As wealth managers adjust to a new era of disclosure under the SEC’s Regulation Best Interest, the agency’s latest enforcement case shows the high stakes.

Voya Financial Advisors agreed to pay $22.9 million — or 5% of its annual revenue, according to

With Reg BI going into effect this past June, independent broker-dealers like Voya have been ramping up disclosure of potential higher expenses that clients pay because of the firms' conflicts. Critics ask why the SEC’s rule hasn’t required firms to eliminate conflicts rather than disclosing them. Some firms are

Voya breached its fiduciary duties by not adequately disclosing that it was conflicted because of higher client costs due to 12b-1 fees on mutual funds, lower client yields in cash sweeps and the added price of commissions on illiquid alternative investments, according to the SEC. The higher costs of the 12b-1 fees and the commissions violated best execution rules, the regulator says.

Over a five-year span between January 2013 and December 2018, Voya failed “to disclose all material facts relating to how those conflicts could affect the advice” the firm and its representatives provided to clients, according to the SEC order.

The firm’s disclosures weren’t “sufficiently specific so that clients could understand the conflicts of interest concerning Voya’s investment advice and have an informed basis on which they could consent to or reject the conflicts,” the order continued.

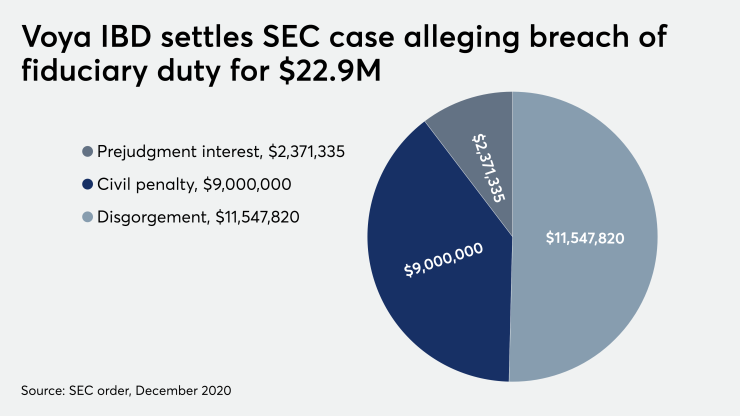

Des Moines, Iowa-based Voya agreed to pay a civil penalty of $9 million, as well as $11.5 million in restitution and prejudgment interest of $2.4 million, the document states. The firm will also notify advisory clients and hire an independent consultant to carry out compliance reviews.

“Ensuring that our customers receive the appropriate products and services to help them meet their retirement needs is core to our focus as a company,” Voya spokeswoman Laura Maulucci said in an emailed statement. “Restitution (including interest) is being paid to our customers, and we have revised our procedures and disclosure to avoid a recurrence of this issue.”

Other wealth managers could soon follow Voya with similar enforcement cases, if a similar