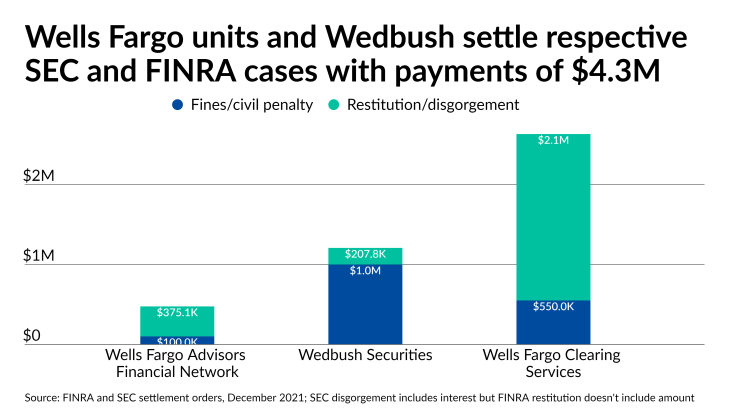

Two wealth managers paid for not following their own compliance policies — one with respect to unit investment trusts another on unregistered securities.

In settlements of separate cases filed this week by FINRA and the SEC, two Wells Fargo units

Wedbush’s failures caused the firm to serve unwittingly as one of the brokerages deployed by an offshore pump-and-dump and market manipulation scammer named

“Broker-dealers have a critical obligation to inquire into the origin of any microcap security they sell, as well as an obligation to report suspicious activity relating to transactions in the markets,” Gurbir Grewal, director of the SEC’s Division of Enforcement, said in a statement. “It is our expectation that they will fully perform these important gatekeeping obligations, and when they fail to do so, we will hold them accountable.”

Representatives for Wedbush declined to comment on the case.

In the case against Wells Fargo Clearing Services and Wells Fargo Advisors Financial Network, investigators allege the firm cost clients millions of dollars in upfront sales charges between July 2013 and June 2018 by rolling over their investment in one UIT to another prior to its maturity. In some instances, the firms’ representatives switched their clients to an identical UIT, according to FINRA. The case represents the last one stemming from a sweep FINRA

“You find the products that pay the highest commissions and you'll find the products where most of the abuses occur,” said fraud expert Douglas Schulz of Invest Securities Consulting. UIT’s have “always been a problem,” he said, because clients have trouble with all the different types of fees collected upfront, during the investment and at the end. “It's almost impossible for them to really figure out and know what are the charges and potential charges,” Schulz said.

Wells Fargo’s procedures described UITs as “generally suitable” if clients can hold the products until their termination while instructing reps and principals to consider the costs of switching when recommending rollovers, according to FINRA. The firm didn’t have an automated way to detect UIT rollovers in advance of maturity, though, investigators say.

“As part of an industry-wide review of UIT early rollovers, Wells Fargo Advisors has enhanced training and education for financial advisors and supervisors and enhanced its electronic system for monitoring early UIT liquidations,” spokeswoman Shea Leordeanu said in an emailed statement. “We are pleased to have this matter resolved and will be making payments to impacted clients, with interest.”

At Wedbush, employees didn’t have enough training “as to how to identify and avoid participating in illegal unregistered offerings,” despite the firm’s policies calling on reps assigned to the account to determine whether stock shares were exempt from registration requirements, according to the SEC. At certain points, the company accepted Silverton’s “non-sequitur responses” to questions on its deposit forms asking about the registration status without taking the basic step of searching the SEC’s Edgar database, according to investigators.

Silverton generated $43.7 million in proceeds through the sale of 97 million shares deposited at Wedbush between January 2017 and September 2018 — the month before Knox’s

The firm “overlooked red flags which, taken together, should have alerted Wedbush to the likelihood that Silverton’s transactions were suspicious,” the document stated.