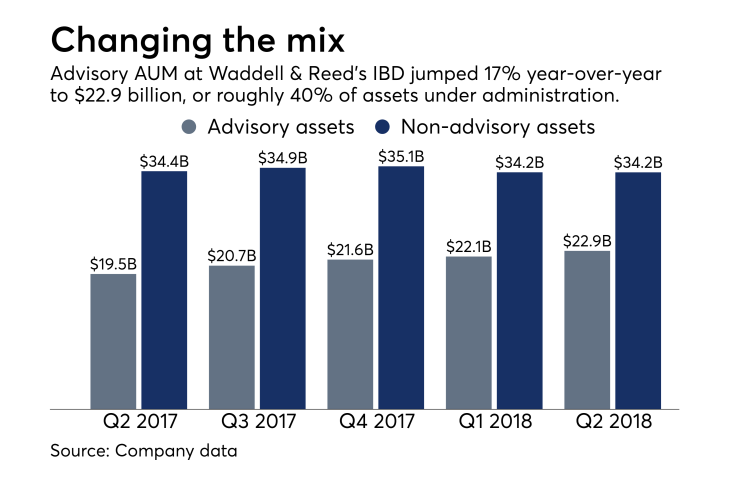

Waddell & Reed Financial’s overhauled broker-dealer is boosting advisory assets and revenue, despite shedding more than 450 advisors in the past year.

While the No. 13 IBD’s head count has fallen by 29% to 1,130 advisors, its average productivity has jumped 35% to $314,000 per advisor, the firm

A new payout plan launched this year

Over the same span, Waddell & Reed’s reduced spending in three areas — the now-vacated fiduciary rule, the merger of several investment funds and consultants

The overall firm, which is best known for its mutual funds, is still struggling to stanch the outflow of assets amid the loss of longtime managers and institutional clients. The IBD unit, however, is planning to roll out a new business platform for advisors and a new elite service program for top performers.

“In light of continuing industry consolidation, broker dealers have the potential to become a commoditized service focused exclusively on payouts and losing the personalized service, which financial advisors have historically enjoyed,” Mihal said,

“With the development of our corporate strategy we have deployed initiatives designed to increase payouts for higher performing advisors, enhance technology, offer a broad selection of programs and services designed to support our advisors' practices, and expand in our product and service offerings.”

-

The firm is prioritizing its most productive advisors after shedding some 30% from its headcount.

May 1 -

Headcount dropped by 413 brokers year-over-year, but productivity per FA jumped by 29%.

February 1 -

The IBD has boosted payouts for advisors as it trims lower producers from its ranks.

December 5

The firms with the highest percentage growth year-over-year are cutting their head counts and fueling the record level of M&A deals.

The parent firm doesn’t break out the IBD’s net income, but its total advisory fees, 12b-1 fees, commissions and other revenues rose 11% year-over-year to $117.2 million. Advisory revenue also jumped 14% over the year-ago period to $66.6 million, or nearly 60% of the IBD’s revenue.

Waddell & Reed has begun developing a new platform aimed at helping advisors’ efficiency through the use of aggregated data in the firm’s business procedures. The work is “well underway,” Mihal said, noting the firm will select a vendor for the platform by the end of the year and launch it next year.

The reduced spending on the IBD overhaul, which the company calls Project E for "evolution," does not mean the transformation is complete, spokesman Roger Hoadley said in a follow-up email, noting the company continues to invest in technology and other major areas.

The company has finished the request for information process on the business and data analytics platform and is considering a "subset" of vendors focused on data management and efficiency, Hoadley said. The project will connect advisors' devices with the home office better through streamlining of data on clients, accounts, advisors, compensation and products.

"Our preliminary timeline targets introduction of certain system functionality in the first half of 2019," he said.

In the past quarter, the firm also started directing resources toward connecting top-performing advisors with a personal service professional under a new program. In the third quarter, it will fill newly created and lead positions through hiring, with its full rollout slated throughout this year and into 2019.

Mihal had

Waddell & Reed had also established a cost-savings target of up to $40 million off its annual expenses, and CFO Ben Clouse says it’s on track to slash the final $10 million to $20 million by the end of the year. The lower in-flow of new advisors has made real estate one of the main areas of savings.

An analyst asked Mihal if the broker-dealer’s profitability would revolve more around cost containment or revenue generation, given advisors’ increased productivity.

Mihal replied that in addition to cutting costs and supporting top producers, the IBD is “finding additional opportunities there to continue to focus on revenue growth, and we're certainly turning our attention in that direction as we move forward into subsequent quarters.”

The parent firm’s net income soared by 85% to $44.5 million, or 55 cents per share, on revenue of $295.3 million, which beat analysts’ consensus estimates of $0.48 in EPS and $289.2 million. Waddell & Reed’s stock value surged by 7% to $20.71 per share at market close after the earnings announcement.

Despite noting long-term and weakened net outflows from the firm's investment funds, Keefe, Bruyette & Woods analyst Robert Lee raised the firm's EPS estimates through 2020 and increased its price target to $23 per share from $21.

The more optimistic forecast stemmed from Waddell & Reed's second-quarter results and "lower ongoing expenses, partially offset by lower revenues due to weaker asset growth and fee reductions," Lee said in an analyst note.