Want unlimited access to top ideas and insights?

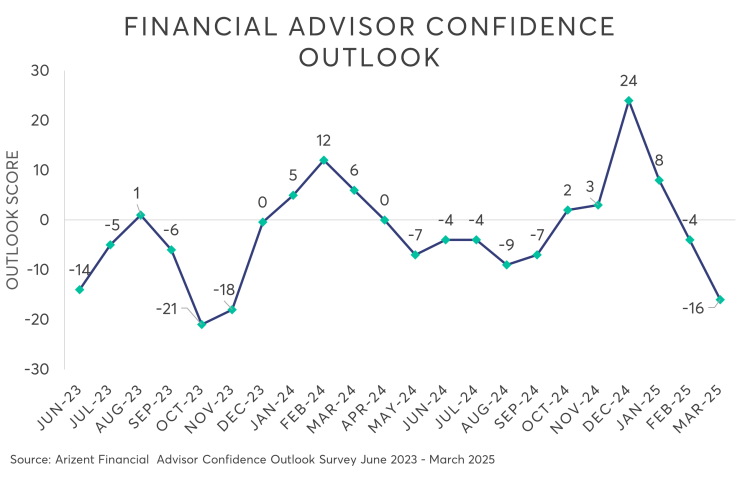

Financial advisor confidence levels have collapsed over the past few months, new data reveals.

That's the overall sentiment reflected in the March

After the 2024 election, advisors had a much more positive outlook, with the overall confidence score rising by a record-breaking 21 points from November to December 2024.

But in January's survey, the overall outlook took a 16-point nose-dive back down to 8. That figure fell even further in February to minus-4. That's the first time the score has fallen below zero since September 2024, when it was minus-7.

And this March? It was down to a staggering minus-16.

The main culprit, according to respondents, was largely the chaotic policy moves of the new presidential administration.

READ MORE:

"Way too much up in the air with Trump tax cuts, tariffs, government job cuts, Russia and China," said one advisor. "There is a lot of uncertainty."

Another advisor said the source of distress was "the inability of the current administration to act like adults."

READ MORE:

Other respondents were slightly more blunt, with one saying they were concerned with "geopolitical issues" and "having an orange buffoon run our country."

Contributing to this dismal score were negative perceptions regarding the overall economy (minus-29), client risk tolerance (minus-37) and asset allocation (minus-20), the latter two scores of which each sunk to all-time lows.

"There is a high level of uncertainty right now, economically and politically," said one advisor. "That is getting people nervous, and my clients are not an exception."

Faith in the global economic system was down as well, dropping from a score of minus-51 in January to minus-63 in February and minus-64 in March.

"The constant news is causing some discomfort for our clients as they are being

Another respondent said they were alarmed by "the instability of the coup and that all the slashing of services will have a recessionary effect."

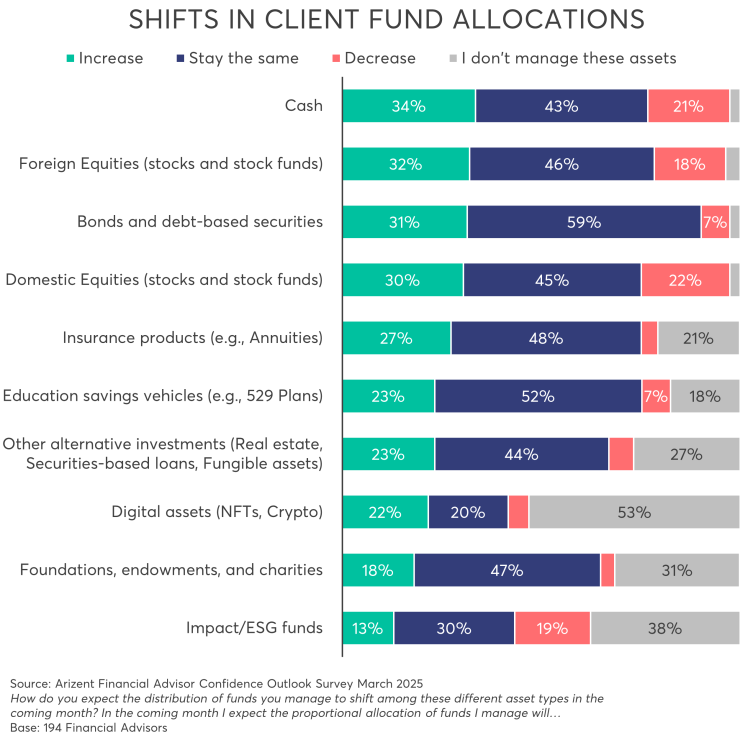

"Uncertainty of tariff policy impact on inflation and economic contraction gives me a bearish outlook on equities and also skittish on bonds," they said.

It wasn't all bad news. One area that was up, if only slightly, was practice performance, ticking up from 21 in February and 24 in March — perhaps reflecting that in times of turbulence, clients turn to professionals for help with their finances, in turn boosting practice performance.

And artificial intelligence was specifically mentioned by at least one advisor as fueling the need to keep advancing their business practices.

"