The first two dozen FINRA arbitration decisions involving a UBS options overlay strategy have gone slightly against the clients seeking about $200 million in combined damages.

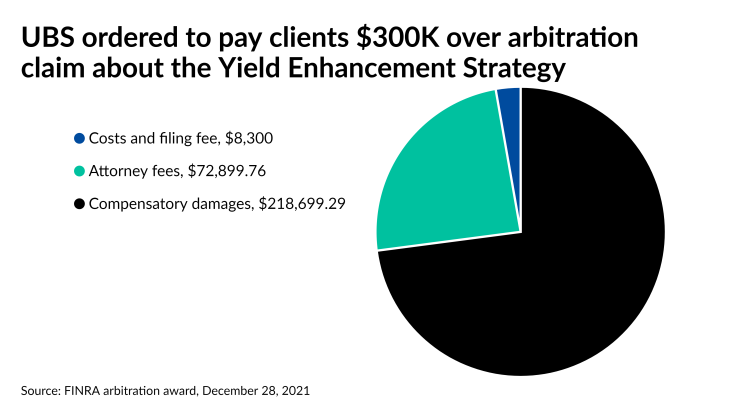

However, at least 10 clients have received compensation after filing cases alleging that the UBS Yield Enhancement Strategy, or “YES” for short, was an unsuitable recommendation, including Claimant Cheryl E. Amyx’s Dec. 28

The award providing nearly half of Amyx’s requested damages, as well as fees for her lawyer, comes as UBS has prevailed in a dozen other decisions relating to the options strategy and paid less than the amount clients have sought in the filings, the news outlet AdvisorHub

“You may have clients that differ in their understanding of the product itself,” O’Neal said, pointing to

O’Neal testified as an expert in the Amyx decision handed down unanimously by a Washington, D.C.-based panel, as well a September

“You are hoping as an investor that the market is not moving very much in either direction,” O’Neal said. “There's always the possibility that you're going to be wiped clean by a spike in the market or a dip in the market.”

Representatives for UBS declined to comment on the cases.

Two most recent decisions

The firm inherited the strategy when the former Credit Suisse private bank team that had launched it joined UBS in 2015. The company is fighting the wave of cases just as

Amyx lodged her claim against UBS in August 2020, seeking more than $445,000 in damages based on allegations of fraud, unsuitable recommendations, negligence, breaches of contract and fiduciary duty, and other claims. The filing didn’t identify her advisor, a decorated

The main arguments from the UBS side revolved around whether von Lipsey, who Greco credits for being “truthful” in his testimony, or the team behind the strategy was to blame for the losses, Greco said.

“It was presented as a lower-risk strategy to my client and, as I understand it, to many others,” Greco said. “It was a high-risk strategy, so I think on a very basic level it was just a straight-up misinformation type case.”

Von Lipsey didn’t respond to requests for comment to The von Lipsey Team, the name of his Washington, D.C.-based practice with UBS. Just as the firm did in its statement of answer and request for expungement of Amyx’s complaint, von Lipsey denied the allegations in his own comment on

“I deny any allegation of improper conduct and made no misrepresentation [to the] client of the risks and opportunities associated with the Yield Enhancement Strategy as disclosed to me by the 3rd party investment managers engaged on behalf of my client,” von Lipsey said in the comment on BrokerCheck. “I fully informed my client as to all the investments at issue and discussed the risks and suitability of the investments with my client.”

He added that he “acted in my client's best interests at all times” and that the losses were “unprecedented and beyond any possible outcome scenario presented by the investment managers.”

A Dallas-based panel of arbitrators approved the expungement of a different UBS broker’s record in a

“The investment was not unsuitable,” according to the award. “It was adequately explained to the customer. There were no misrepresentations and there were no omissions that would have changed the outcome of the case.”

The opportunity for advisors to generate more fees without bringing in any more client assets often creates opportunities for abuse, according to Greco.

“Unfortunately the customers are being told one thing about the risk, and the truth is something different,” he said. “It comes down to the amount of risk involved and the amount the customers were or weren't told about that.”