It's going to be harder for wealth management firms to find top executive talent this year.

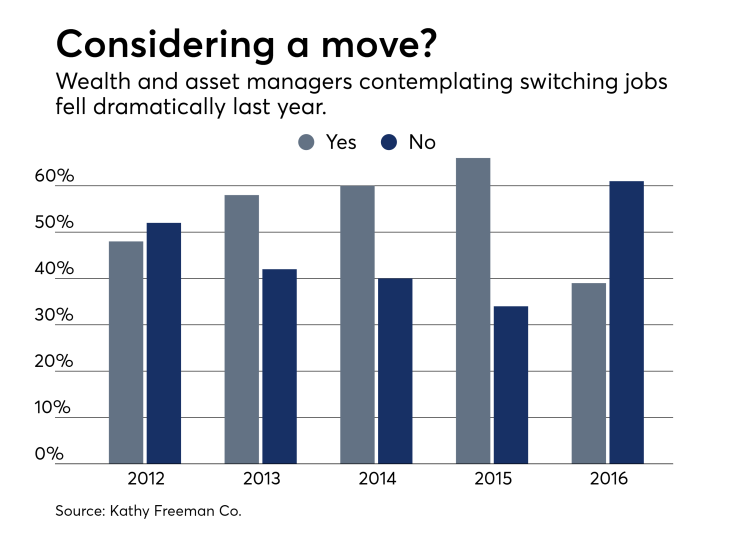

Only 39% of client-facing wealth and asset managers said they would be willing to consider taking another job in 2017, down from 66% who indicated that they were thinking about making a move in 2016, according to a new industry report.

"These people are not unhappy," says Kathy Freeman, who heads an eponymous executive search firm in California which just released its annual talent trends survey. "The markets are up, they are not underpaid and they are busy. They are not looking."

The expected continuing consolidation of the advisory industry and record M&A activity may help break the logjam, however.

One quarter of the wealth managers surveyed expect that their firm may be merged or acquired in the next two years.

"That creates uncertainty," says Freeman. "Any time there are workforce reductions, there is always fear and trepidation about larger and deeper cuts, and even highly accomplished executives may consider new roles."

ROLE OF COMPENSATION

To attract passive candidates in a tight job market, the report recommends that advisory firms consider a comprehensive approach including excellent pay, clear opportunities for professional growth, and a positive company culture.

Compensation, however, isn't a major issue for job seekers at the moment, according to the report.

"Compensation isn't a pain point right now," Freeman says. "It's a given that firms will offer competitive pay."

RESTRUCTURING FOR RETENTION

Indeed, 45% of respondents to the survey saw their compensation rise in 2016, and 50% expect to see their compensation increase even more in 2017.

"Compensation isn't a pain point right now. It's a given that firms will offer competitive pay." - executive search firm head Kathy Freeman.

Consequently, firms who haven't restructured their compensation packages to retain top talent need to do so immediately, Freeman cautions.

"Successful executives won’t make a career move solely for compensation if their current pay is in line with the industry norms." the report states. "They view compensation as a minimum bar rather than a retention tool.”

WHAT TOP TALENT WANTS

Wealth and asset management firms are also moving toward offering executives a base salary plus an annual bonus component, instead of variable payouts, according to the report.

As profit margins shrink, firms are looking for more predictable compensation numbers, the report noted. Annual bonuses provide more flexibility to manage the firm’s cash flow.

What is the best way to attract and retain top wealth managers?

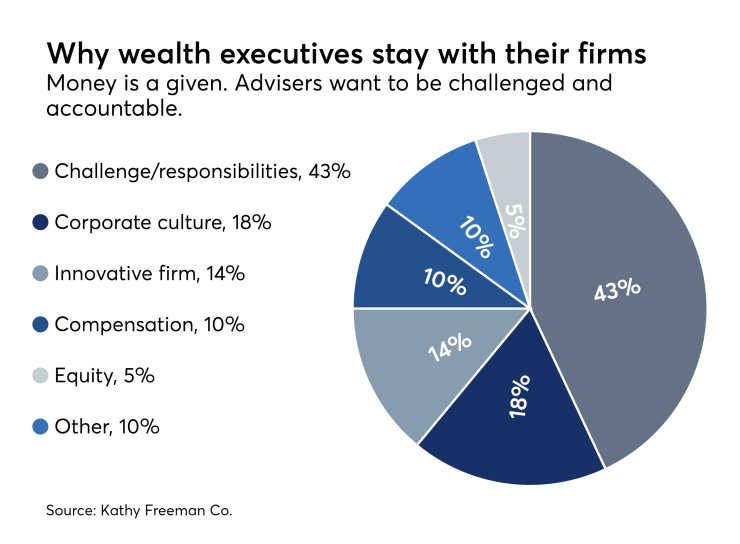

By a wide margin, offering advisers a continued challenge at their job along with expanded responsibilities was the most commonly cited reason respondents said they stayed with a firm.

Advisers also want a strong corporate culture, a firm that is innovative and flexible — and also offers attractive compensation and equity.

"The bottom line is that the intangibles determine whether there is a good long-term fit at a firm," according to the report. "They set the stage for a successful offer and acceptance."