A wirehouse aiming to stem the flow of breakaway brokers to the independent channel is boosting pay for more than half its roughly 6,000 financial advisors.

After rival Merrill Lynch made slight changes for higher compensation as part of its

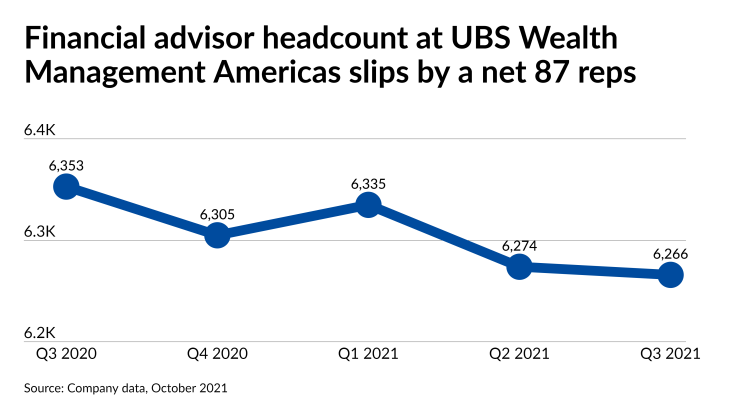

The headcount of advisors with UBS Wealth Management Americas has

“Top producers are very valuable and are becoming more prized by the day. Firms want to retain and hire as many as possible,” Elzweig said in an email. “UBS is outlining a career path here for its most productive advisors. The message is simple: stay here, be part of a team and we'll boost your payout as your longevity increases.”

Representatives for UBS declined to provide any details of its pay grid or make any executives available to discuss it with Financial Planning, although the company confirmed the information that

Next year, registered representatives with tenures of at least 20 years with UBS will earn a payout of 60% — which is 1.5 percentage points higher than the largest share of revenue for advisors with $2 million in annual production among any employee brokerage, according to the 2021 pay grids disclosed by 10 firms as part of

Advisors “don’t have to do any calculations beyond how long they’ve been at UBS and how much revenue they produce,” Chandler told Barron’s. “They don’t have to worry about conflicts, or targets or number of accounts.”

More than half of the firm’s 6,266 reps will get higher payouts next year, according to both publications. With advisors getting less than 1% of their trailing 12-month revenue from smaller accounts below $250,000 and above its current minimum account of $100,000, the firm is paying advisors an incentive if they refer those households to its digital and call center arm, the UBS Wealth Advice Center. In addition, since 60% of reps are part of teams, UBS will pay groups of advisors a higher rate together than they would earn individually.

“Our new grid will provide greater certainty, transparency and simplicity to your reward structure,” the company said in the memo to managers obtained by AdvisorHub.

A net 87 reps have left UBS over the past year, which is a much smaller amount than the more than 1,000 advisors missing from 3rd quarter headcounts at

Independent wealth managers such as Snowden Lane Partners, an RIA and brokerage backed by private equity firm Estancia Capital Partners, are getting wirehouse breakaways for many of the same reasons that they did when the firm launched in 2011, according to Chairman Lyle LaMothe, the onetime head of Merrill Lynch’s U.S. wealth management arm.

The firm has added about 15 advisors with $2.5 billion in client assets in 2021, most of them

“The premise has remained relatively constant,” he said. “A decade ago, it was really more the pioneering spirit that encouraged people to move from the safety of the wirehouse to the independent channel. Today I think it is viewed as far less risky. I think it may be viewed as riskier to stay.”