When it comes to talent, Wells Fargo’s ongoing losses continue to be turned into gains for fast-growing regional firms.

Baird has poached two advisors with more than $550 million in client assets from Wells Fargo, according to the firm. Irv Mindes oversaw $360 million in assets while at the wirehouse and will become managing director, Baird announced. Bill Fedor oversaw $206 million in assets and joins as senior vice president.

The new hires are the latest additions to the firm’s wealth management segment. In early 2018, Baird acquired

The new moves come shortly after Baird reported record revenue for the eighth year in a row. Revenue at the employee-owned wealth management firm swelled to $1.53 billion in 2017, a 10% increase over 2016. Operating income totaled a record $199 million, and the firm’s 2017 return on book value was almost 21%.

“Being employee-owned and independent also enables us to make strategic investments that expand and deepen our capabilities to deliver the best advice and service to our clients,” said Steve Booth, Baird CEO, in a statement.

The firm’s wealth management segment grew its assets under management to $136 billion, a record for the business. The group now has more than 880 advisors serving clients at 88 locations in 29 states. Headquartered in Milwaukee, the regional broker-dealer’s clients are mostly registered as high-net-worth individuals, according to their latest Form ADV.

Like other regional BDs, Baird has ramped up recruiting efforts to capitalize on advisors exiting the wirehouses. Baird’s has hired planners from

Both Mindes and Fedor will work at the firm’s Tucson, Arizona office and are joined by branch administrative supervisor Marcie Shatz and client specialist Christy Yetka.

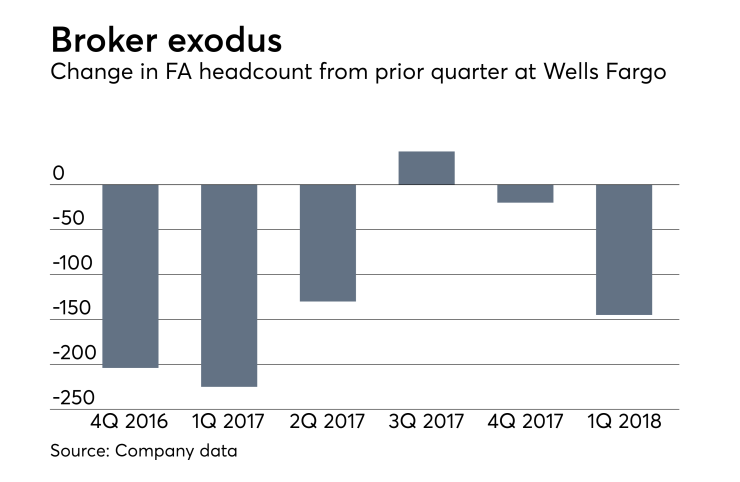

For Wells Fargo, the loss is part of an ongoing trend, as the wirehouse has reeled from advisor attrition in recent years. Headcount dropped five out of the six last quarters as numerous scandals have hit the bank, including one specifically at its wealth management segment. The firm’s ranks fell by 300 advisors year-over-year in the fourth quarter to 14,544.

“We continue to take a disciplined recruiting approach and it’s working,” a Wells Fargo spokeswoman said after the firm reported its earnings last month. “We feel no need to focus on raw headcount numbers.”

Although advisor headcount fell, profits surged at the wirehouse. Net income in the firm’s wealth and investment management business rose 7% year-over-year to $714 million, driven higher in part by falling income tax expenses, the firm says.

Wells Fargo declined to comment on the departures.

The pair of Mindes and Fedor bring neary 60 years of industry experience to Baird. Mindes has 36 years of industry experience, beginning his career with Merrill Lynch in 1982, moving to A.G. Edwards in 1993 and registering with Wells Fargo in 2008, per FINRA BrokerCheck records.

Fedor joins Baird with 23 years of experience. He began his career with A.G. Edwards in 1994 and registered with Wells Fargo in 2008, per BrokerCheck.