United Capital has added three firms with a combined $758 million in assets under management to its roster, underscoring the growing importance of the market for smaller RIAs.

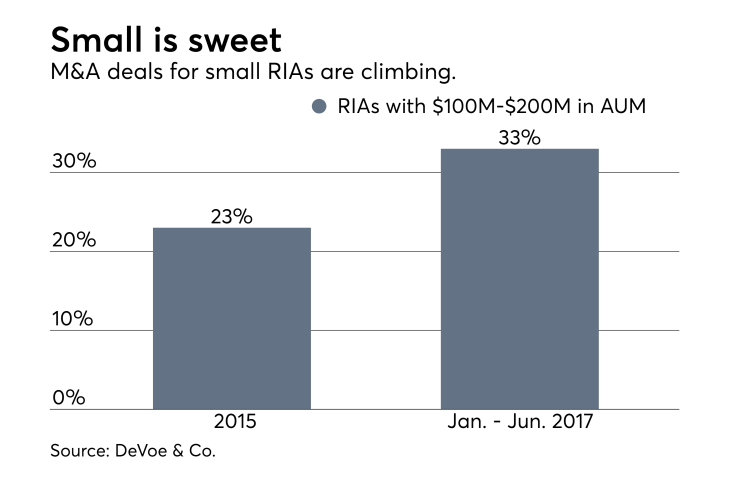

Deals for RIAs with between $100 million and $250 million in AUM are soaring. Smaller firms have made up 33% of sellers through June, compared to 23% in 2015, according to DeVoe & Co.'s Second Quarter Deal Book.

Indeed, interest in the lower end of the market pushed RIA M&A activity to a record high in the first half of 2017, according to DeVoe, climbing 15% over the same period last year.

"It’s never been a better time to be a seller," says investment banker Liz Nesvold, managing partner of the New York-based investment banking firm Silver Lane Advisors. "Even though 2016 was a record year for M&A in our sector, less than 3% of all firms transacted. The real benefit to sellers here is that they can choose to align with a broader range of potential models."

BONANZA FOR BOUTIQUES

Dan Seivert, CEO of Echelon Partners which hosts the annual Deals & Deal Makers conference for the RIA M&A market, agrees.

"It's a great market for firms with a boutique business model," Seivert says. "Firms of this size often haven't yet introduced all the C-level executives and the specialization that goes with it. They can enjoy great profitability and sell for attractive prices."

Asset One, with offices in Colorado and, Louisiana, was the largest of the three firms acquired by United with $403 million in AUM. Jensen Wealth Advisors, based in Palm Desert, California, was the smallest with $145 million, while Indiana-based Compass Wealth Advisors holds $210 million in assets.

United, which was founded in 2005 and now has over $19 billion AUM , has long been a leading aggregator of smaller firms. However, it is now facing increased competition.

ATTRACTIVE MARKET

Former AMG partners John Copeland, Rich Gill and Sean Bresnan

"We've seen a lot of players come and go," says Matt Brinker, United's chief business development officer, "but certainly less have stayed. At this size of the market it's less about financial engineering and Excel gymnastics and more about client interest and improving the business that your pricing is based on."

Inertia of potential sellers is more of a problem for United than any particular competitor, for most of its competitors, Brinker maintains. But he does believe that more smaller firms will come up for sale, continuing to drive an already overheated market.

"We don't have a gun to our heads to do deals," he says. "Last year saw a lot of desperation in the market but we were able to hold to our model and let other people act irrationally."

NATIONAL AMBITIONS

United's ambition to create a national firm will help attract sellers, Brinker argues, along with its infrastructure, scale and emphasis on planning and using mobile devices.

Indeed, Greg Schoenfeld, Compass Wealth's owner and CEO, cited United's resources and Thomas Baumler, CEO of Asset One, cited the firm's "systems for client acquisition, retention and growth" as reasons they sold.

But Seivert notes that United "demands that sellers adopt their way of doing business. Their strength is the well-thought-out operating and marketing procedures.” He adds: “The vulnerability is they take away all of the entrepreneurship associated with being a wealth manager."