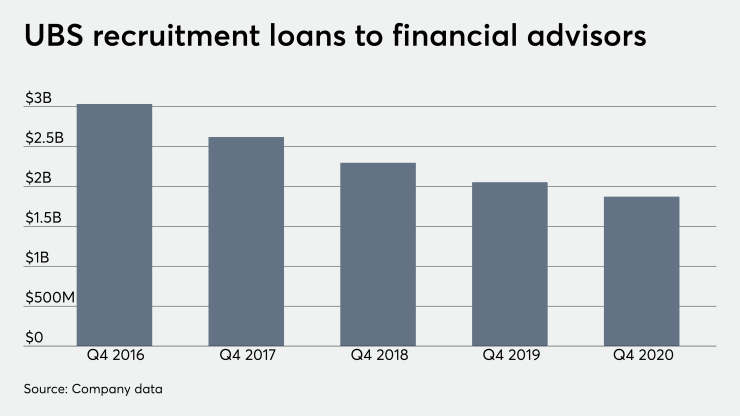

UBS’ half-decade-long trend of cutting back on hiring has made a big dent in the firm’s outstanding recruitment loans to financial advisors.

The wirehouse reported $1.872 billion in recruitment loans for the fourth quarter. That’s almost half of the $3.03 billion UBS reported for the fourth quarter of 2016, the year the firm announced its intention to cut back on recruiting, citing high costs and its desire to shift resources to other operations.

Accompanying the drop in recruiting activity and costs has been a slide in advisor headcount. UBS’s wealth management Americas business, which includes a small number of advisors in Latin America and Canada, fielded 6,305 advisors at the end of last year, down from 6,549 for 2019. UBS reported 7,025 advisors in its Wealth Management Americas business at the end of 2016 (in the years since then the firm has made changes in terms of how it reports numbers for its wealth management businesses).

In 2019, then CEO Sergio Ermotti emphasized that the company’s strategy “plays to the bottom line” and that “the recruiting loans and all the arrangements in the U.S. to recruit people are basically diluting earnings.”

To be sure, UBS still selectively recruits advisors who cater to high-net-worth and ultrahigh-net-worth clients. Last year, the company picked up an $11 billion team

Eaton Vance and E-Trade deals expected to boost the firm’s performance.

Pretax profit for UBS’ Americas wealth unit rose by $135 million to $386 million, according to the Swiss bank. Revenue rose by $88 million to $2.382 billion due in part to higher invested assets.

UBS said its Americas region notched a pretax profit of $1 billion for 2020.

The wirehouse reported $1.568 trillion in invested assets, up from $1.403 trillion for the year-ago period, representing an 11% increase. The firm’s advisors brought in $1.4 billion in net new money, up from $9 billion in outflows last year.