Wealth managers have boosted spending on new technology more than other professionals. But they're still facing headwinds connecting with some clients amid the coronavirus pandemic, according to a new survey by Arizent.

More than a third of respondents who work in wealth management said they have increased their tech budget — outpacing financial services, professional services and fintech/IT, according to the study, which was conducted between April 14 and April 23. Arizent is the parent company of Financial Planning.

Video calls are more frequently substituting for face-to-face meetings. Some advisors are even saying they prefer them. But even with wealth management firms upping their investments in new technology more rapidly than other industries, there are hurdles in reaching certain clients. Some clients live in rural communities with poor access to the internet, to name one. Not all clients are apt to adapt to virtual meetings, to name a second.

To meet these challenges, many wealth management companies are boosting employee training in order to help clients utilize their technology — 29% of firms said they’ve upped their spending in this area, according to Arizent research.

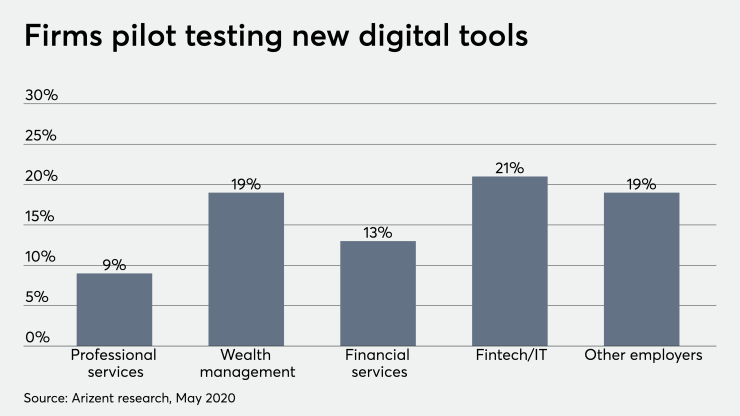

At the same time, wealth management lags behind other sectors in some areas. For instance, fintech and financial services firms (other than wealth managers) are providing customers with online tutorials or videos on how to use their platforms, something only 14% of wealth management firms are doing.

Still, most respondents in the wealth management industry have been pleased at how their firms have adapted to the rapidly changing environment caused by the coronavirus, according to the research.

More than half — or some 56% — of respondents said that their company was more agile in adapting to the new conditions than they originally anticipated, and 46% said that their ability to serve customers digitally had also exceeded expectations.

But there have clearly been challenges.

“In rural parts of our territory, internet infrastructure is not yet present or robust, which has been a problem for some clients,” said one advisor who had a client pass away from COVID-19. Some elderly clients were experiencing difficulty using video conferencing or file sharing, the respondent said.

Other notable hardships included falling revenue; client fear; makeshift at-home offices (one respondent said they were using their bed as a desk); and difficulty, or inability, to meet new prospects.

Yet there have been some positives, too: One advisor said they were (remotely) finding new types of clients they wouldn’t have met otherwise. A wealth manager reported spending time developing an online presence, while another said that meetings with existing clients are easier via phone, video or email.

“We were already set up for something like this,” one advisor noted, saying that half of their meetings had already been virtual and the firm has been bringing on new assets, during the pandemic.

“The hardest part will be getting everyone to go back into business dress at the end [of this],” they said.