to launch RIAs according to their own visions.

Yet independent fiduciaries also face growing competition, according to founding NAPFA member Bob Maloney, who notes that even insurance agents now call themselves “financial advisors.” Fee-only advisors must sell clients on their greater value to sustain their new firms, he says.

“Everyone wants to get away from the connotation of being a salesman,” says Maloney, the founder of Squam Lakes Financial Advisors in Holderness, New Hampshire. “What you’re selling is trust and confidence. And if you can’t do that, get the hell out of the business.”

FEES AND SELF-WORTH

Most founders struggle with setting their fees, whether based on assets under management, hourly costs or retainers. RIAs may prosper under any model, but advisors must avoid going too low, says Peggy Kessinger, who started at $3,000 per year and now charges $6,000.

If you don’t see 20% of your people leaving because of pricing, you’re probably not charging enough. -- Peggy Kessinger

“If you don’t see 20% of your people leaving because of pricing, you’re probably not charging enough,” says Kessinger, principal of Cedar Financial Advisors in Beaverton, Oregon. “People value it based on the way you value yourself, and that comes through in your pricing.”

The Great Recession prompted more advisors to use retainers, says Frank Moore, founder of Vintage Financial Services in Ann Arbor, Michigan. A friend of Moore’s allowed clients to pick between AUM and retainers, noting many would pay less under a retainer model, he says.

“And yet none of his clients opted to go to the retainer model,” says Moore, who charges clients 100 basis points of their total portfolio. “What they told him was that, ‘I like the idea that when my portfolio goes up, you get paid more, and when it goes down, you get paid less.’”

COMPLIANCE SCARES

RIAs must register with either state securities regulators or, if they have more than $100 million in AUM, the SEC. Firms like RIA in a Box provide registration services, while National Regulatory Services offers compliance training, notes Cindi Hill of Hill Compliance Advisors in San Diego.

“It’s a really great class, and the junior advisors who have gone have come back scared. But they learned a lot,” says Hill, who gave up her RIA to focus on compliance several years ago.

TECH ‘STUPID-PROOFING’

Software for advisors such as eMoney is akin to “stupid-proofing myself,” says Patricia Jennerjohn of Focused Finances in Oakland, California. And cloud-based remote meeting services, such as ScreenMeet, remove the need for most face-to-face meetings and physical office hours.

“My vision is to allow me to serve a broad range of clients and to do it profitably. That probably wasn’t possible 10 years ago because of the technology,” says Jennerjohn, who works from home and rents temporary shared office space for client meetings.

Software for advisers such as eMoney is akin to “stupid-proofing myself.” -- Patricia Jennerjohn

Michael Solari of Solari Financial Planning in Bedford, New Hampshire, uses Wealthbox as his customer relationship management software. He employs Blueleaf to manage his workflow, Adobe Sign for easy signatures and Zapier, an automating app, among other software products.

“I spend a lot of time, because I’m a sole practitioner, finding ways to make things easier,” Solari says.

INVESTMENT MANAGEMENT?

Founders of new RIAs must also decide whether they will provide investment management services, in addition to planning, at their new firms.

“It’s a pretty important question when you’re starting a practice because it’s going to define your trajectory in a lot of ways,” says Mark Berg, the founder of Timothy Financial Counsel in Chicago.

-

HighTower and Dynasty added big platform clients as wirehouse brokers continued to flee.

April 10 -

The Broker Protocol is just the first step. Those entering the fiduciary world still have to proceed with caution.

May 2 -

Switching firms can be a herculean task, but independent firm Steward Partners furnishes ex-wirehouse advisors with teams of specialists to ease the process.

May 10 -

Sometimes, the best way to keep control is to relinquish it.

May 1

“My clients are not looking for a money manager, they’re looking for an advisor. And there’s a big difference.”

Moore, who does manage money while also serving as his firm’s CIO, cites the appeal of such services to prospective acquirers of RIAs. The approach carries risks for AUM advisors, though.

“You get questions like, ‘Why didn’t you beat the S&P this year?’” Moore says. “Now, we all get questions like that, but I think you get them more when you charge the AUM fee.”

PROFIT PROPHECY

Advisors should plan on standing up their firms with no profits for at least three or four years if they are being “realistic,” according to Moore. Startup capital is a must, and trying to set up a new firm on the cheap represents one of the most common mistakes, Jennerjohn says.

Kessinger, who started her firm with her business partner after they both spent more than 15 years working at Intel, felt at ease by her third year, she says.

“Once you get that flywheel turning, it’s just the most satisfying profession that I can imagine,” Kessinger says. “It’s worth all that initial stuff.”