Wells Fargo is proving to be a leading source of talent ― for rival firms looking to lure away advisors.

The wirehouse has lost at least 80 advisors managing over $12 billion in client assets year-to-date, according to hiring announcements compiled by On Wall Street.

And the hits keep coming. Wells Fargo Advisors lost six more financial planners, this time to Stifel Financial, RBC Wealth Management, Raymond James and Janney Montgomery Scott, firms that have been successfully luring away Wells’ brokers over the past several months.

Wells Fargo was among biggest losers as advisors jumped to other firms.

Advisors Mark Demo and Raymond Patraw moved last week to Stifel. The duo previously managed $230 million in assets, according to Stifel.

Broker David McClure went to RBC earlier this month. He managed $110 million while at the wirehouse, according to RBC.

Raymond James announced that father-son team Clay and Nate Brandt, who the firm says managed $173 million in assets at Wells Fargo, joined a new branch in Burlington, Wisconsin.

Eileen Keegan is joining Janney Montgomery Scott in Glatsonbury, Connecticut. The firm says she managed $77 million in assets at Wells Fargo prior to her arrival.

A spokeswoman at Wells Fargo Advisors declined to comment on the departures.

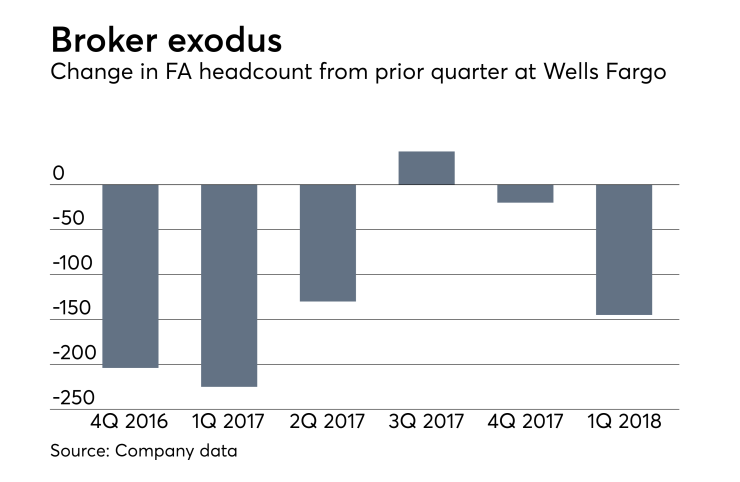

Last quarter, Wells Fargo’s

Wells Fargo has suffered from heightened regulatory scrutiny following scandals on its consumer banking side, including the unauthorized opening of millions of customer accounts without.

And the firm

As Wells Fargo’s headcount shrinks, its smaller rivals have been on recruiting sprees, luring in talent by offering more of what they say are better working environments and more freedom in how to serve clients.

RBC, for example, recruited a

-

Such a move would also coincide with efforts to cut costs in the bank's wealth management business by $600 million by 2020.

June 19 -

Advisor exodus from beleaguered firm shows no sign of abating in 2018

June 13 -

A client's alleged complaint sparked a dispute between the wirehouse and its former advisors.

June 4

“Some of the bigger wirehouses have lost sight to how important the client is and how important the advisors are,” says Stifel manager Randy Powers, who oversees the firm's branch locations in New York state.

Powers adds: “They just don’t seem to care enough about the advisor or the client in the decisions they make, in the products they roll out, the pricing structure, the fees. It’s a constant change in compensation every year.”

Demo and Patraw are the first advisors of a new Stifel branch in Syracuse, its third location in New York, according to the firm.

While there is still more interest from advisors wanting to join the Rochester branch in New York, Powers says it only has room for about two more. The firm has intentions to move into a new building in Rochester in order to accommodate the growth.

Stifel is also interested in expanding into Buffalo, Albany and Utica, said Powers.

McClure moved to RBC for its culture, people and growth potential, says Chip Anderson , RBC complex director in Atlanta.

RBC recently opened a branch in North Carolina, one in Tennessee and two in California. The firm has hired 69 financial advisors year-to-date, quickly approaching the firm’s original recruiting goals for the year ― objectives it had not anticipated meeting until later in the year, according to Anderson. The majority of the new hires have come from Wells Fargo.

Anderson says advisors have chosen RBC over competing regional BDs because of its smaller size, boutique-like culture and business model that focuses on higher net-worth clients.

Of his move to Raymond James, Brandt says his team was motivated to make the move in part for the regional firm's culture and technology platform.

"It is a true pleasure to be with a company whose associates provide advisors with first class service, are accountable, responsive and pay attention to detail to get the job done right," he said in a statement.