John Kortze, an advisor overseeing $500 million in client assets with his brother, had never switched firms during his nearly 25-year career.

To be sure, years of industry consolidation changed the name of his employer, from Prudential Securities to Wachovia to Wells Fargo. But Kortze had stayed put through mergers, acquisitions, a dot-com bust and a financial crisis. That is, until last week.

"It was very clear to me, and I'm not talking about the headlines, that the direction at Wells was kind of counter to what we held near and dear," Kortze says of he and his brother Cary's approach to wealth management.

The brothers became uncomfortable with the increasingly "robotic and automated" direction the wirehouse was taking. They preferred instead to operate within what they say is "a true and robust advisory platform."

"For the first time in our careers, I felt that we needed to make a change not for us but for our clients," Kortze says.

On Thursday, the team joined Steward Partners, an independent firm affiliated with Raymond James.

They're not alone. Other brokers leaving the wirehouse channel in recent years have cited what they see as overburdensome compliance and policies that cater to the common denominator.

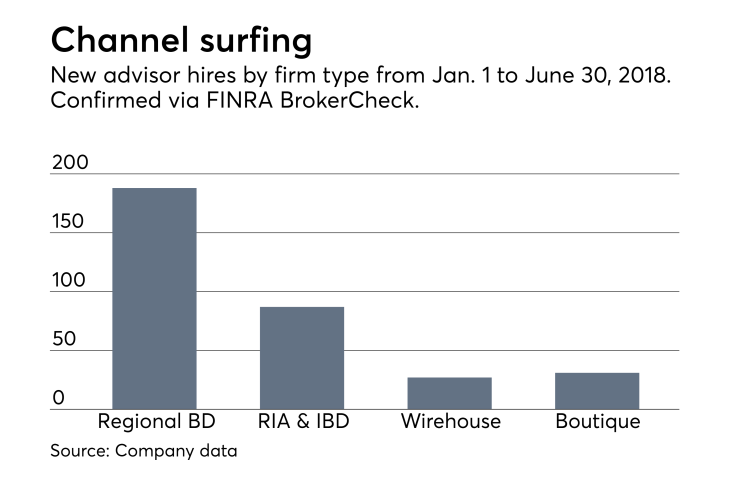

Steward Partners, like other independent firms, has benefited from this trend. Founded in late 2013 by former wirehouse managers, the firm has grown rapidly with the addition of a number of wirehouse recruits.

The Kortze brothers now staff the firm's newest office in Newtown, Connecticut ― Steward Partners' first in the state and 16th branch overall. The firm is headquartered in Washington, D.C.

"Being part of Steward gives us opportunity to be part of something that is growing," Cary Kortze says.

While Raymond James and Stifel are on hiring sprees, Wells Fargo is still losing talent.

The brothers' departure also marks the latest in a string of losses for Wells Fargo, which has been

But hiring announcements and BrokerCheck records show that

Although Steward Partners has been among those benefiting from the exodus of talent from Wells Fargo (

"I don't care where they come from. We want good people running good businesses," says Jim Connors, New England divisional president at Steward Partners.

Connors worked at Wells Fargo as a managing director in Boston until 2016.

A spokeswoman for the wirehouse declined to comment on the departure of the Kortze team.

Cary Kortze, who is the younger of the two brothers, joined the industry in 2000 after a short stint at Fidelity, he says. The brothers have worked as a team ever since.

Speaking a day after their move to Steward Partners, the brothers say the initial client reaction has been positive.

The brothers spent roughly a year exploring different options. They ruled out other wirehouses that seemed too similar to what they didn't like at Wells Fargo. In Steward Partners, they liked the firm's relationship with Raymond James and partnership structure.

"It was the independence we wanted but with a strong backing and infrastructure," John Kortze says.

Though they made the move, it still was something unusual for a team that had had its feet firmly planted for so long.

"Moving doesn't do anything for the client. It helps the advisor. With our scope and scale, there was temptation monetarily to move, but at the end of the day it wasn't good for the client," Kortze says.