One of the major aims of asset allocation is to craft a portfolio with ingredients that don’t all behave in exactly the same way. This low-correlation stew offers protection against all assets heading south at the same time.

But, of course, that downside protection can be a double-edged sword; the portfolio’s ingredients are also unlikely to all do well at the same time. While some of your funds will be winners, others will be relative losers.

That’s the deal with a diversified portfolio; over the long haul, it works out well, but we have to be patient in the short run.

A common sentiment heard during the 2008 financial crisis was, “All correlations have gone to 1.” While not exactly true, it was the case that correlations among a large number of asset classes increased in relation to large-cap U.S. stocks (the S&P 500) during the latter part of 2008.

We now have sufficient historical perspective to do a look-back and see where we were then and where we are now in terms of correlations among major asset classes. In this analysis, the asset class against which all correlations will be calculated will be large-cap U.S. stocks. The other 11 major asset classes that will be included in this analysis are shown below:

As a reminder, the maximum correlation between two things is either +1 or -1. A correlation of +1 indicates that the two parts move up and down at the same time.

A correlation of -1 indicates that the two parts behave very differently — when one moves up, the other always moves down.

We’re generally happy when the correlation between the ingredients in a portfolio are in the range of -0.40 to +0.50.

Finally, a correlation of zero or closer to zero indicates that the behavior between the two portfolio ingredients is random — and that is the goal.

We’re generally happy when the correlation between the ingredients in a portfolio are in the range of -0.40 to +0.50. There will clearly be exceptions to that, such as the correlation between large-cap U.S. stocks and mid-cap U.S. stocks (which tends to be quite a bit higher than +0.50).

Studying correlation makes the most sense when we do it in the context of a diversified portfolio. This analysis utilizes the 12-asset model shown below. Correlations were calculated over rolling 12-month periods starting on Jan. 1, 1998, and going through Nov. 30, 2016.

CALCULATING CORRELATIONS

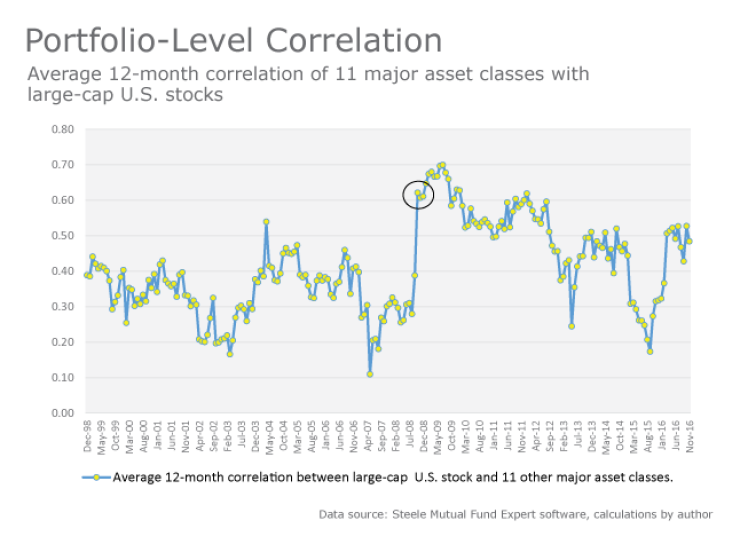

See the chart “Portfolio-Level Correlation.” The first 12-month correlation of large-cap U.S. stocks and mid-cap U.S. stocks was calculated from January 1998 through December 1998, and it was 0.96.

The correlation between large-cap U.S. stocks and small-cap U.S. stocks was calculated over the same 12 months, and it was 0.97.

The average correlation between large-cap U.S. stocks and the other 11 asset classes during the first 12-month period was 0.39. Over the next 12-month period (February 1998 through January 1999), the average correlation in the portfolio was 0.39.

This same calculation was done for all the subsequent 12-month rolling periods through November 2016 (for a total of 216). The average portfolio-level correlation for this 12-asset model was 0.41 over the total 18-plus-year period.

It’s clear to see that, in the fall of 2008, the average correlation between large-cap U.S. stocks and the other 11 asset classes spiked higher (see circle in graph). In October of 2008, every asset class in this 12-asset model had significant negative monthly returns — except for cash.

WEARING A SEATBELT

This serves as a reminder of why we wear seat belts, and why we have cash in a broadly diversified portfolio. October of 2008 was indeed a seismic event in terms of its impact on correlation among the ingredients in this 12-asset portfolio.

This serves as a reminder of why we wear seat belts, and why we have cash in a broadly diversified portfolio.

Consider this: The rolling 12-month portfolio-level correlation was 0.39 as of September 2008. Then, one month later, the average correlation of the 11 assets classes to large-cap stocks jumped to 0.62.

Aggregate correlation within the 12-asset portfolio continued to increase over the next several months, and hit a high point of 0.70 in June and July of 2009. Since that time, correlation within the 12-asset model has declined.

In September 2015, correlation had declined to 0.17. As of November 2016, the average correlation of the 11 asset classes to large-cap U.S. stocks was 0.48.

DEEPER VIEW

Let’s now examine the rolling correlations of each individual asset class with large-cap U.S. stocks for the two years prior to and after October 2008 (see “Upward Pull”). It’s visually clear that correlations between large-cap U.S. stocks and the 11 other major asset classes were generally lower prior to October 2008 and higher afterwards — except for cash.

Cash, by virtue of its consistently positive nominal returns, tends to have low correlation with large-cap U.S. stocks. Fixed-income asset classes also tend to have reliably low correlation with large-cap U.S. stocks. In October 2006, the rolling 12-month correlation between large-cap U.S. stocks and U.S. bonds was 0.21. Correlation was 0.09 with U.S. TIPS, -0.21 with non-U.S. bonds and -0.12 with cash.

By October 2008, the 12-month correlation had become 0.46 between large-cap U.S. stocks and U.S. bonds, 0.46 with TIPS, -0.09 with non-U.S bonds and 0.22 with cash. By October 2010, the 12-month correlation between large-cap U.S. stocks and U.S. bonds was -0.38, and it was -0.06 with TIPS, 0.23 with non-U.S. bonds and -0.17 with cash.

We observed some upward fluctuation in the correlation between large-cap U.S. stocks and U.S. bonds and U.S. TIPS, but in general, these fixed-income ingredients maintained their low correlation with U.S. large-cap stocks during this particular four-year period.

By contrast, the correlation between large-cap U.S. stocks and the other equity ingredients started fairly high and went higher. Indeed, in October 2006, the 12-month correlation between large-cap U.S. stocks and mid-cap U.S. stocks was 0.84, and it was 0.78 with small-cap U.S. stock, 0.63 with non-U.S. stocks and 0.77 with emerging stocks.

In October 2008, the 12-month correlations had jumped to 0.98 with mid-cap stocks, 0.96 with small-cap U.S. stocks, 0.92 with non-U.S. stocks and 0.85 with emerging stocks. As of October 2010, the 12-month correlation between large-cap U.S. stocks and mid-cap U.S. stocks remained high at 0.96, and was 0.91 with small-cap U.S. stocks, 0.90 with non-U.S. stocks and 0.92 with emerging stocks.

THE DIVERSIFIERS

Among the diversifier asset classes, the 12-month correlations with large-cap U.S. stocks as of October 2006 were relatively low: 0.57 for real estate, 0.34 for natural resources and -0.03 for commodities. By October 2008, those correlations had risen to 0.84 for real estate, 0.72 for natural resources and 0.53 for commodities. At the end of October 2010, they were even higher: 0.87 for real estate, 0.95 for natural resources and 0.87 for commodities.

As of November 2016 (not shown in “Upward Pull”), 12-month correlations between large-cap U.S. stocks and the other U.S. equity asset classes were still high (0.96 with mid-cap stock and 0.92 with small-cap stocks).

Encouragingly, the correlations between large-cap U.S. stocks and non-U.S. equity have declined somewhat (0.79 between large-cap U.S. stocks and non-U.S. stocks, and 0.68 between large-cap U.S. stocks and emerging stocks).

The diversifiers are doing their job better now (0.67 correlation between large-cap U.S. stocks and real estate, 0.64 with natural resources and 0.23 with commodities).

Finally, as of November 2016, U.S. bonds had a 12-month correlation with large-cap U.S. stocks of -0.07, and 0.10 for TIPS, 0.10 for non-US bonds and 0.32 for cash.

While it’s important to consider the correlation of each ingredient with every other portfolio ingredient, we can also get an overall sense of the aggregate portfolio correlation by simply calculating the correlation of each portfolio ingredient with large-cap U.S. stocks.

So, did correlations all go to 1 in the fall of 2008? No, not if measuring correlation over rolling 12-month periods at the portfolio level.

Just as performance tends to regress to its mean, portfolio-level correlation tends to do the same. One key message from this analysis is that, although portfolio-level correlation increased in 2008 and 2009, that is not a reason to abandon the core investing tenet of diversification.