The founders of an upstart firm that launched a broker-dealer two years ago say the company is growing again and saving advisors and clients millions of dollars.

The week

The Hamms are part of a nascent trend: hybrid RIAs that are changing their relationships with IBDs as they seek to compete with giants in a fragmented industry by offering advisors and clients a smaller firm and, they say, lower costs, higher yields and a greater payout.

While the firm lost hundreds of advisors

“We went in with the premise that we wanted to maximize the return to our clients first, then to our advisors and be a profitable firm, too,” the elder Hamm says, comparing the firm’s process of starting a BD to flying a plane while building it at the same time.

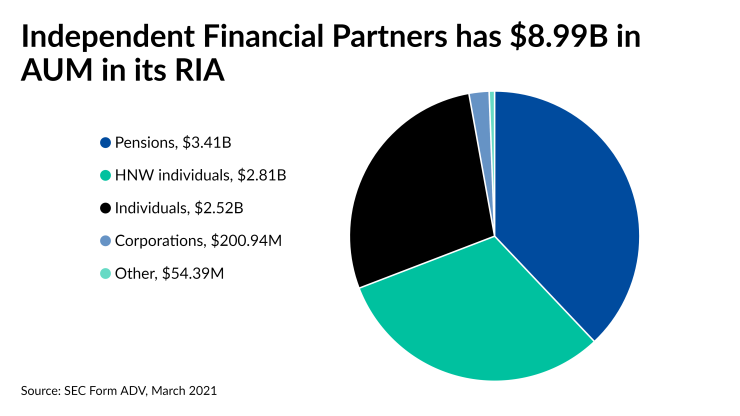

While the firm’s SEC Form ADV brochure and its other disclosures list common industry conflicts of interest from cash sweeps and various forms of revenue sharing, Bill Hamm says IFP’s clients earn about 100 basis points more on their cash than with typical BDs. The savings to advisors stem from lower administrative fees and higher payouts, according to the firm.

Not charging a fee for advisors who manage assets on their own makes IFP stand out to recruiter Jon Henschen, who notes an emerging trend of “fiduciary-friendly” BDs focusing on advisory services without markups, platform fees and other kinds of costs. However, compliance expenses usually make it difficult for smaller BDs to earn much profit, he points out.

“That's been my focus in my recruiting — helping advisors find places that treat their clients' money better,” he says. “Advisors will see other broker-dealers where their clients’ money is treated better, so that makes it more attractive to go there.”

Still, the level of competition and hiked up regulatory costs under the SEC’s Regulation Best Interest and other oversight make wealth management a difficult terrain for small IBDs, recruiter Jodie Papike of Cross-Search agrees. At the same time, advisors often seek out the trusted, personal relationships with top executives that can be hard to develop at larger firms, she says.

“My hats off to anyone who starts a broker-dealer in this environment,” Papike says. “It's not easy. There's still a lot of demand for midsize, quality, privately-held broker-dealers.”

Managing compensation processes across more than 2.5 million transactions involving about 200 mutual funds, insurers, custodians and other third parties proved challenging before the firm began automating those processes, the elder Hamm says. IFP has also had “a little bit more robust interaction with regulators” since launching the BD, his son says.

They’ve “all been really nice interactions so far,” Chris Hamm says. “When you're not a broker-dealer, you really are shielded from some of that.”

In seeking to provide value to IFP’s advisors, the firm has more than tripled the amount of assets it manages on their behalf to $620 million. IFP continues to hire engineers to keep building out its technology, and it’s rolled out practice valuation tools with an eye toward eventually bringing in a production coach to work with advisors. Even though it has no OSJs now, the elder Hamm says he would be open to those and hybrid RIAs in the future.

“What we're trying to do is make sure that the economics work for everybody,” Hamm says. “I don't want to compete with my advisors. We're trying to make sure that we're all headed in the right direction.”